The economy has been turned upside down and shaken like a snow globe. Certain industry groups like leisure and hospitality are being held hostage by COVID-19, while others like information technology have never been stronger.

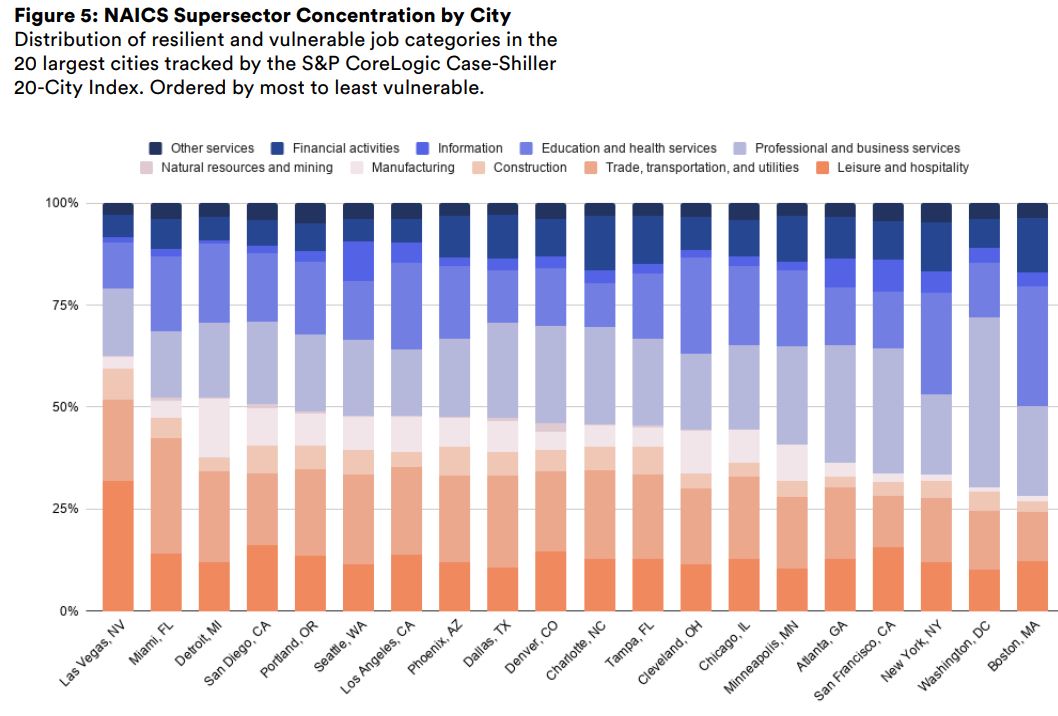

By looking at the breakdown of industry concentration by different cities, Unison was able to determine which are the most vulnerable and the most resilient to the current economic landscape.

Not surprisingly, Vegas is in big trouble. Unison wrote:

With the highest concentration of construction (7.7%) and leisure & hospitality (31.8%) jobs, Las Vegas leads all cities in at-risk sector employment share (62.6%) and is most likely to see the weakest home price performance. Not only is Vegas the leisure and hospitality center, its role in transportation cannot be overlooked, as the city is home to the 8th busiest airport in the U.S.

On the other end of the spectrum are cities like Boston, Washington DC, New York, and San Francisco. When you hear the word San Francisco, at least when I do, my brainy goes to technology; However, Unison raises a good point, writing:

At first glance, San Francisco appears to be a one trick pony, since a big portion of the jobs look like “tech” jobs. However, the actual sector composition becomes much more diverse once we look into the actual economies these tech employers serve. For example, AirBnB, Slack, Uber, Twitter, Yelp, Instacart, and Salesforce each play in very different sectors, with their company fortunes driven more by the constituents they serve than by the livelihood of the technology sector. Also lost in the high-tech fanfare is the fact that San Francisco is the second largest financial center in the U.S. and home to firms like Wells Fargo, Visa, SoFi, and Square.

I have little doubt that 2020 will mark some sort of turning point for the real estate market. It’s hard to know exactly what these changes will look like and how far they’ll go, but the most obvious one to me is how we think about “going” to work.

Some industries require their employees to physically be at their place of business, like factory workers and pilots for example. But we’ve learned that working remotely is feasible and even preferred for some portion of the population. And business travel? I don’t know if that ever returns to what it once was.

What does this mean for the housing market? For commercial real estate? Unison looks at this and more in their new research report, which you can find here.

More: