On today’s show we discuss:

- My plumber story

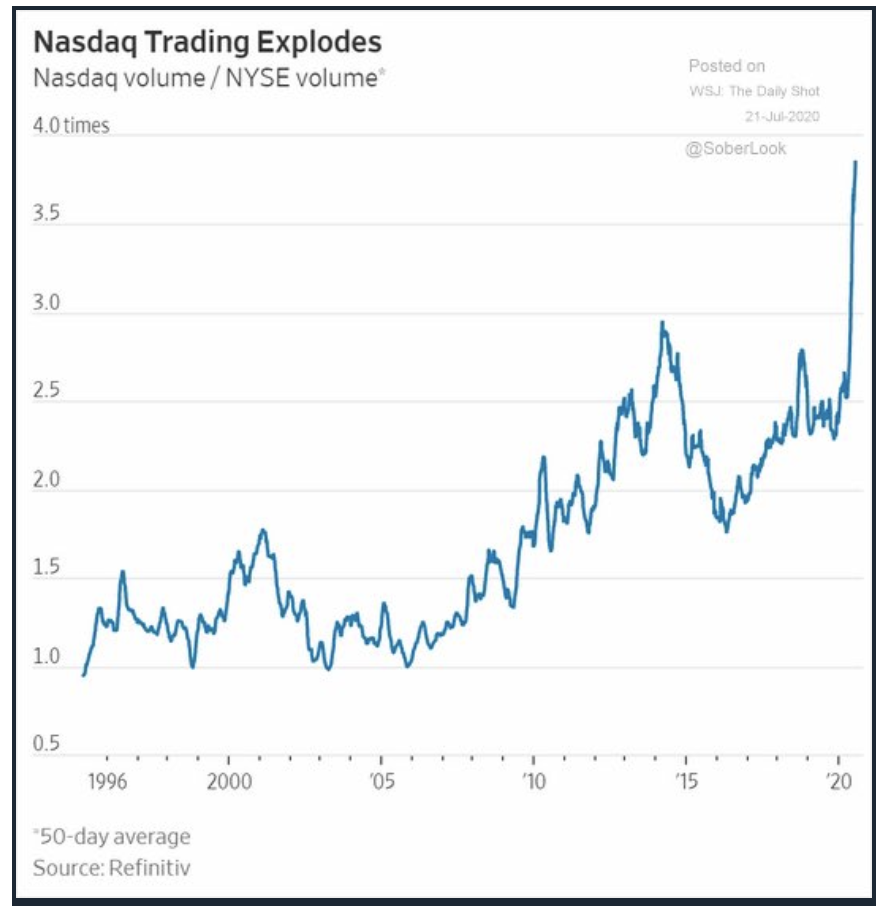

- Everyone’s a day trader now

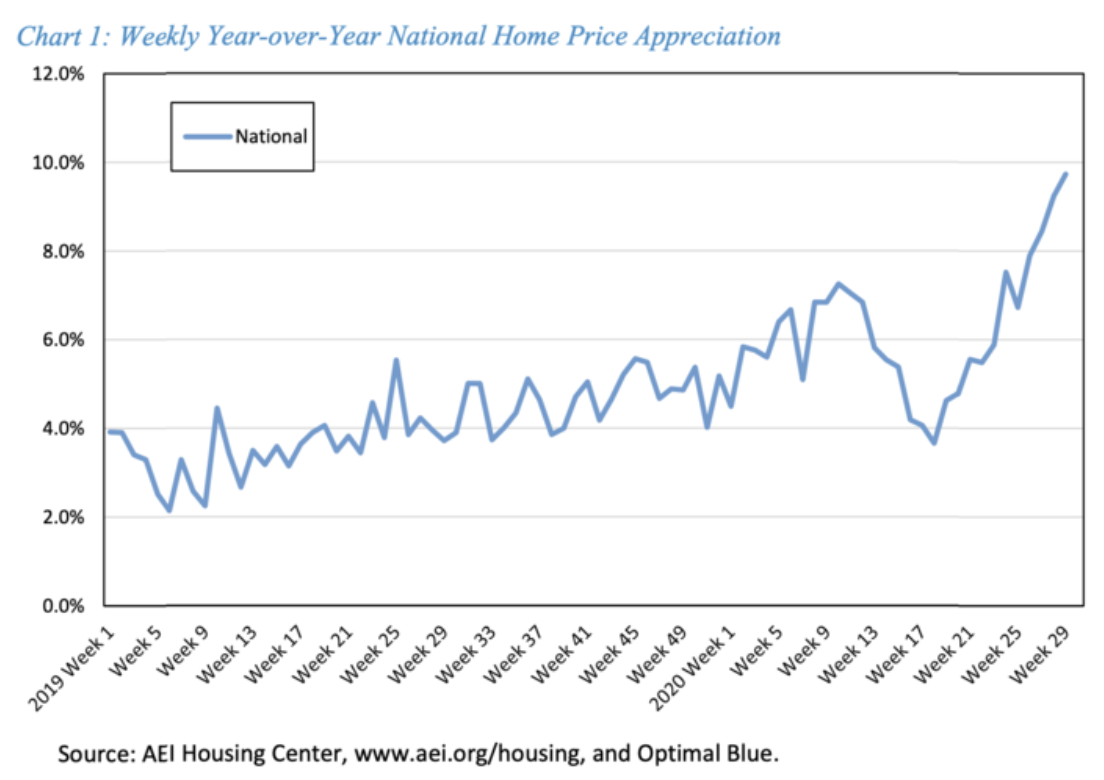

- Existing home sales are red hot

- Special purpose acquisition vehicles are all the rage

- Hamptons prices hit record high

- Millions of Americans moved due to the pandemic

- Commercial real estate is in a lot of trouble

- $32 millions set to lose their $600 a week

- Business travel makes up 60-70% of airlines

- NASDAQ Cloud computing index

- Flowmageddon

- If you’re a teacher or know someone who is, send them to this link

- Tenet is postponed indefinitely

- Google extends work from home until summer 2021

- The golden age of fraud

- Nathan’s hot dogs is a publicly traded company

- Jason Zweig on gold

Listen here:

Recommendations

- Fear City

- Against the Gods

- Ford Versus Ferrari

- Palm Springs

- Dan Carlin and Tom Hanks

- Defending Jacob

Charts:

Tweets:

Gold and silver ruled last week in ETF Land as $GLD, $IAU and $SLV all made the Top 5 list for weekly flows. I don't think I've ever seen that. $GLD and $IAU are also both in the YTD Top 10 as well. It's gone from a 'feeding frenzy' to an outright 'craze' pic.twitter.com/VRnReHGhk1

— Eric Balchunas (@EricBalchunas) July 27, 2020

It's not just Robinhood seeing a spike in trading and users.

TD Ameritrade ($AMTD) Earnings Snippets:

– Average Client Trades Per Day: +311% Y/Y & 65% Q/Q

– 661,000 new retail accounts

– Top 15 trading days in Firm's history during Q2, 10 in June@awealthofcs @michaelbatnick pic.twitter.com/oFr2sXd2Fp— North Star Capital (@NrthStarCapital) July 21, 2020

The market value of an industry is very inconsistent with its contribution to GDP.

Source: Carlyle pic.twitter.com/2v7pnUUQ2f— Peter Mallouk (@PeterMallouk) July 23, 2020