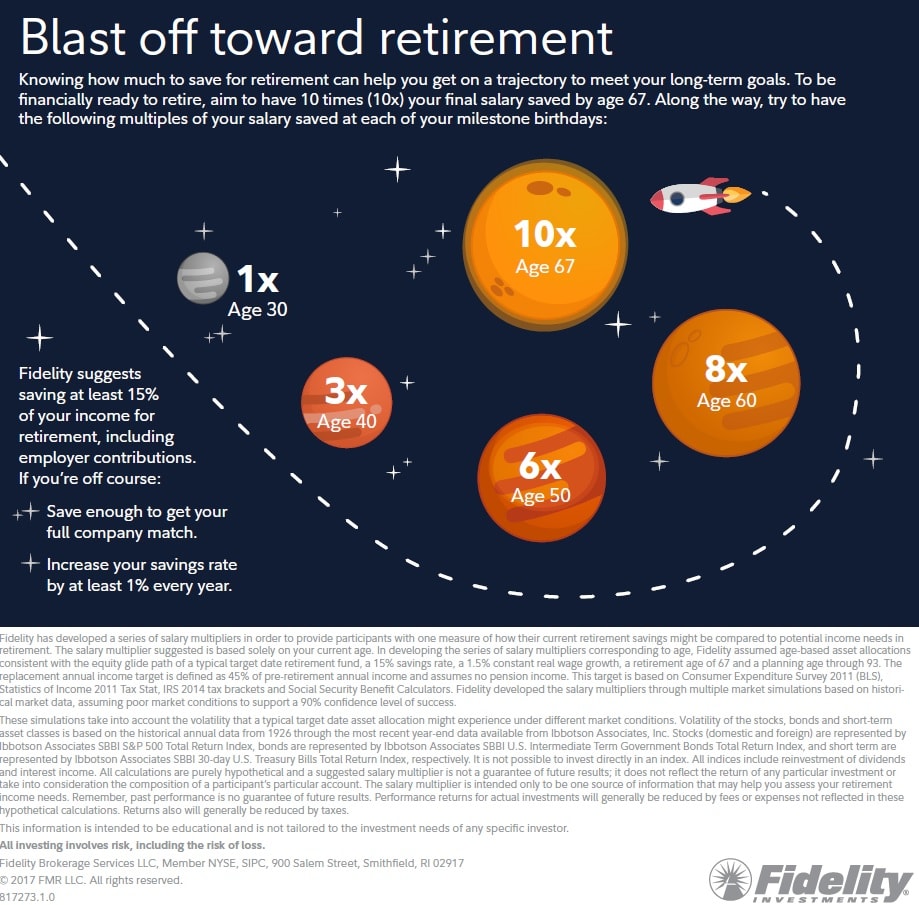

By age 30 you should have saved 1x your annual income.

If this makes you feel bad about yourself, you’re not alone. The internet was triggered by these numbers from Fidelity.

Ben and I spoke about this concept on a podcast we did about retirement. I thought these numbers were completely ridiculous. 3x your income by 40? How? Well, lucky for us we have spreadsheets. It turns out, these milestones are more realistic than I thought.

I understand that saving money is hard. I understand that young people are burdened by student loan debt. I understand that the more money you make the more money you spend. I understand all the reasons why it’s hard to save money, but in this post I only want to look at the math. How much do you need to save and earn in order to hit Fidelity’s targets?

I made a few assumptions:

- You begin saving right away, at age 22.

- Your salary increases 2.5% a year.

- You earn 5% annually.

- I used 40k as a starting salary, but the savings rate and rate of return are unaffected by whichever starting salary you use

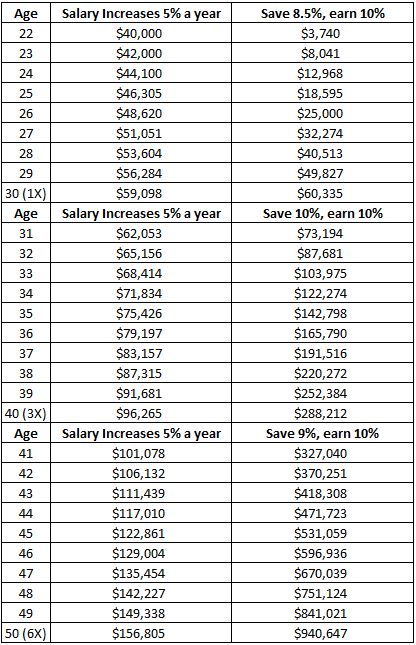

If you save 10% of your gross income and earn 5%, you’ll have 1x your salary saved by the time you’re 30 years old. As I said, this assumes you start right away. Both the savings rate and rate of return are reasonable.

Things start to get tricky over the next decade. In order to have 3x your salary by age 40, you’ll need to crank your savings rate up to 14%. In order to hit 6x your salary by age 50, you’re going to have to save 19% of your gross income. Not impossible, but also not easy. I understand that life gets more expensive with kids in the picture. Camp, clothes, life, etc, I get it. Again, we’re just looking at numbers, so take it easy.

If you think you can get achieve a return higher than 5%, well what happens if you’re able to do 10%? In the first decade of saving, your rate of return doesn’t matter that much because it hasn’t had time to let compounding work its wonders. You still have to save 7.5%, down from 10% in the previous example, to get to 1x by age 30.

In the next decade, you’d actually feel a reprieve, unlike in your 20s. Now, you’ll need to save just 6.5% in order to hit 3x by the time you’re 40. Then the magic kicks in. You can spend everything you make in your 40s and still get to where you need to be by age 50.

You might be wondering, okay but what if I have a kickass career and my salary increases at 5% a year? Counter intuitively, this makes hitting Fidelity’s numbers much more difficult. Nick Maggiulli wrote about that concept this week. If you earn 5%, you now have to save 19% a year in your 30s and 28% a year in your 40s. This ain’t happening. At least for 99% of us.

Even taking your returns from 5% to 10%, you still have to save 10% a year in your 30s and 9% a year in your 40s. The savings part can happen, it’s the returns that probably won’t.

One thing that we didn’t look at here is starting age. Delaying even a few years can have enormous ramifications. Be that as it may, the truth is Fidelity wasn’t so far off. Are these bogeys easy to hit? Absolutely not. But are they impossible? No, they aren’t.

We’re all in different situations, but the one thing we all have in common is we’re human. It’s hard to be disciplined about saving money. The very best way to short-circuit our tendency to spend first and save later is to save first and spend what’s left. You have a much better chance of saving money if it’s out of sight and out of mind. Automate, automate, automate.

I don’t know what the right numbers are for you. Only you can answer that. Whether or not you’re where Fidelity says you should be, I hope these numbers convinced you that saving is a long game. If you’re reading this post, then you’re probably in a position where you can afford to save at least a little bit of money, and a little bit can go a long way.