I started trading in 2010 with real money. It wasn’t a ton of money, but it was all I had, and it was very real to me.

I had no experience with investing, but I was aware of the market environment. It was impossible not to be. At that time, the GFC had just ripped a hole the size of Texas through our financial system.

To learn more about how to navigate the waters, I hit the books. I dove headfirst into the pool of Benjamin Graham. I wanted to learn how to find undervalued companies that the market didn’t understand.

So naturally, one of the first things I did was open up an account at TD Ameritrade and purchase FAZ. For those unfamiliar with this ticker, it’s an ETF that gives you three times the daily return of bank stocks, but in reverse. So if banks were up 1%, this thing would be down 3%. If the banks fell 3%, this product would be up 9%. Why was I reading about value investing and then shorting banks? Because I had absolutely no idea what I was doing!

I had never experienced what it was actually like to build a portfolio of stocks. I didn’t know about diversification, and I didn’t understand the first thing about risk management. I was on a motorcycle when I should have been on a bicycle with training wheels.

I was never a big fan of paper trading. My thinking went, it’s impossible to simulate how you feel when real money is on the line. I still believe this, but I no longer feel that’s a good enough reason for jumping into the market when all you’re seeing are slot machines.

Losing real money doesn’t necessarily make you a better investor. It makes you an investor who knows the pain of losing money. If the only prerequisite for good investing were having a few losses underneath your belt, everyone would be a good investor. There’s a lot more to it than that.

Another reason I didn’t love paper trading is that the simulated portfolios were never any good. There wasn’t a slick piece of technology where you could simulate the feel of buying and selling and building your own portfolio. Now there is.

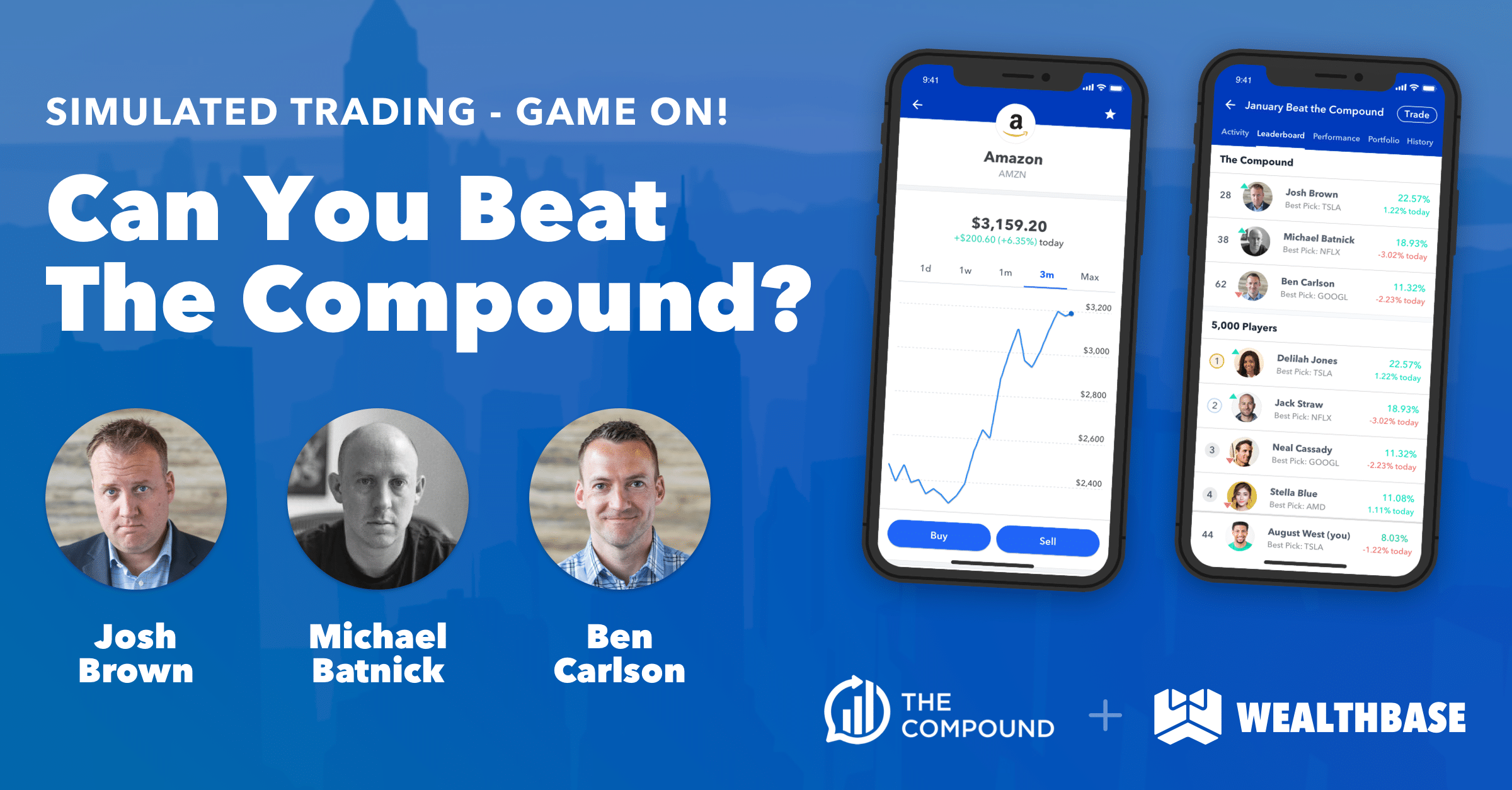

Wealthbase is a simulated trading app that allows you to buy, sell, and, heaven forbid, short stocks in a paper portfolio. I’m excited to share that Josh, Ben, and I will be doing a simulated trading game in January, which will last the whole month. No money is on the line. There is no cost to join. The only thing we have to offer is fun, competition, and the chance for new investors to learn to crawl before they learn to walk. Actually, there is one other thing. Wealthbase will be giving an Amazon gift card for whoever places in first, second, or third.

I hope young people will find this software, trade their butts off, and develop a better appreciation for how tough an opponent the stock market is.

The competition starts on January 4th, but you can hop in and build your own portfolio right now. We’ll announce the winners on The Compound

Please see the below disclaimer for more on this:

Wealthbase – RitholtzTerms and Conditions

Josh and I spoke about this and much more on the most recent edition of What Are Your Thoughts?

Subscribe to the channel. You’ll get a notification as the show is about to premiere each week.

Josh and I use YCharts when creating visuals for this show and many aspects of our business. What Are Your Thoughts viewers can get a 20% discount for YCharts by clicking here (new users only):

You can hit us with a topic for next Tuesday’s episode – shoot us an email at askthecompoundshow@gmail.com, and we’ll choose one straight from the inbox.