“You ever hear of Jumia?”

“No,” I said as I punched up the chart. “HOLY SHIT!”

“Crazy, right? It’s supposed to be the Amazon of Africa. I bought a few thousand shares three weeks ago in the 20s, and now it’s close to 50.”

This was a very real conversation I had on December 22nd with a family member. Take a look at this chart, and you’ll see why I responded the way I did.

I kept tabs on this over the next few days and watched it fall 30% in 9 sessions. So I hadn’t thought about it until yesterday when I thought, “Hey, I wonder how that Jumia stock is doing.” Well, it went up 25%…YESTERDAY

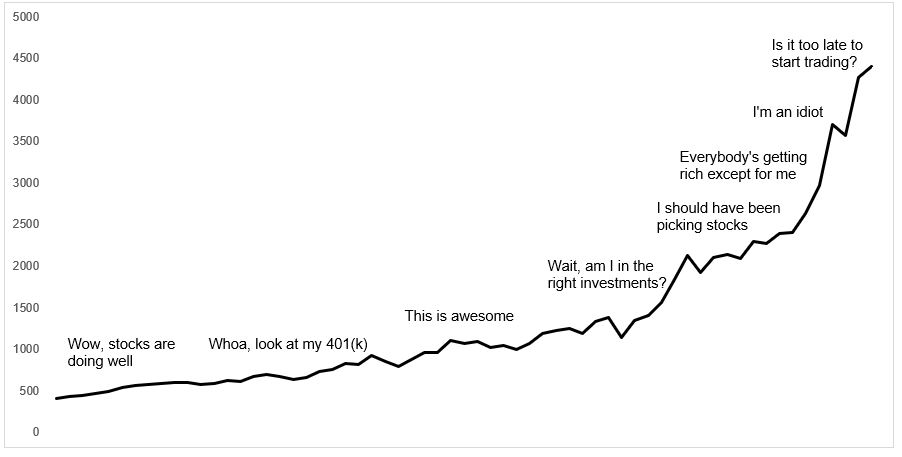

This type of thing is playing out all over the place. You probably heard about the person who made $3 million in GameStop…YESTERDAY. Or the post about the guy who made more than $10 million in Tesla. It’s not easy to see things like this day after day and not feel like you’re missing out.

Everything in life is relative, especially stock market returns. You can be fully invested and still feel like you’re missing the boat.

My portfolio is fully invested, as it always is. And I even own some of these speculative names. Even still, I can’t help but wonder why I didn’t buy the dip in Jumia. Granted, I know nothing about this company, but I know that it went up 25% yesterday, and I feel regret for missing it. Completely irrational regret, but real feelings all the same.

If you feel like you’ve missed a once in a lifetime opportunity, then welcome to the stock market. These types of episodes have happened before and are sure to happen again.

All we can do is remind ourselves that we didn’t see it coming, and we don’t know when it’s going to end. And therefore, it’s only prudent to stick to what’s tried and true. To be clear, what’s tried and true will differ from person to person, but having the ability not to get swept away in a mania is something that all successful investors will have in common.

I can’t help but think I was born 15 years too early. If I were a younger person, I’d be all over this. So I don’t begrudge anyone making millions. In fact

This type of market is a young person’s game. Young people have less money to lose, fewer responsibilities, and more time to make it back should the party end.

If you have a family and are building a nest egg, then you have too much on the line to YOLO trade.

Those feelings of missing out, let them go. You must accept that from time to time, people will use the stock market to get rich overnight. You will not be one of these people. The flip side of this is some of them will lose it all overnight. You will also not be one of these people either.

As I’ve said time and again, if you want to play with 5% of your portfolio or something like this, then go nuts. But be responsible, resist the temptation.