Today’s Animal Spirits is brought to you by Interactive Brokers.

On today’s show we discuss:

- Investing in a bubble

- Klarman is angry (Here he is in 2010 talking about the Fed)

- Corey Hoffstein on Odd Lots

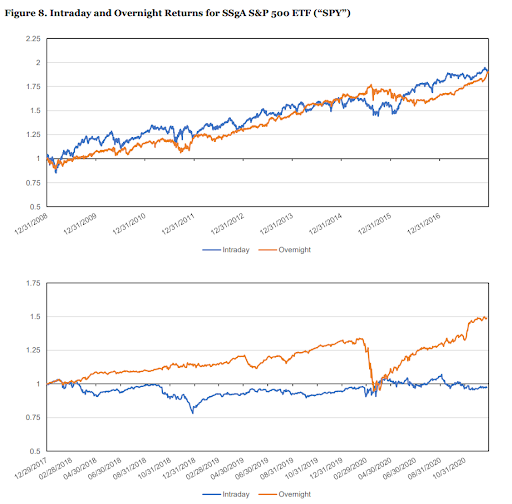

- Corey on structural changes in the market

- The juxtaposition of AAII and WSB is remarkable

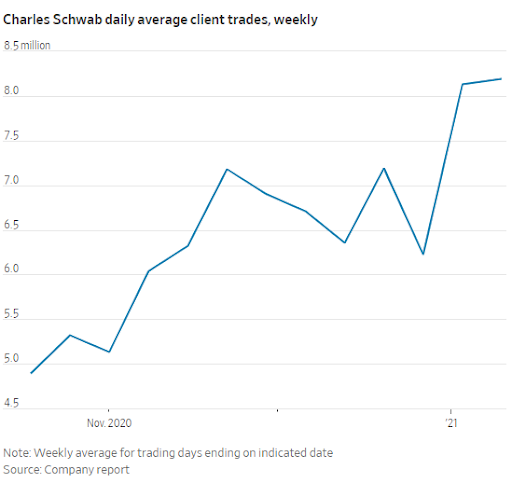

- The trading numbers at the big custodians is off the charts

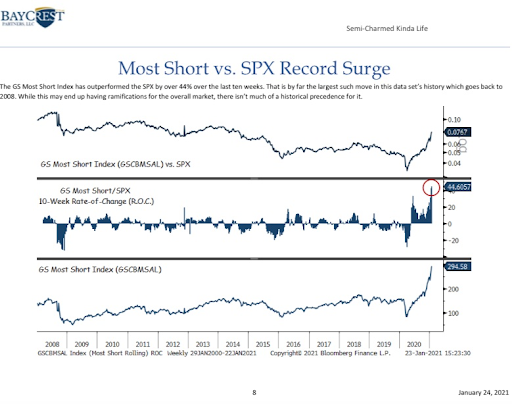

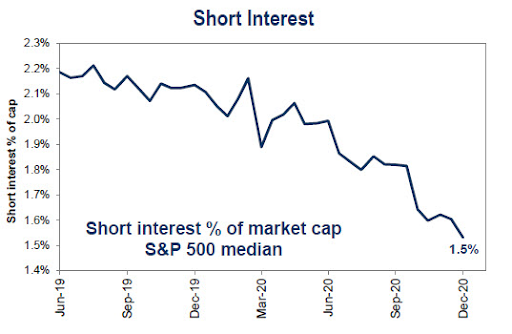

- An epic short squeeze

- Hedge funds getting squeezed

- Short sellers lost $1.6 billion in GameStop

- WSB owns 5.8% of GameStop

- GameStop YOLO update

- GameStop is up because they got a new board member, ya right

- GameStop was a deep value stock

- Matthew Klein on Biden’s new spending plan

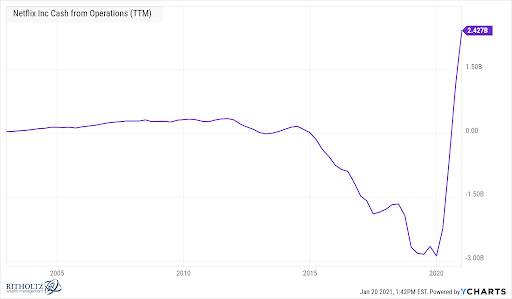

- How Netflix won

- Resist the temptation

Listen here:

Recommendations:

Charts:

Tweets:

The Yolo Index (which tracks the short term performance of r/wallstreetbets and other trading subreddits) is up 916% since January 1st 2020. While this index has historically done poorly, 2020 has been a truly incredible year. So why now? And how much longer can it last? pic.twitter.com/1I5pHpB2Br

— marketstream.io (@marketstream_io) January 24, 2021

Basket of the 11 most shorted Russell 3000 stocks is up 100% todayhttps://t.co/4e0tYIzXxm pic.twitter.com/bdA1MoSTR2

— zerohedge (@zerohedge) January 25, 2021

We're seeing the types of speculative activity almost solely seen near short- to medium-term peaks.

We're also seeing the kinds of thrusts and recoveries almost solely seen near the beginnings of long-term uptrends.

It's very strange.https://t.co/FbYewrRM7i

— SentimenTrader (@sentimentrader) January 22, 2021

https://twitter.com/RobinWigg/status/1353763494961836034/photo/1

It’s a whole new world… pic.twitter.com/9dmcRs77uk

— Adam Feuerstein ✡️ (@adamfeuerstein) January 25, 2021

digital transformation is a hell of a drug pic.twitter.com/UliUTGBa3C

— modest proposal (@modestproposal1) January 22, 2021

IBM paid down billions in debt and its stock plunged. Why? Wall Street is hammering any company repaying debt pic.twitter.com/OGXvKDuY5z

— zerohedge (@zerohedge) January 25, 2021

The level of engagement on this tweet is insane. It's just an event promo slide from the company handle. Most tweets from asset manager accts (w similar follower count) lucky to get 10 likes total. This is one serious fan base.. https://t.co/KS1T5hLEZZ

— Eric Balchunas (@EricBalchunas) January 22, 2021

I hope regulators are watching WSB. Manipulating the markets should be reserved for rich hedge funders with 200-page slide decks, delivered to exclusive audiences behind closed doors.

— Joe Weisenthal (@TheStalwart) January 25, 2021

I see lots of traffic about $GME and whether some law is being broken by /r/wallstreetbets. Allow me to introduce you to 10b5, 'cause I suspect we're going to be talking about it a lot: https://t.co/7Ux6WJwBog

— Dave Nadig (@DaveNadig) January 25, 2021

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: