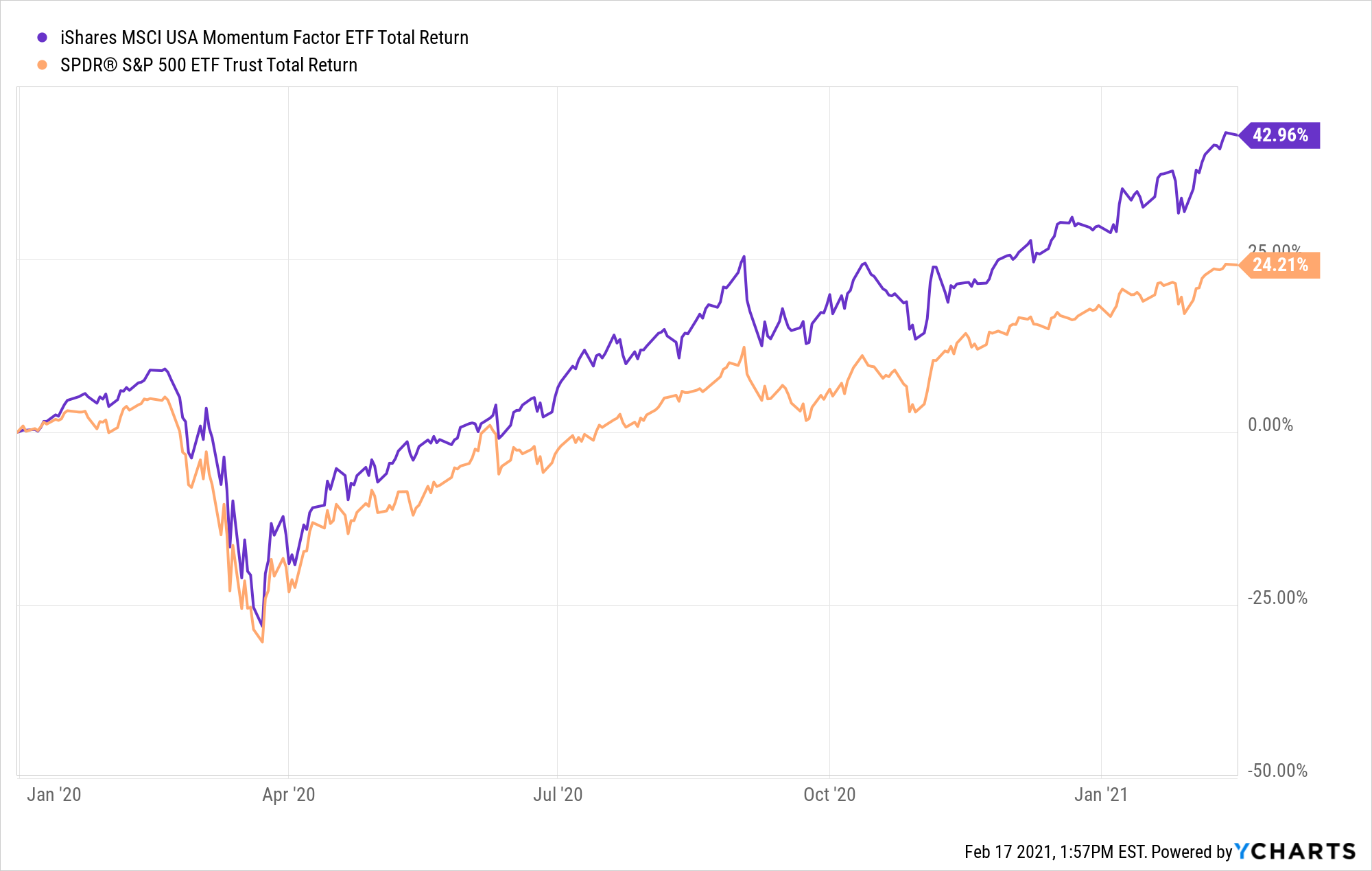

Momentum strategies aren’t bothered much by stock market crashes. At least that’s the conclusion you could draw from 2020.

But we know that’s not true. One of momentum’s weak spots are sudden shifts in market direction just like we saw last year. In order to reconcile this, it helps to take a look under the hood.

Daniel Sotiroff notes that:

MTUM and IMTM entered 2020 with heavy allocations to defensive sectors, including utilities, consumer staples, and healthcare, which provided some ballast as the market declined.

As it turns out, their emphasis on defensive sectors heading into 2020 was not an act of clairvoyance…Their defensive stance heading into the new year was more coincidental than intentional. Understanding this context is important. Momentum strategies won’t always find themselves so well-positioned to bear the brunt of a bear market.

Past performance does not equal future results because no two markets are exactly alike. The inputs of a strategy might not change, but the market where it derives its signal is always changing. This is why you have to go past the eye test when looking at past performance.

Source: