Today’s Animal Spirits is brought to you by YCharts

Mention Animal Spirits to receive 20% off when you initially sign up for the service

On today’s show we discuss:

- What if interest rates don’t matter as much as we think they do?

- But what if they do?

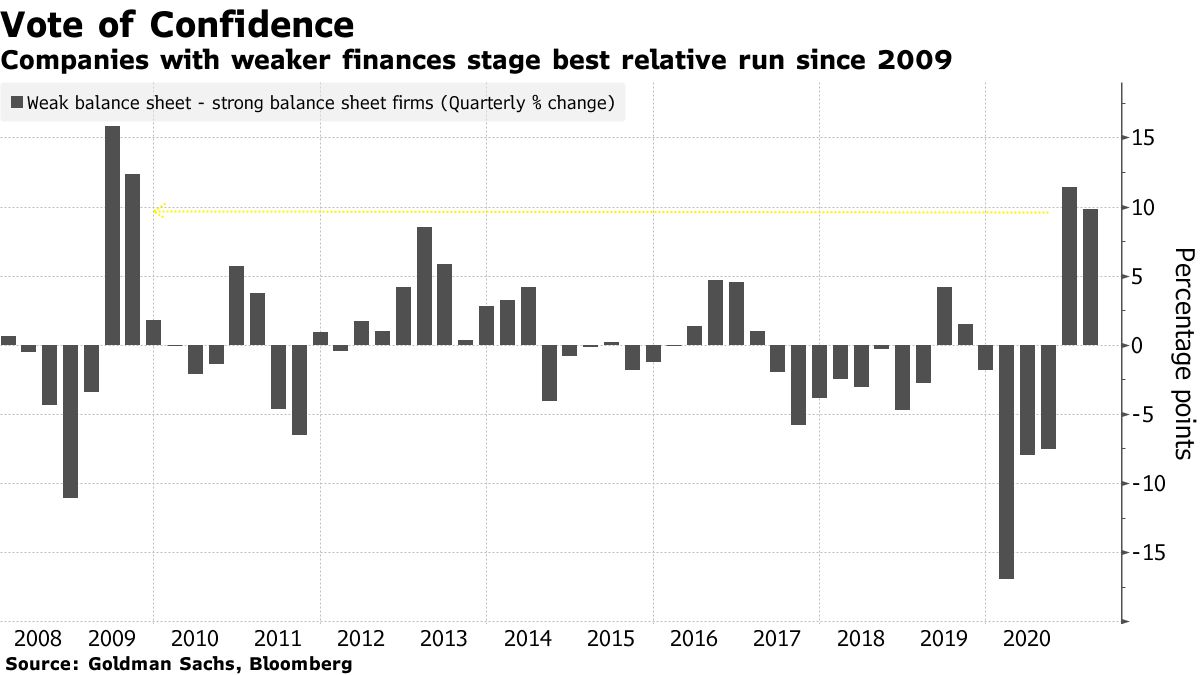

- Companies with weak balance sheets are outperforming

- Buffett’s annual letter

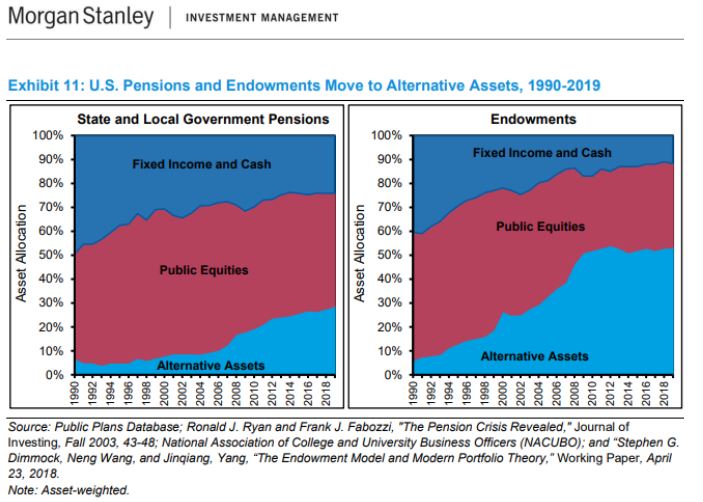

- Institutions hold less fixed income than they used to

- Two-year auction makes history

- Everything is oversubscribed

- Ray Dalio on bubbles

- Grantham says it’s a retail bubble

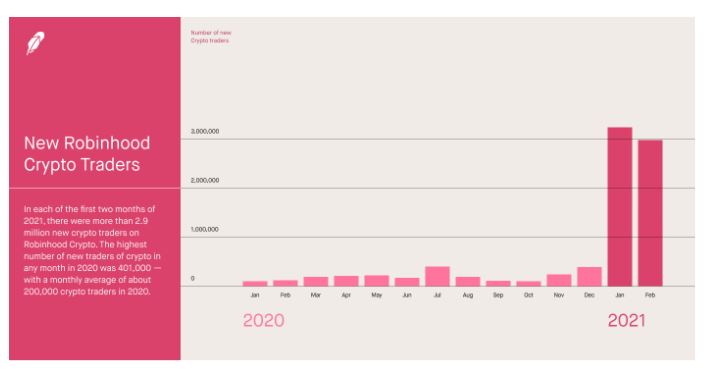

- Robinhood IPO

- Bitcoin lost half its value in two days

- Square bought a lot of Bitcoin

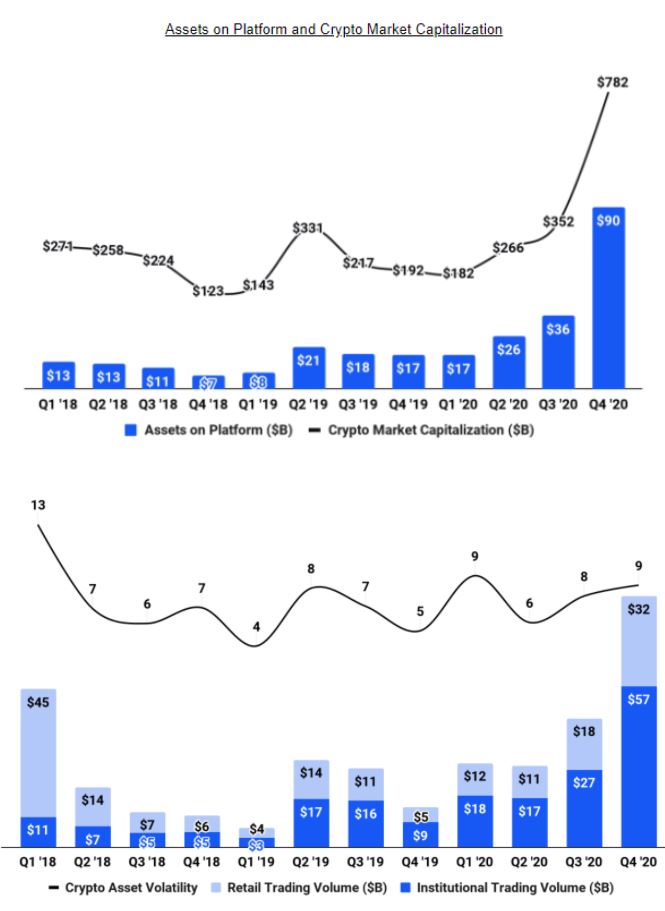

- Coinbase is making money

- Broker commissions in real estate aren’t budging

- Where have all the houses gone?

- There’s a lumber shortage

- And a semiconductor shortage

- Our moon landing

Listen here:

Recommendations:

For All Mankind

Wealth, War, and Wisdom

WandaVision

Charts:

Tweets:

Beginning in March, momentum funds will enter into – what we believe – will be the highest turnover period ever.

Financials + Energy will be bought.

Tech + Healthcare will be sold.

In this report, we map out the reasoning, winners, losers, and implications.@3F_Research pic.twitter.com/I9rT3pjOqP

— Warren Pies (@WarrenPies) February 25, 2021

https://twitter.com/realjonbovi/status/1364959694180278272?s=12

Only the 1994 experience left to take out🤪Chart shows US 10-year yields' past breakouts higher from 6-mth trading ranges. Can it last?! Let's see interest rate risks migrate into risk assets for signaling. pic.twitter.com/BXas22DID3

— Ben Breitholtz (@benbreitholtz) February 25, 2021

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: