The stock market is usually right.

Relax, take a deep breath.

I know you can give me 10,000 examples of why markets are inefficient. GameStop probably comes to mind. The actual value of this business cannot be $483 in the morning, $112 a few hours later, and $193 by the close of the day. To state the very obvious, prices don’t always reflect the underlying fundamentals of a business. But usually, it gets the big things right.

Take 2020 for example.

The pandemic sorted the stock market into winners and losers in a hurry. Let’s talk about that first group first.

The economy shut down but our lives didn’t stop. They just migrated from everywhere to nowhere. And because we were confined to the four walls of our homes, we stocked up on sanitizers (Clorox), and we got enough paper towels to last a lifetime (Costco). More time in the home meant more batteries and more groceries (Walmart). It also meant home improvement (Home Depot).

These businesses reported numbers like we’ve never seen before, and their stocks responded. More accurately, these stocks were on fire, and we later found out that the fundamentals supported the upward move. But it didn’t take long for the market to discount all of it.

Home Depot and Clorox peaked in August. Walmart and Costco peaked in December. All of these stocks have sold off and are now below their 200-day moving average. Why? Because their stocks already reflected the good numbers, and are now reflecting tougher comps going forward. The market knew before us. It always does.

The other group of stocks that benefited from the pandemic became known as the stay-at-home stocks. Zoom replaced the office, Peloton replaced the gym, Teladoc replaced the doctor, and Overstock, well, we bought a lot of stuff from Overstock. While the former group of stay-at-home stocks are down roughly 15-25%, this group of high-fliers is down 35-50%. Why? Because their stocks already reflected the good numbers, and are now reflecting tougher comps going forward. The market knew before us. It always does.

The pandemic was a tail-wind for some businesses and an absolute nightmare for others. Casinos, airlines, malls, and cruises were all effectively shut down. The stock market reacted accordingly.

In 19 days, Wynn fell 70%. In 20 days, Delta lost 63% of its value. In 18 days Simon Property fell 70%. And in 19 days, Carnival Cruise fell 80%.

The stock market took all of three weeks to discount the catastrophic numbers that were sure to follow. Casinos bottomed in March, cruises and malls bottomed in April, and airlines bottomed in May.

These stocks bottomed and started rising as cases and deaths were still exploding higher. Why? Because their stocks already reflected the awful numbers to come, and are now reflecting easier comps going forward. The market knew before us. It always does.

Outside of leisure and travel, another group of stocks that were obliterated were the ones most sensitive to the economy. Capital One, John Deere, Exxon Mobil, and Alcoa can tell you all that you need to know about the health of the American economy. They’re all on fire. And they all bottomed within days of each other.

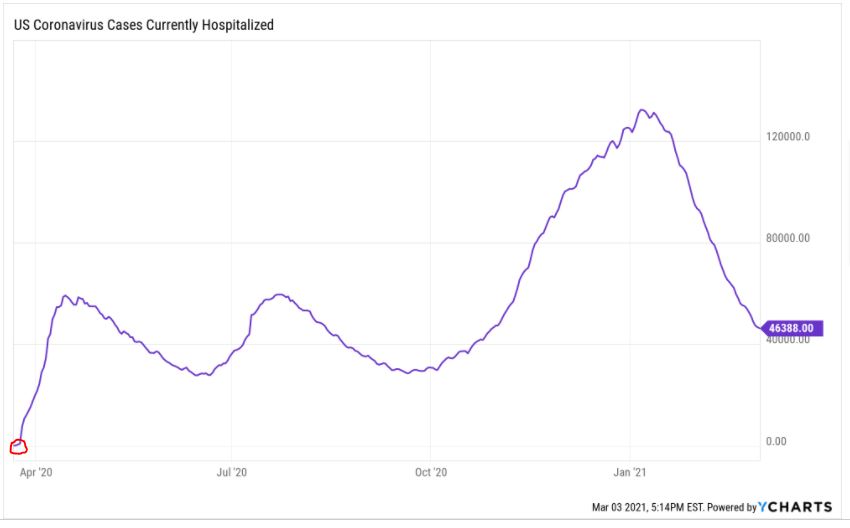

The chart below shows the number of people in hospitals due to the Coronavirus. The red circle shows where the cyclical names bottomed.

Things got worse while these stocks were recovering. They got so much worse. But the market saw that things would eventually get better.

The stock market always sees things before we do. And the stock market is usually right. At least most of the time.