Stocks are blowing up left and right. Yesterday’s darlings are today’s pariahs.

Shop and Square are down 20%. Peloton and Zoom are down 40%.

And yet, for all the damage that we’ve seen in individual names, it hasn’t spilled over to the broader index. At least not yet.

I can’t believe I’m writing a “don’t panic” post while the S&P 500 is within 5% of its all-time high, but here we are. If you want to use this as a contra that shit is about to get way, way worse, I ain’t mad at ya.

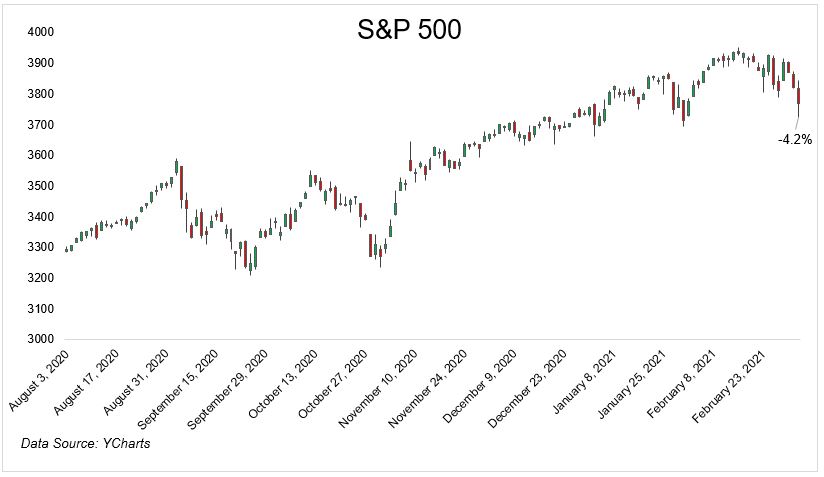

Here’s where things stand today.

People are starting to get anxious. Every time the market falls a little, we worry it’s going to fall a lot. Every. Single. Time.

The news changes and the stocks differ, but the feelings are always the same. It’s no different this time. And here we go again.

I want to share a few charts from the last decade that might or might not take the edge off. Every chart ends at the bottom of each correction when it looked like the wheels were about to fall off. They never did. Okay, last year they did, but let’s chalk that up to a global pandemic.

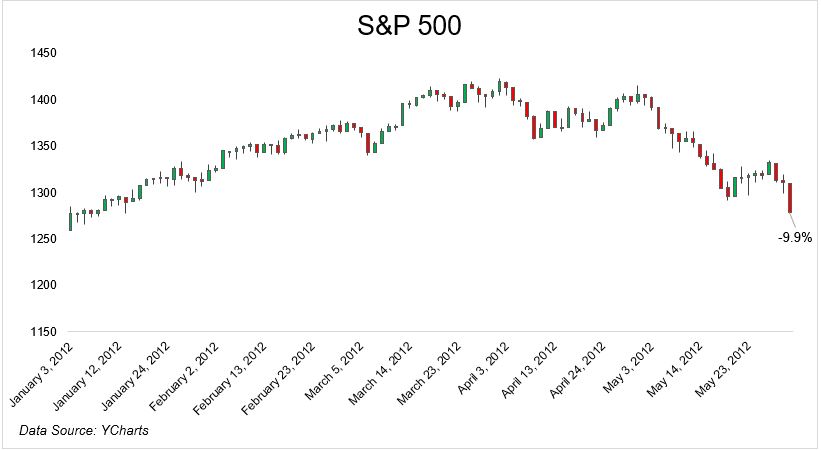

Remember the spring of 2012?

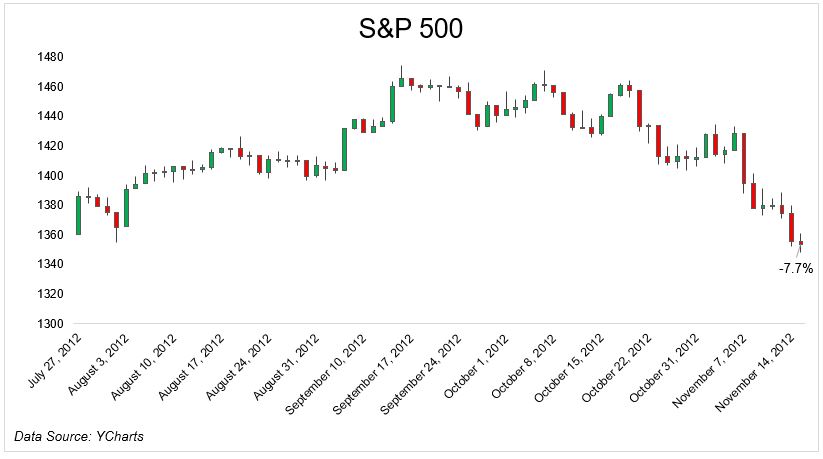

Or how about the fall? That looked pretty double dippy.

What about the Ebola selloff of 2014? That got pretty scary for a minute.

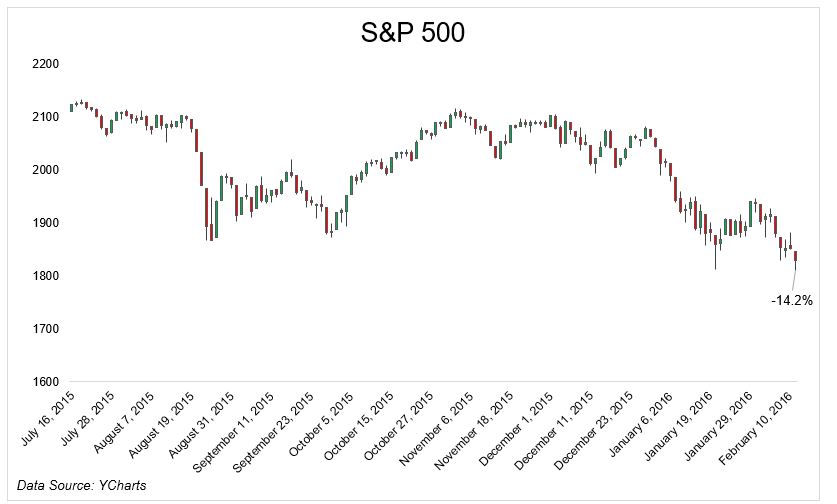

Or how about 2015? That was a fun year. We got the Yuan devaluation in August, crude prices crashing, and a stealth earnings recession.

What about 2018? I can’t even remember what this was about. Oh yeah, that’s right, it was the trade war. Good times.

And who can forget December 2018 when Mnuchin assured us that the banks all had ample liquidity. Why did we need that assurance? I don’t know, but the stock market liked it. The next day it bottomed.

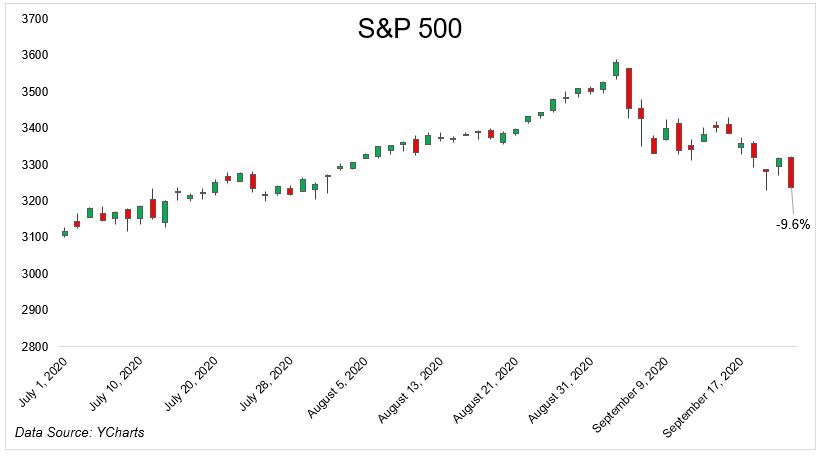

And who can forget 2020? Okay, that actually was a crash, so I’m not going to post the chart. But remember way back in September when stocks quickly corrected 10% on second wave fears?

We’ve had a handful of pullbacks and corrections over the last ten years and only one led to way lower prices. That’s not to say that now is a good time to go all in, for crying out loud we’re not even in pullback territory (-5%) and I shudder to think what would happen if we get to a correction (-10%).

I’m just trying to remind you that it feels like this every time. Every time stocks fall a little, it feels like they’re going to fall a lot.