If you know nothing else about a bubble, know this:

“Assets whose prices more than double over one to three years are twice as likely to double again in the same time frame as they are to lose more than half their value.”

This comes from Yale’s William Goetzmann (via Vanguard). In a paper called Bubble Investing: Learning From History, he said:

“The chances that a market gave back its gains following a doubling in value are about 10%.”

It’s easy to shout BUBBLE, it’s difficult to make money betting against them.

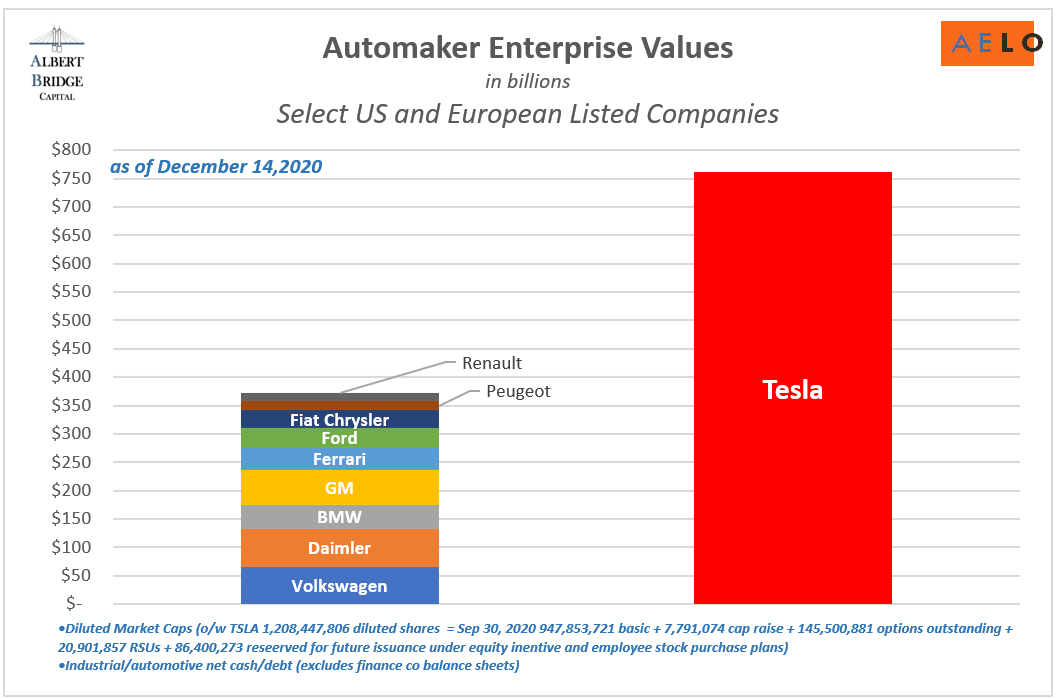

One of the great “bubbles” of our time is Tesla. This chart from my friend Drew Dickson is incredible. It shows how the market is valuing Tesla relative to some of the other giant automotive companies.

Tesla appears to be a bubble by almost all measures: the cult-like following, the returns, and the fundamentals relative to its size.

But Tesla doesn’t care what its skeptics think. Consider this take from Rob Arnott and his team at Research Affiliates (emphasis mine):

Our view is that the market constantly creates single-asset micro-bubbles, isolated examples of extreme mispricing which require severe right-tail outcomes to justify the asset’s price. Over the first quarter of 2018, Tesla has been an excellent example of a micro-bubble….Absent the unfolding of this rosy scenario, Tesla’s current price would require remarkably aggressive assumptions to deliver a positive risk premium.

When they wrote this piece, Tesla was trading at $50 a share, adjusted for stock splits. Today it’s $675. This is a 1,250% return!

From its highs in January, it would have to fall 95% to get back to the level where they identified it as a bubble. Holy shit. The story isn’t complete, but this chapter is over. In this case, early was very very wrong.

I’m not dunking on RAFI, I probably nodded my head when I read this. The point is that it’s easy to call things a bubble, it’s almost impossible to profit from them. Sure you can get lucky, but good luck doing it twice.

Josh and I spoke about this and much more on today’s Live What Are Your Thoughts?

Subscribe to the channel, you’ll get a notification as the show is about to premiere each week.

Josh and Michael use YCharts when creating visuals for this show and many aspects of their business. What Are Your Thoughts viewers can get a 20% discount for YCharts by clicking here (new users only):