Today’s Animal Spirits is brought to you by YCharts

Mention Animal Spirits to receive 20% off when you initially sign up for the service

On today’s show we discuss:

- Investors put more money into stocks last week than they did in all of the 20th century

- Index funds are worse than Marxism

- The biggest ETF launch ever

- Real estate expert Bill McBride agrees with Ben

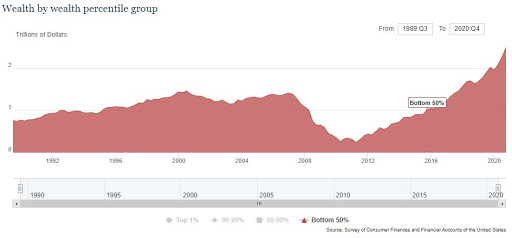

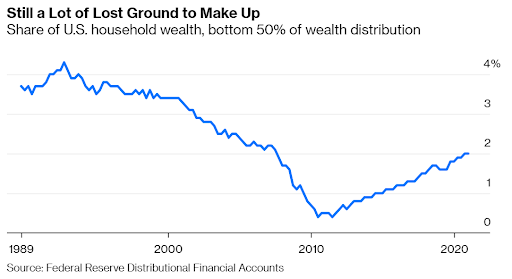

- Some good things are happening for the bottom half of Americans

- A worker shortage

- The right way to think about “paying” for the infrastructure bill

- Fidelity is hiring, check it out

- Margin loan is not a leading indicator

- 1 in 4 workers will be looking for a new job. I’m not buying it.

- First time investors are now 15% of the retail market

- Robinhood is a big player in crypto

Listen here:

Recommendations:

Charts:

Tweets:

The technologically enabled innovation evolving today is dwarfing that during any other period in history. It is creating “good deflation” and explosive demand. Battery technology is a good example. In @ARKInvest’s view, EVs will scale 15-20 fold in the next five years.

— Cathie Wood (@CathieDWood) April 6, 2021

The chart below shows that equity funds & ETFs have barely taken in fresh investments since the March 2009 bottom, despite a 660% return for the S&P 500. Incredible. Bond funds & ETFs, meanwhile, have taken in more than $3 trillion. Begs the question: Where’s the bubble? pic.twitter.com/v7IMAAYAt7

— Jurrien Timmer (@TimmerFidelity) April 6, 2021

(Bill McBride tweet: “Speculation would be significant house-flipping”)

(Myles Udland tweet: “$UBER: “As vaccination rates increase in the U.S.”)

Some highlights…

1. UHNW investors have more money in collectibles than gold/precious metals.

(Are they just coming up with an excuse to buy what they want?) pic.twitter.com/qrZwvbChO0

— Corey Hoffstein 🏴☠️ (@choffstein) April 10, 2021

Investors @CollectableApp have opted to REJECT the $34,500 ($13.67/share) buyout offer presented to them for the '1996 SI for Kids Tiger Woods Card’ (PSA 10) 🐯

91% of shareholders (share-weighted) voted no on what would have represented a 36.7% ROI in 40 days. https://t.co/NuFZSIlwca pic.twitter.com/JEA5RRoqDo

— Altan Insights (@AltanInsights) April 9, 2021

Good lord.

“Collectable received an offer to acquire the Wilt Chamberlain 1961 Fleer Rookie Card PSA 9 for $350,000. The asset was offered on Collectable this past Sunday, April 4th, 2021, for $200,000.” pic.twitter.com/C5skHNZwml

— Michael Batnick (@michaelbatnick) April 7, 2021

1/ The amount of U.S. dollar banknotes in circulation just hit $2.1 trillion.

Patterns in banknote usage are typically very stable, so we can get a good feel for how much cash would be circulating in a hypothetical world without COVID-19. pic.twitter.com/glUjN3m1dN

— John Paul Koning (@jp_koning) April 10, 2021

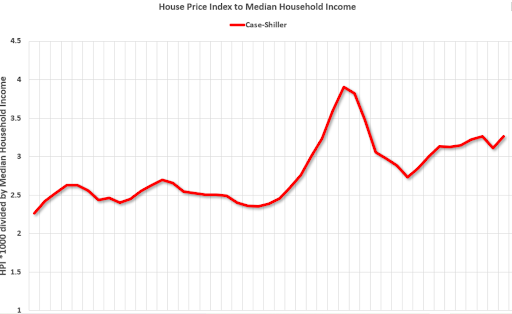

CoreLogic: House Prices up 9.2% Year-over-year in December https://t.co/YyM5k8ffE5

— Bill McBride (@calculatedrisk) February 2, 2021

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: