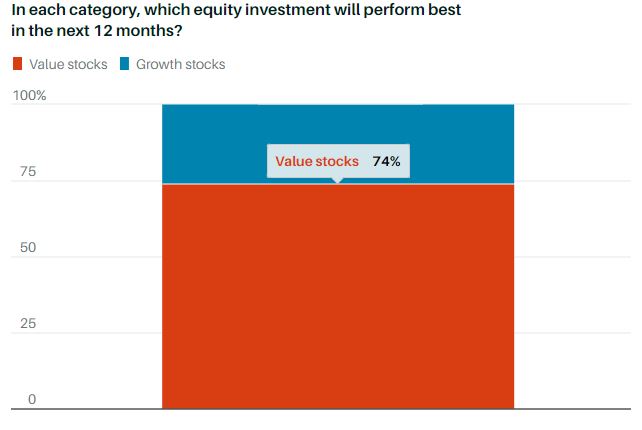

This made me laugh. 74% of respondents said that value stocks will outperform growth stocks over the next 12 months.

This comes from Barron’s Big Money Poll, where they ask 152 money managers across the country were polled about their outlook for various investments over the next 12 months.

We’ve gone from “is value investing dead” to “of course value will outperform” in less than 6 months.

I went back to the last poll (October 2020) to see what investors were saying about value versus growth and found that they weren’t saying anything because they weren’t asked about it. Why not? Because value was experiencing its worst year ever relative to growth. The beating was so severe that value outperforming growth wasn’t on anybody’s radar. But now that value has had a comeback, the overwhelming majority of investors in this poll think it will continue.

2020 has been the worst year for the academic value factor (HML). The second worst year (1999) was followed by a very strong comeback of the value factor. What about 2021?

Q1 2021 was the 2nd best quarter in history! How will the story continue? Stay tuned! pic.twitter.com/RnOUf8WdL8

— Matthias Hanauer (@HanauerMatthias) April 27, 2021

This one also is a hoot. Last year, more than twice as many investors were worried about deflation than inflation. I don’t say any of this to point fingers. I definitely wasn’t worried about inflation last year. The point is that nobody knows what’s going to happen. Very few predictions age well.

Josh and I are going to discuss the most recent big-money poll, Bill Miller’s comeback, the “stock market bubble,” and much more on tonight’s live What Are Your Thoughts. We’re going live at 5:30. Hope to see you there.

Subscribe to the channel, you’ll get a notification as the show is about to premiere each week.