Here are some numbers:

- Spotify subscribers are up 21% year-over-year.

- The Trade Desk grew revenue 37%

- Twilio grew revenue by 62%

- Shopify grew revenue by 110%.

- Square’s gross profit grew by 79%.

- Peloton subscription revenue grew 144%

Here are some more numbers:

- Spotify is 44% below its 52-week high

- The Trade Desk is 52% below its 52-week high

- Twilio is 39% below its 52-week high

- Shopify 31% is below its 52-week high

- Square is 28% below its 52-week high

- Peloton is 51% below its 52-week high

First-level thinking goes something like this: “Shopify is a great business. Buy the stock.” This has served investors well over the last few years.

Second-level thinking, which is the idea that “Shopify is a great business, but everyone already knows this, so don’t buy,” hasn’t worked out too well.

Second-level thinking is back. With the benefit of hindsight, investors should have been paying attention to the expectations that were baked into some of these stocks.

Now we’re at the third level, which is “Shopify is a great business, but the stock is getting killed. What do I do now?”

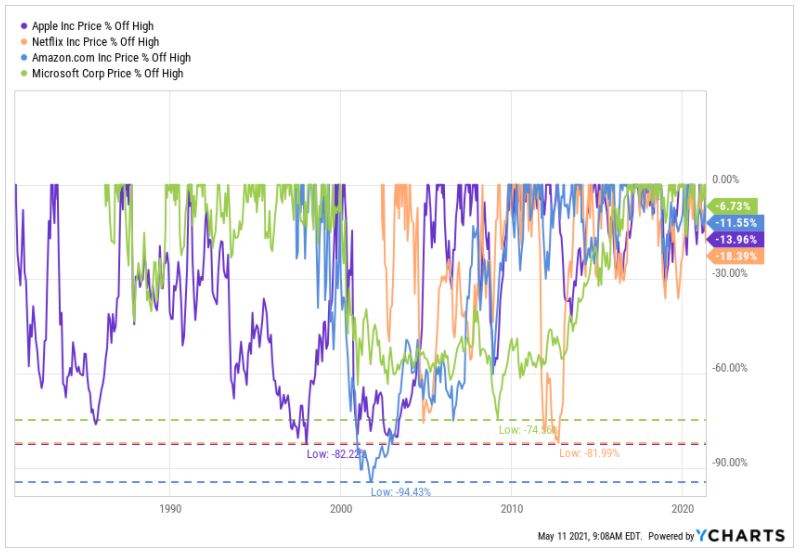

This is a question that every owner of individual stocks will have to answer at some point in their lifetime. Every stock gets killed, even the biggest winners. Amazon, Netflix, Apple, and Microsoft have lost more than 70% of their value over the course of history.

But how do we know if Shopify is going to be like Apple or more like Fitbit? Well, you can look at fundamentals, for starters. Are they growing? Is free-cash-flow positive? The problem is that these winning stocks have already been rewarded for their fundamentals. The unanswerable question now is what their growth looks like in the future, and how will investors react to it?

One of my favorite data points from JP Morgan’s The Agony & The Ecstasy shows the risk in individual equities. “More than 40% of all companies that were ever in the Russell 3000 Index experienced a “catastrophic stock price loss,” which we define as a 70% decline in price from

peak levels which is not recovered.” In tech stocks, where all the damage is in today’s market, that number jumps to 73%.

If you know that most stocks get killed, then it would behoove you to size your positions accordingly. Never let one stock or one group of stocks become so large a piece of your portfolio that you become paralyzed by fear. If you’re thinking of selling because you’re worried about how much lower these names can go, then you’ve already lost. You need to plan for these selloffs before they happen because they always happen.

Josh and I will cover the tech wreck and more on tonight’s What Are Your Thoughts?

Subscribe to the channel, you’ll get a notification as the show is about to premiere each week.