Inflation is the word du jour.

The cover story in this weekend’s Barron’s was Inflation Is Here and Hotter Than It Looks. Why It’s Time to Worry.

But people don’t have to read a financial publication to know there’s inflation. They feel it all around them, especially business owners. A near-record number of companies plan on raising their prices.

Higher costs are bad for consumers but can be okay for businesses. Their ability to pass on costs is why stocks can perform well in periods of rising prices.

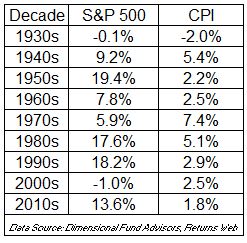

But when prices rise too fast, everything can come off the rails, as we saw in the 1970s. During that decade, the S&P 500 compounded at 5.9% a year, but it wasn’t enough to keep up with consumer prices, which grew at 7.4%

High inflation wrecks currencies, damages society, and can up-end economies and stock markets. The 1970s were the worst version of this. We got rising prices without an accelerating economy. Stagflation resulted in the worst real decade ever for stocks.

I understand why people who lived through this are deathly afraid of it happening again. Spiraling inflation is unequivocally destructive. But what about above-average inflation?

If you look at inflation through the lens of an equity investor, you’ll see that inflation is not a good determiner of stock prices. The chart below plots the monthly change in inflation with the monthly return for stocks. Looking at these items concurrently might not be the optimal way to show how inflation impacts stocks, but I think it’s good enough, and I’m not interested in torturing the data.

This chart shows what we already know. Some of the worst months occurred during periods of rapidly rising prices. But it also shows a lot of noise. Inflation is a critical factor, but it’s just one factor.

You can’t talk about inflation without talking about earnings. Or wages. Or interest rates. Or fiscal policy or monetary policy. Or the pace of innovation. Or valuation. Or sentiment.

A second ago, I asked you to look at inflation through the lens of an investor, but you don’t need to have a brokerage account to feel rising prices, and that’s what makes it such a wild card. You feel inflation at the gas pump and the grocery store. And if people are worried about rising prices, that alone can cause prices to rise. I’m usually not a fan of “slippery slope” or “self-fulfilling” arguments, but I’m sympathetic to this one.

There’s no telling how long it will take for supply to catch up with demand, but there appears to be a shortage of everything right now. That’s the bad news. The good news is that businesses can pass on rising prices. Inflation doesn’t have to crash the stock market.

Josh and I are going to cover this and much more on an all-new What Are Your Thoughts?

Subscribe to the channel, you’ll get a notification as the show is about to premiere each week.