Today’s Animal Spirits is brought to you by YCharts

On today’s show we discuss:

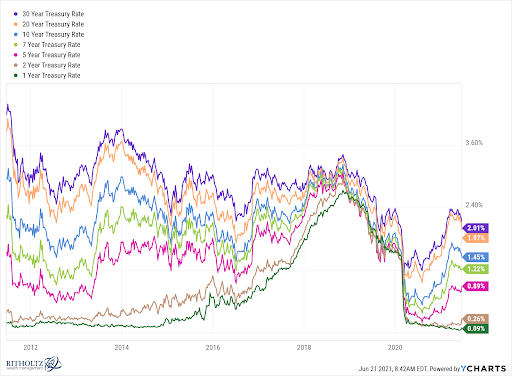

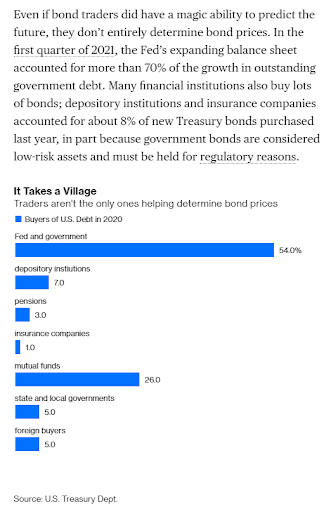

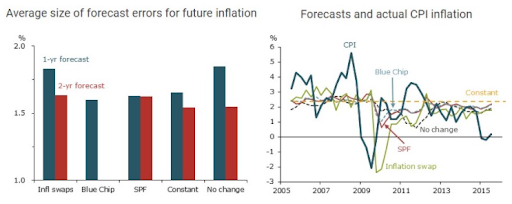

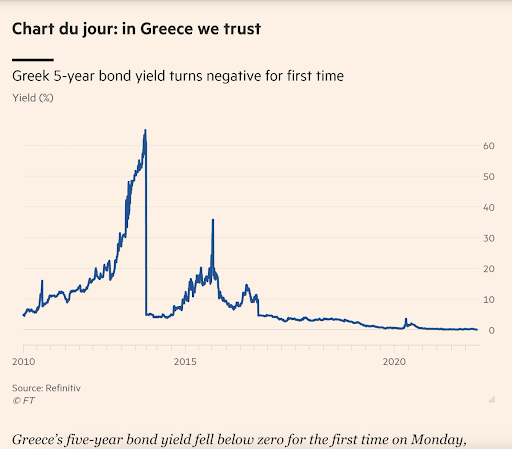

- Bond traders aren’t better than anyone else at predicting inflation

- Ben on why it’s so hard to predict inflation

- Inflation is personal

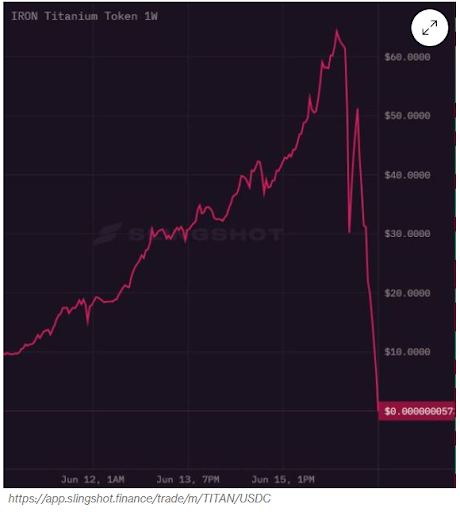

- Cuban calling for crypto regulation. Tough scene.

- We should prepare to manage an economic boom

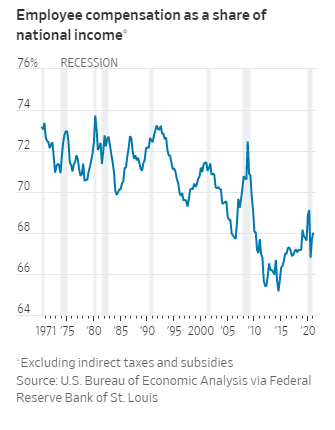

- 649,000 retail workers say “enough is enough”

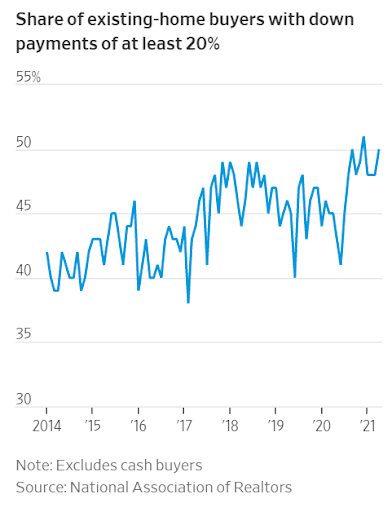

- A record number of home buyers putting down >20%

- People are not tapping their home equity like they were in 2005

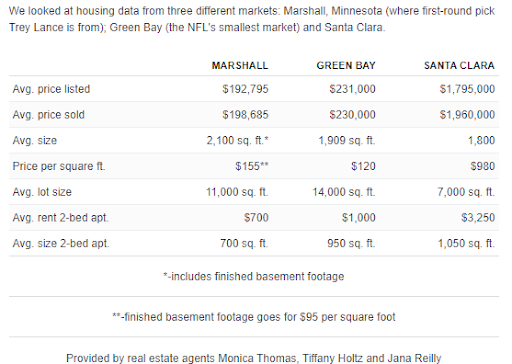

- San Francisco is too expensive for professional athletes

- Great take from Nick on why success early in life can be a hindrance

- Young people earning 6 figures are living paycheck to paycheck. And that’s not a bad thing.

- If you’re curious about corn

Listen here:

Recommendations:

Charts:

Tweets:

Investors’ response to the Fed’s hawkish dot-plot was to unwind some of the reflation bets, which have become crowded recently. In the equity markets, inflation-sensitive shares took a hit. pic.twitter.com/A5u83GEhwN

— (((The Daily Shot))) (@SoberLook) June 18, 2021

CoreLogic: House Prices up 9.2% Year-over-year in December https://t.co/YyM5k8ffE5

— Bill McBride (@calculatedrisk) February 2, 2021

Millennials buying fractional ownership stakes in second/vacation homes using some sort of tech platform (definitely not “timeshares.”) Basically pull out the Baby Boomers 1990’s playbook and figure out how Millennials will reinvent it. https://t.co/ynhDpuY7kb

— Conor Sen (@conorsen) June 15, 2021

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: