I’m a house-picking genius.

In the two and a half years since I moved in, my home has appreciated by 40%. I learned of this through an appraisal for a refinance that I’m going through.

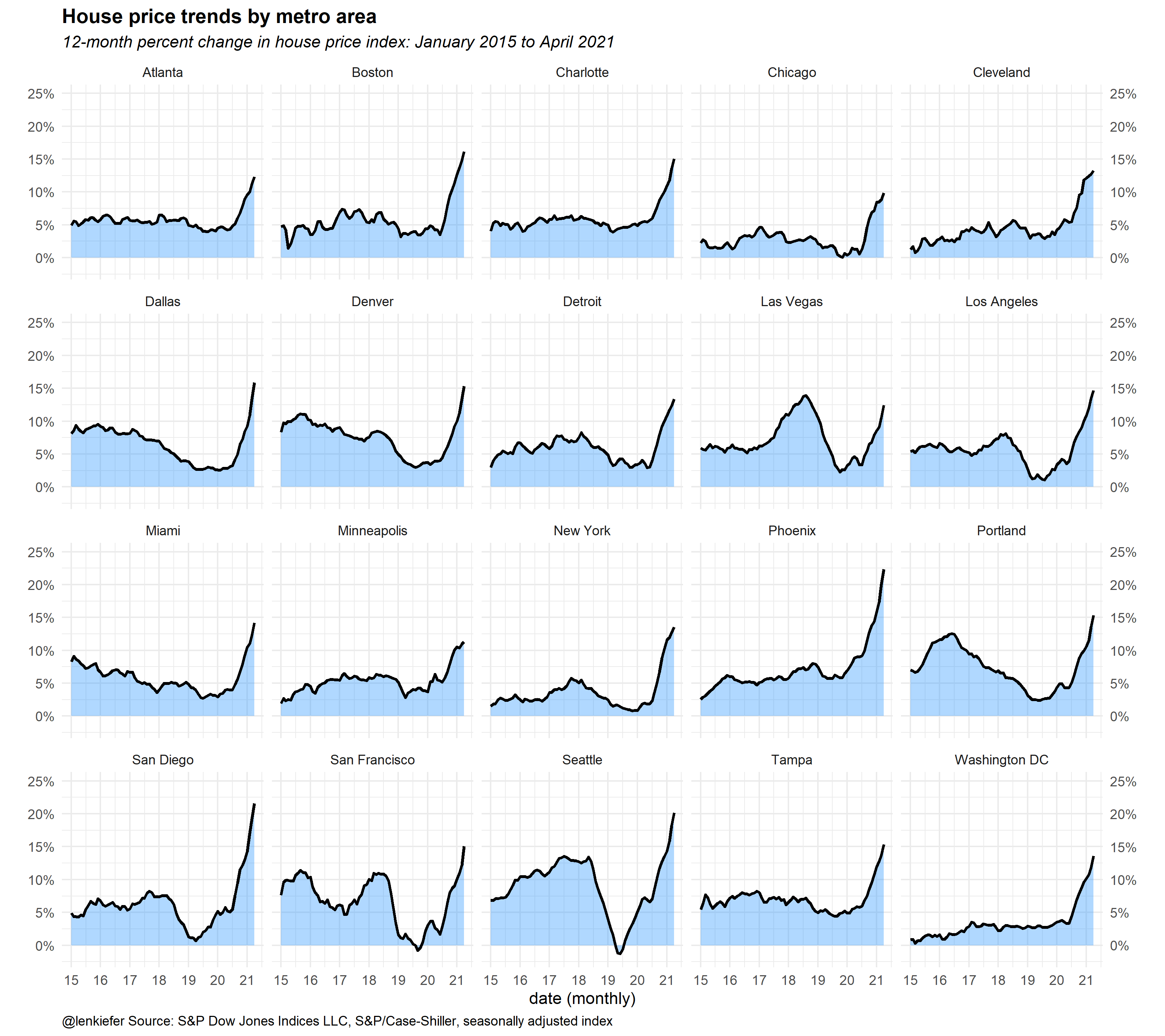

Everyone has anecdotes like this, but what we’re seeing and hearing is confirmed by the data.

Prices have gotten completely out of hand. Today we learned that home prices across the country gained 14.6% y/o/y, which is the biggest gain on record.

Look at this chart from Len Kiefer.

The Fed has bought $982 billion of mortgage bonds since March 2020. Fair enough, they did what they had to do. But they continue to act as if the economy is on life support and are continuing to buy $40 billion of mortgage bonds a month.

It’s hard to quantify the impact mortgage buying has on the housing market.

George Pearkes did a good thread on what impact these purchases have. The TL:DR is “Fed buying MBS reduces risk premiums via removing duration and hedging requirements from private sector balance sheets, but isn’t a direct driver of higher mortgage credit provisions and therefore home prices.”

San Francisco Fed President Mary Daly shared a similar sentiment when she said:

My best-guess estimate is that we are having a de minimis effect on mortgage interest rates with our mortgage-backed securities purchases.

Fine, let’s stipulate that this is true. Whether it’s treasuries or mortgages, the fed is buying bonds to stimulate the economy and I don’t think this is the appropriate thing to do at this point.*

I’m not a fed hater. In fact, I’ve been accused of being a fed apologist in part because I don’t blame them for the rising prices. Demographics and Covid are at least as responsible for housing prices going up as interest rates are. That being said, I just don’t understand what the rationale is for the continued bond buying. It seems like some fed officials don’t either.

Here’s a quote from James Bullard, St. Louis Fed President:

I’m leaning a little bit toward the idea that maybe we don’t need to be in mortgage-backed securities with a booming housing market and even a threatening housing bubble here, according to some people.

Here’s another one from Boston Fed President Eric Rosngren.

The mortgage market probably doesn’t need as much support now

Josh and I discussed the housing market and more on the newest edition of What Are Your Thoughts?

Subscribe to the channel. You’ll get a notification as the show is about to premiere each week.

*I take my own opinion of what fed officials should or shouldn’t be doing with an enormous grain of salt.