I love reading pieces that challenge your beliefs or the prevailing narrative. Something landed in my inbox recently that did both of those things.

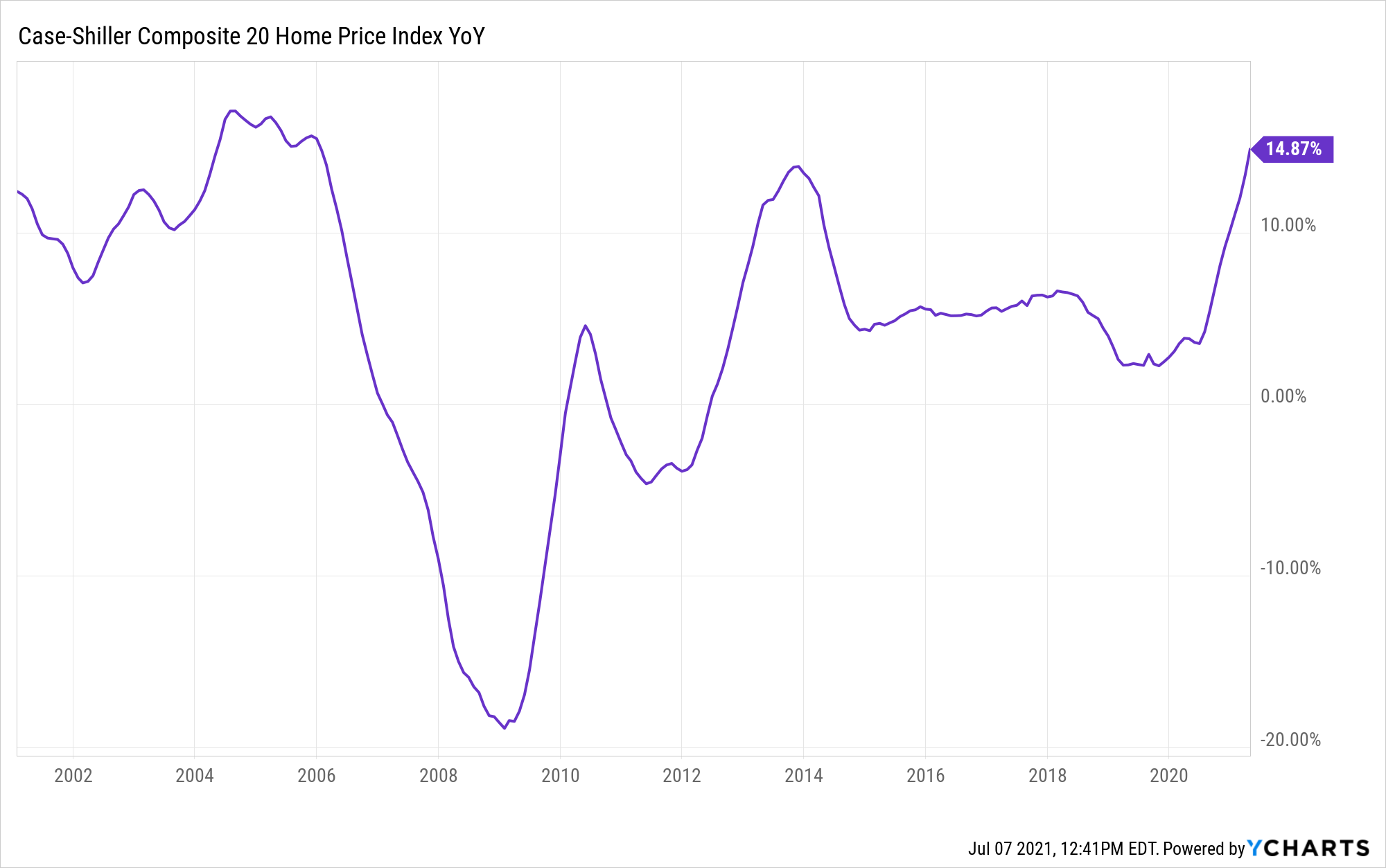

Much has been made over the Blackstones of the world and the impact that they’re having on the housing market. Home prices, as you’ve probably noticed, are on fire.

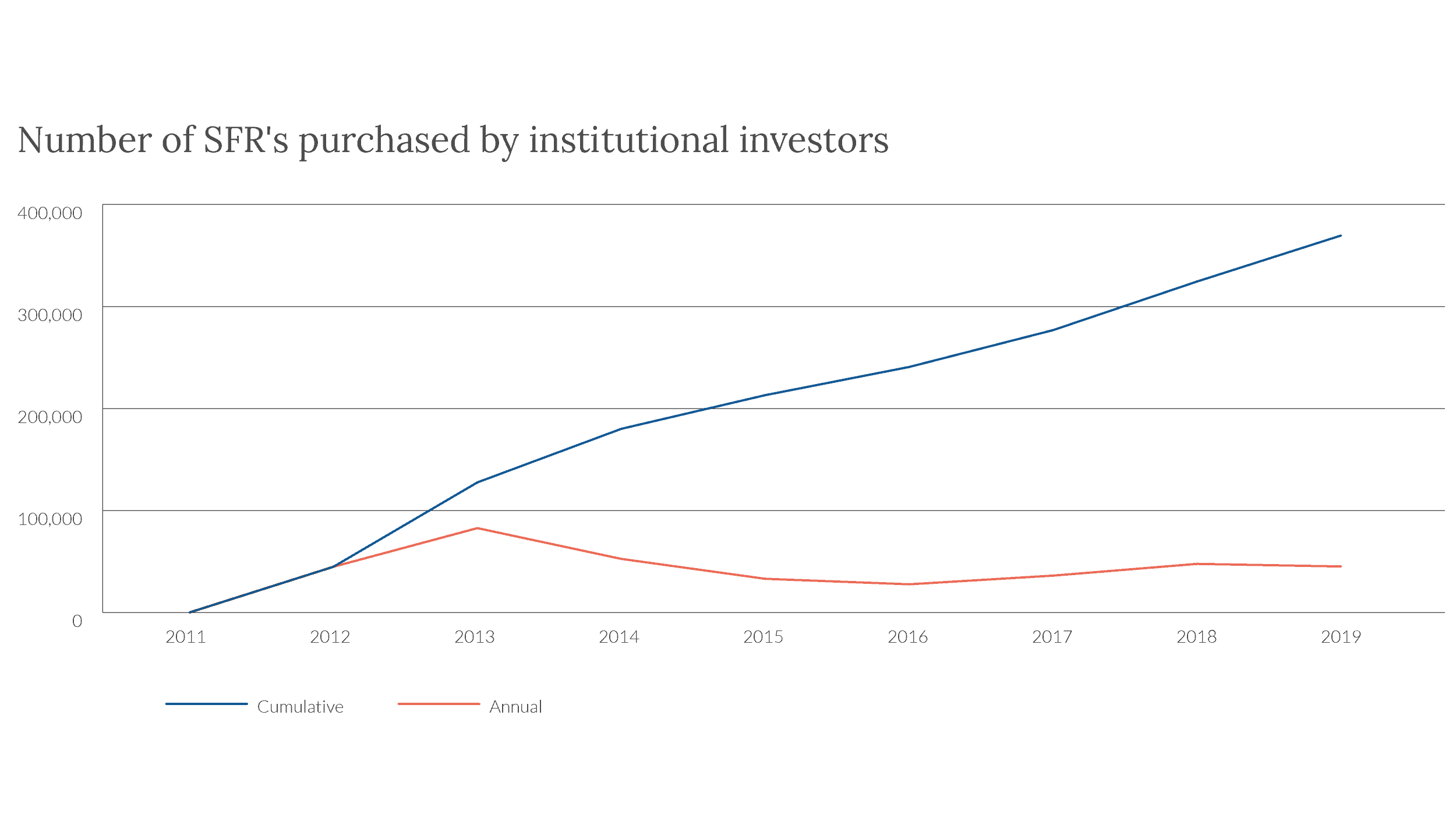

In Are Private Equity Firms to Blame for Rising Home Prices? Coby Lefkowitz gave some background on how institutional investors are growing their presence in this market. Single-family rentals weren’t really a thing before the GFC. But the housing bust allowed these investors to swoop in and purchase these homes at a steep discount.*

Here’s Coby’s take:

According to the latest data from the American Housing Survey, there are nearly 86 million single family homes in the US. Institutionally owned SFRs represent less than a half of a percent of this market. If we were to narrow our focus solely to the rental market of single family homes, of which there are 16 million, institutionally backed firms only own 2.5% of the market. While investors purchase 20% of all homes nationally today, only 1–2% of homes are bought by larger investment firms. Most rentals are owned by small investors.

Here’s some more data to put institutional home buying in perspective. Of the 23 million single-family homes in the United States, single-family rental home companies own just over 1%.

And one more, for good measure, from the National Rental Home Council:

“In 2020, a year when home sales were the highest in 14 years, single-family rental home companies accounted for less than .14% of homes purchased.”

Okay, so maybe institutional investors aren’t to blame after all. But even though they’re a small part of the market today, their presence is growing. Blackstone recently announced that they’re going to be deploying $6 billion into this market. Six billion dollars. That’s a lot of money. But it’s desperately in need of context.

First of all, that will likely take years to deploy, but even if they were to do it in one year, this alone wouldn’t move the needle. There are ~6 million existing-home sales a year. Using the median home sales price, this would imply 17,250 houses or 0.3% of existing-home sales. Granted, Blackstone is not the only player in the market, far from it, but I think these numbers should help bust the narrative** that institutional investors are responsible for the rising prices.

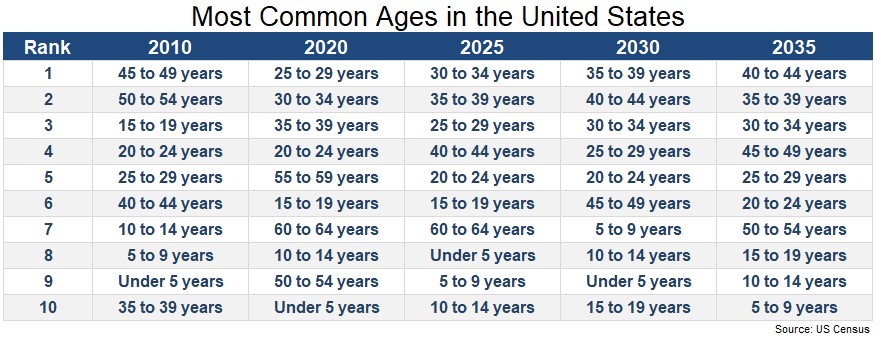

So if Blackstone isn’t the culprit***, then who is? This is not a great mystery. There is more demand than supply. Interest rates are super low. And there are 72 million millennials who are in their prime home-buying years. The chart below tells the story.

I know why people point fingers at Wall Street. They’re an easy target. And billions of dollars is a lot of dollars. But the housing market is huge, and for now, they’re still a tiny player on the field. Home prices are rising for reasons that can easily be explained, and Blackstone is not the easy explanation some people make them out to be.

*This blew my mind, again from the National Rental Home Council piece: “During the years of the great recession, 2007 – 2011, single-family rental home companies purchased approximately 2% of homes sold through foreclosure and short sales.” I almost find these numbers hard to believe, but they say their data is supplied by NRHC member companies; Freddie Mac, U.S. Census Bureau

**No it won’t

***Not every area is the same. In Georgia, for example, 5% of single-family rental homes are owned by rental companies. Surely this some impact on the communities where they’re buying in bulk. But again, this does not explain the price increases we see all across the country.