Today’s Animal Spirits is brought to you by Masterworks. Go to Masterworks.io/Animal to skip the waitlist.

On today’s show we discuss:

- Is the Roaring 20s kind of already here?

- Bob Burgess Tweet – Household Debt Service as a % of Disposable Income

- 95% of workers want to change jobs, lol

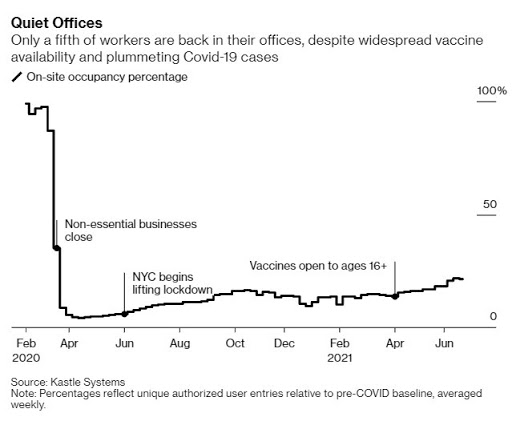

- Subway and train traffic still way down

- Baby Bust

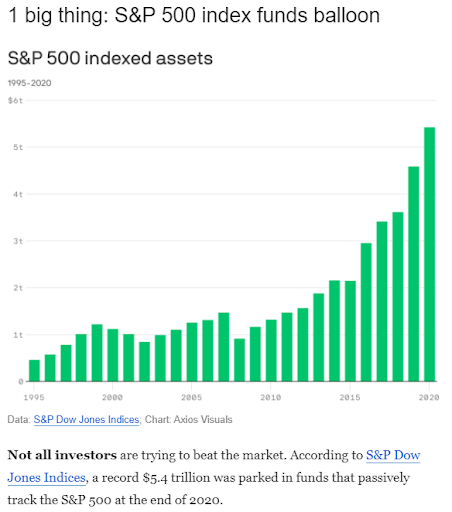

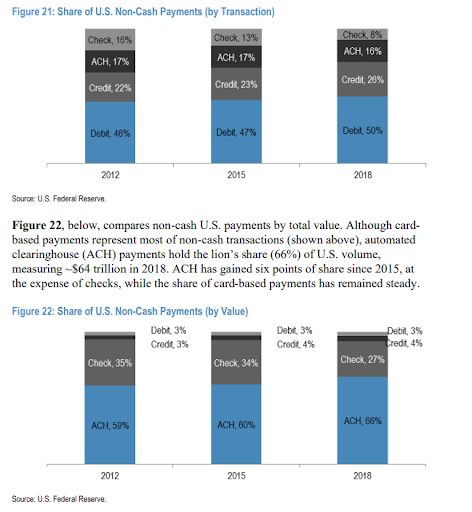

- Cash is disappearing

- Rewards for staking

- The risks of providing liquidity

- Dave Nadig on volatility

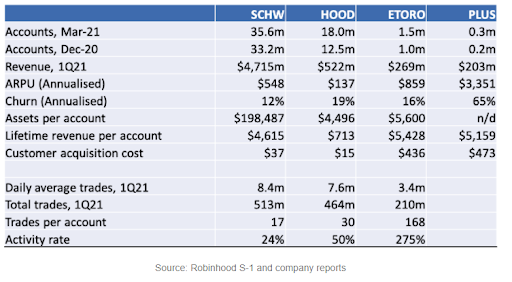

- Average account size

- Home prices rising fastest in areas without mass transit

- Who’s driving up home prices?

- This thing is global

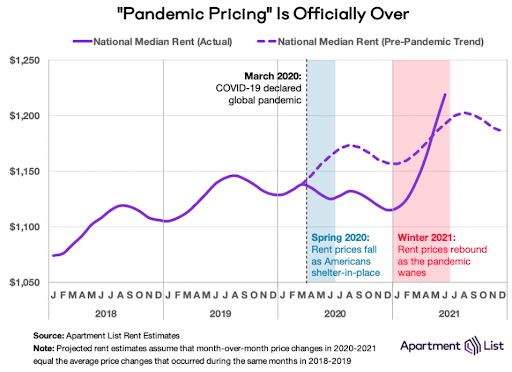

- Rents are playing catch up

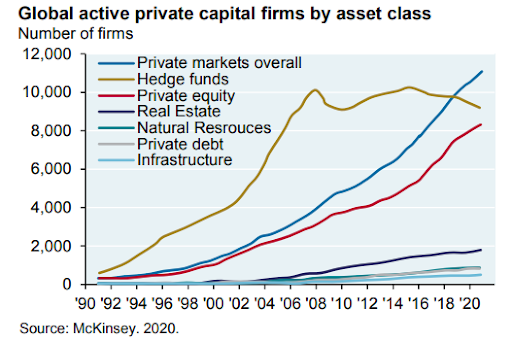

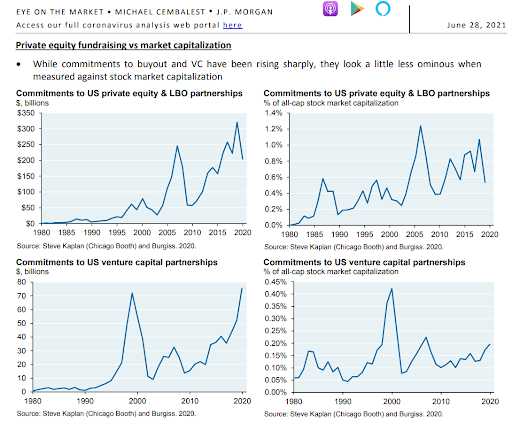

- There’s a ton of money in private equity. But it’s still kinda tiny.

- Movie theaters are dead

- Black Widow’s box office numbers

Listen here:

Recommendations:

Charts:

Tweets:

BREAKING: This is an absolutely amazing chart of just released #Fed data. The percentage of earnings that US households are spending on debt payments has collapsed pic.twitter.com/ivjmasHMhQ

— Robert Burgess (@BobOnMarkets) July 7, 2021

https://twitter.com/JohnStCapital/status/1412457298686001155

Stat of the day via @barronsonline…

Average daily value of shares traded in AMC was *$13.1bil* in June, more than AMZN ($10.3bil) & AAPL ($9.5bil).

Reminder AMC’s market cap = $217mil in April of last yr.

Wild.

— Nate Geraci (@NateGeraci) July 10, 2021

David Schawel tweet – @DavidSchawel “One of my favorites”

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: