Today’s Animal Spirits is brought to you Masterworks.

For more information go to Masterworks.io/Animal to learn more

On today’s show we discuss:

- Bill Ackman wants higher rates

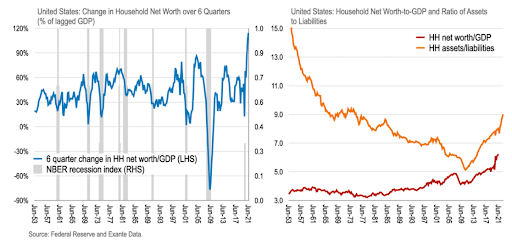

- Probably never had households better prepared for either higher inflation or high rates

- How to invest in iBonds

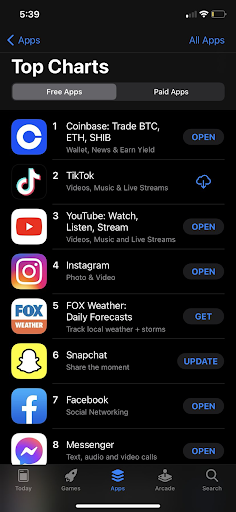

- Shiba Inu is the third most googled crypto in 2021, new study shows

- SquidGame coin investors get rugged

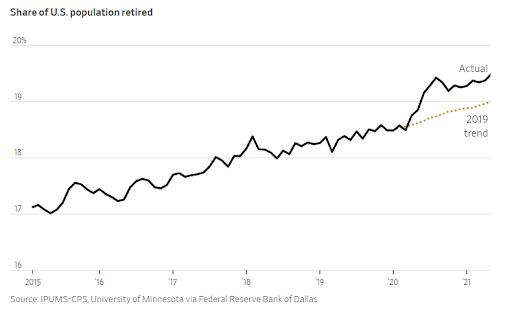

- People are retiring too early

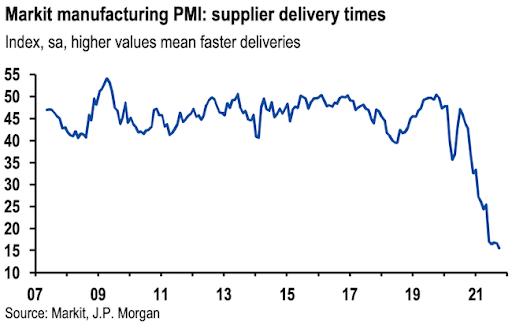

- 20-year truck driver on this mess

- Too much demand is a good problem

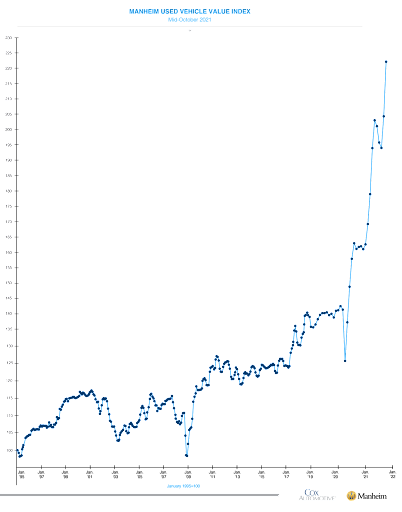

- Used car index is out of control

- Refi trends

- People are moving to Michigan’s wine country

- Electric Vehicles

- Zillow got crushed in Phoenix

- Future Proof: use the code AnimalSpirits to get a ticket 50% off

- How to invest in PINK

Listen here

Transcript (Via Audiograph)

Recommendations:

Charts:

Tweets:

As we have previously disclosed, we have put our money where our mouth is in hedging our exposure to an upward move in rates, as we believe that a rise in rates could negatively impact our long-only equity portfolio.

— Bill Ackman (@BillAckman) October 29, 2021

it didn't feel like it, but that was the S&P 500's best October performance in 6 yearshttps://t.co/GHqKCYuBc2 via @markets by @luwangnyc & @VildanaHajric pic.twitter.com/AnyWcJfYxF

— Katie Greifeld (@kgreifeld) November 1, 2021

I put $2K into a similar meme coin (AKITA) back in January. I ended up selling in 3 tranches, ended up netting $210K. If I had just held, it would have been worth $3.5MM at its peak. Can you believe this—the best trade of my life—makes me sick to think about?

— Legal Whisperer (@legal_whisperer) October 26, 2021

Fake regrets on fake money.

This guy (and 99.99% of you) would have sold way before the $2k got to $1B.

Still sucks, but the actual loss is a few hundred thousand to a few million, not a billion. https://t.co/w8AO4TPp6d

— Nick Maggiulli (@dollarsanddata) October 27, 2021

SHIBA INU HAS A LARGER MARKET CAP THAN DEUTSCHE BANK -CNBC $SHIB

— FXHedge (@Fxhedgers) October 27, 2021

This wallet bought roughly $8,000 of $SHIB last August.

It's now worth $5.7 billion.

From $8,000 to $5.7 billion in roughly 400 days.

We may actually be looking at the greatest individual trade of all time. pic.twitter.com/LtdgQ83bKP

— Morning Brew ☕️ (@MorningBrew) October 27, 2021

Good luck keep business school kids attention for “asset pricing theory” class, might as well just rip up the textbooks

— Leigh Drogen (@LDrogen) October 28, 2021

Heard that a large portion of students a top MBA aren’t interested in banking or consulting or even PE

It’s all startups and VC

This is, indubitably, the clearest sign that this is the top

— Amalgamated Bank of Grit (@GritGrowthCap) October 28, 2021

*Crypto Conglomerate Digital Currency Group Raises $700 Million in Investment Round at $10 Billion Valuation

*Digital Currency Group Investment Round Is Second-Largest in Crypto Sector

*Digital Currency Group Owns CoinDesk, Grayscale, Genesis

— *Walter Bloomberg (@DeItaone) November 1, 2021

$BITO is merely the first step on 5yr-ish journey that will lead to cheap, liquid total market crypto ETFs (poss even from Vanguard) that will hoover up billions in advisor assets (bc that's exactly what happened w every other asset class). New note from me and @JSeyff today.. pic.twitter.com/rUTdyskNkm

— Eric Balchunas (@EricBalchunas) October 26, 2021

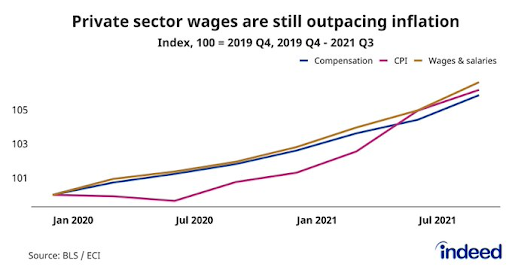

Hey now! Wages and salaries grew by 1.5% OVER THE QUARTER in Q3!

— Nick Bunker (@nick_bunker) October 29, 2021

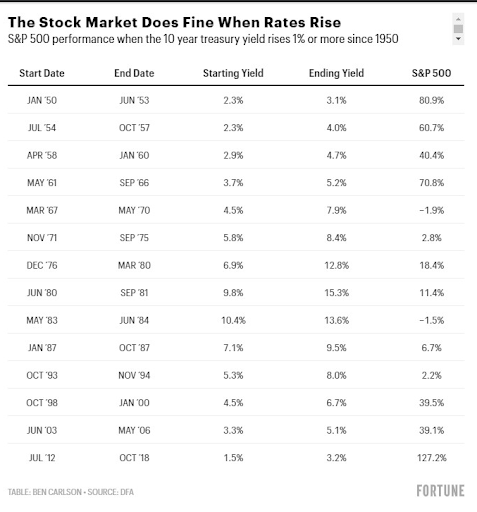

https://mobile.twitter.com/awealthofcs/status/851438898504978432?lang=de

With house prices up, more homeowners are tapping equity via cash out refinance. But much less so than in 2006

In 2006, refinance borrowers cashed out 22.4% of their property value when doing a cash out.

In 2021, only 13.8%, which is the lowest ratio in data going back to 1998 pic.twitter.com/5HtWVsQ5v7

— 📈 Len Kiefer 📊 (@lenkiefer) October 30, 2021

*ZILLOW SELLING 7,000 HOMES FOR $2.8 BILLION AFTER FLIPPING HALT

— *Walter Bloomberg (@DeItaone) November 1, 2021

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: