Today’s Animal Spirits is brought to you by YCharts

On today’s show we discuss:

- Index Coop Analytics

- 3 weeks ago we bet on Omicron being 1% of cases by year end

- Prepare for household disruption this winter

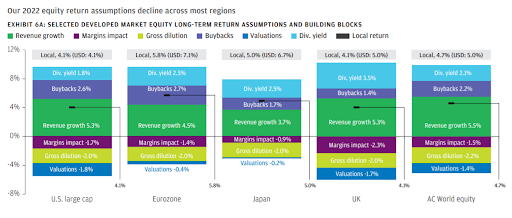

- Long-term capital markets assumptions, via JP Morgan

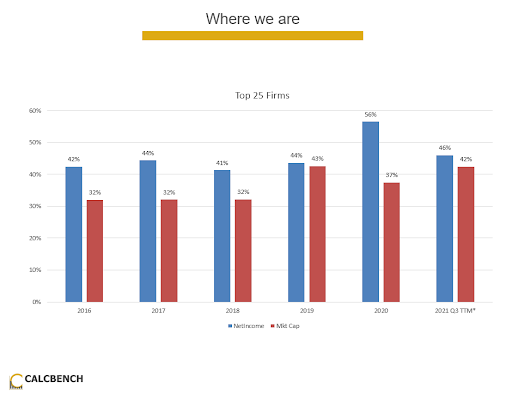

- The U.S. has had an extraordinary decade

- This is why the middle class is unhappy

- What to do with inflation

- Crypto Theses for 2022

- 2022 Digital Asset Outlook

- Is ARKK deep value?

- 83% of investors own crypto

- Millennials in the housing market

- Unfortunately, waiting to buy a house has been a tough financial decision

Listen here:

Transcript here:

Recommendations

- Daffy. Charitable giving/donor Advised Fund

- Inherent Vice

- Sammy the Bull

- Station Eleven

- The Last Duel

- Focus

- Ben Affleck on The Bill Simmons Podcast

Charts:

Tweets:

When you look at this picture are you comforted about the future trajectory of inflation or scared?

Most people are comforted–they picture goods inflation falling while services inflation stays the same.

But what if the shift from goods to services raises services inflation? pic.twitter.com/uY1CHUrPOX

— Jason Furman (@jasonfurman) December 13, 2021

There's no doubt at this point (post the PPI report), the pressure on Powell to sound really hawkish tomorrow is immense. Dot plots to move up in 2022. Maybe a recession is the only way to put the inflation genie back in the bottle.

— David Rosenberg (@EconguyRosie) December 14, 2021

Giant grocery store chains force high food prices onto American families while rewarding executives & investors with lavish bonuses and stock buybacks. I'm demanding they answer for putting corporate profits over consumers and workers during the pandemic. https://t.co/NvY2MKKJNP

— Elizabeth Warren (@SenWarren) December 20, 2021

You’re a fund determined to be a media empire that can’t be ignored…not Gandhi.

— jack (@jack) December 21, 2021

https://twitter.com/tpsarofagis/status/1471158740674125826?s=12

Nov housing starts report is an indication of strength for the housing market. The # of permits issued, which can signal how much construction is in the pipeline, increased by 3.6%, homebuilding rose as total housing starts increased 11.8% M/M (SF up 11.3%).

— Odeta Kushi (@odetakushi) December 16, 2021

2nd highest US housing starts print since 2006,

year-to-date housing starts through November highest since 2006 pic.twitter.com/6G618k4UJh— 📈 Len Kiefer 📊 (@lenkiefer) December 16, 2021

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: