Earlier in the week we* wrote about how quickly the market moves these days. Not surprisingly, this is having a measurable impact on investors’ psyche, and their portfolio.

On Monday, Bloomberg highlighted the wave of panic selling:

In a spasm of panicked selling early Monday, retail investors offloaded a net $1.36 billion worth of stock by noon, most of it in the first hour, according to data compiled by JPMorgan Chase & Co. strategist Peng Cheng. By his estimate, share disposals were 3.9 standard deviations heavier than the full-day average in the previous 12 months.

And then yesterday, according to JPM via Carl Quintanilla, “the retail investor bought $1.69bn on the day; this is the second most on record.”

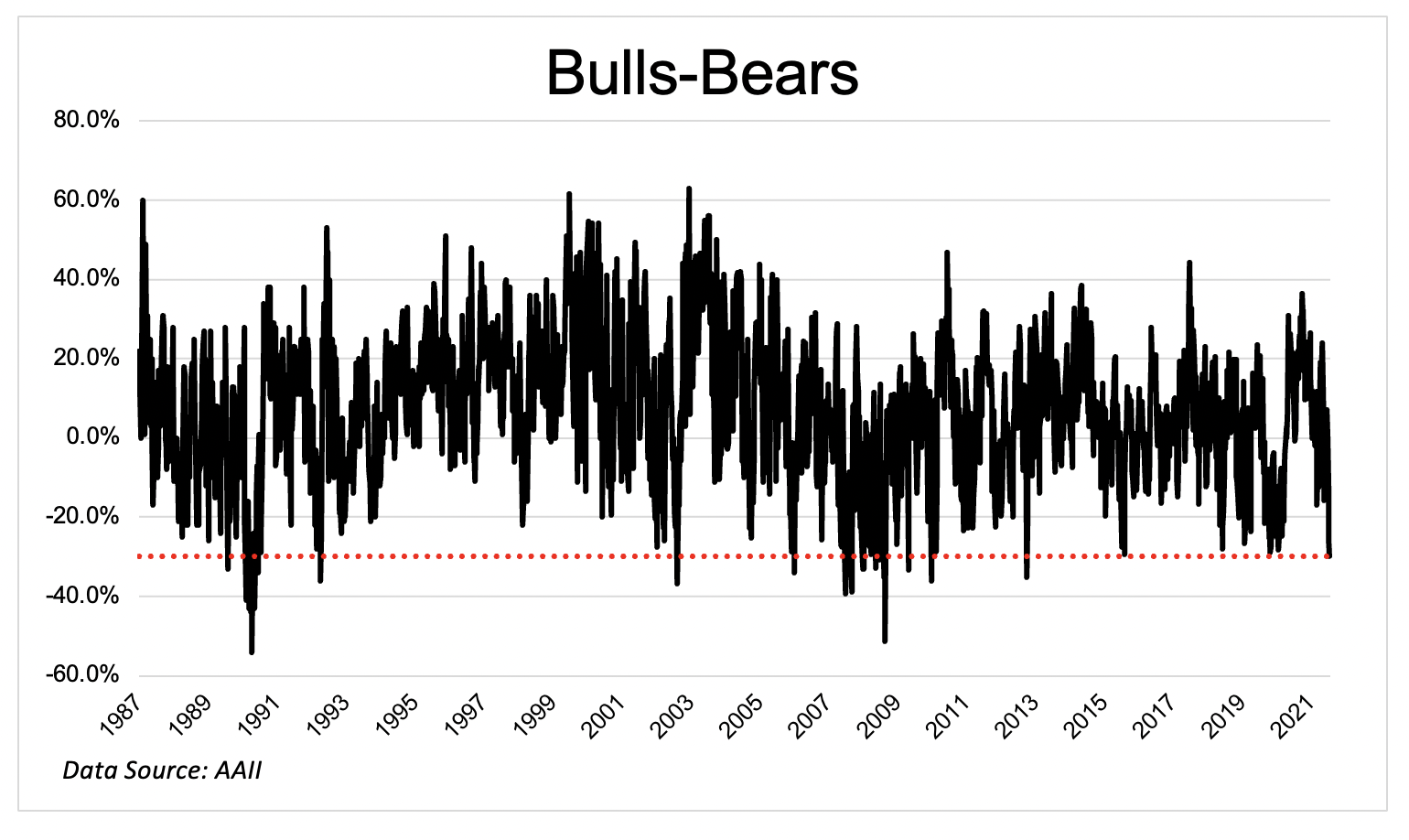

It’s understandable that faster moves in the market are having outsized impacts on investor behavior. It’s hard to believe, but the latest data from AAII (H/T Liz Ann Sonders) revealed the spread between bulls and bears is at the widest level since 2013. Bears outweigh bulls by more today than they did at the pandemic lows!

Right now we have 7% GDP growth and 4% unemployment, yet the spread between bulls and bears is wider today than it was when we were trapped at home and terrified that ourselves or our loved ones would get infected and possibly die during the worst pandemic in over a century. Go figure.

An overgeneralization about rising markets is that they tend to go up slowly over time, rarely ending in a buying panic. Bottoms on the other hand are almost always an event. Looking backwards, you can see that bottoms always come with a spike in bearish sentiment. To be clear, this does not mean that bearish spikes mark a bottom. Although it’s comforting to see the discomfort, it’s just impossible to say whether or not that was it.

If I had to guess why the spread between bulls and bears is so wide today, given that indices are barely in correction territory, I would offer two reasons. First, not everybody owns index funds. A lot of individual stocks are getting absolutely slaughtered. If all you saw was a list of the losing stocks you’d think we were in a massive recession. Second, the reason stocks are falling is scaring the hell out of people. Inflation and rising rates are a nasty cocktail for investor emotion.

It’s encouraging to see such fear out there, but we just can’t be sure if we’re at the peak, or if there is more to come.

*Trying this on. Don’t love it. Why do people say “we” when they’re talking about themselves? I think I’ll stick with the tried and true “I”