Thirteen years ago, the financial world was in free fall. Lehman Brothers, a financial institution that had been around since before The Civil War, declared bankruptcy. Mortgage delinquencies were sky-rocketing, peaking at 11%. One in ten workers was without a job. Things were dire, and the chaos was reflected in the stock market, which in seventeen months, was trading at just 45 cents on the dollar.

If investors were told to hang tight, that the S&P 500 would return 17% a year for the next thirteen years, 700% total, nobody would have believed it. The sky was dark in 2009 and it seemed like the sun would never shine again. But the darkness always gives way to light because hope is more powerful than despair. People never lose the motivation to provide for their families and to make the future better than the past.

Below is a short list of products and services we take for granted today that are proof of our collective drive. None of these things existed when Bear Stearns was being rescued:

- Uber

- Streaming (technically it did but it was garbage)

- Slack

- FaceTime/Zoom

- Airpods

- Crowdfunding

- Venmo/mobile payments

- Crispr

- Reusable rockets

- Smart items in the home. Ring, Alexa, Nest, etc

- iPads

- Electric vehicles (they existed but had 0% market share)

- Self-driving cars (still waiting but maybe a little closer)

- Standing desks

- Shared office space

- Work from home

- Crypto

- Podcasts

- Robo-advisors

- Quantitative easing/zero interest rates

- Theranos

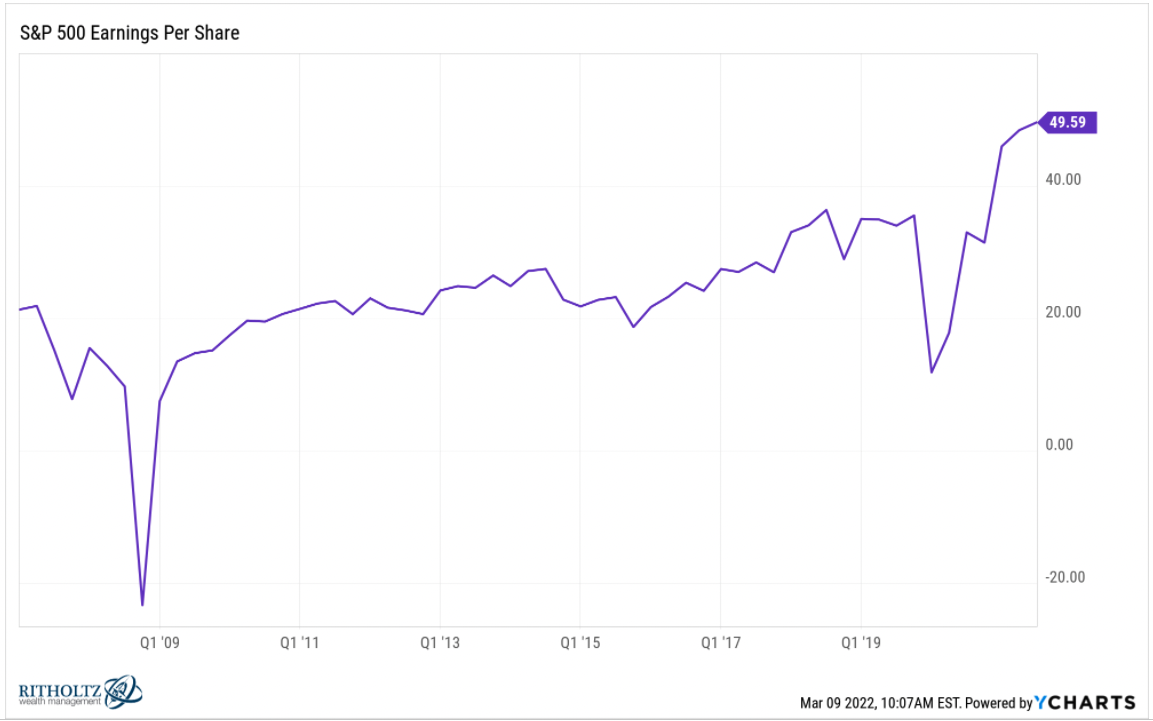

All of that progress is quantifiable and ultimately reveals itself in the stock market. The chart below demonstrates the triumph of the optimists.

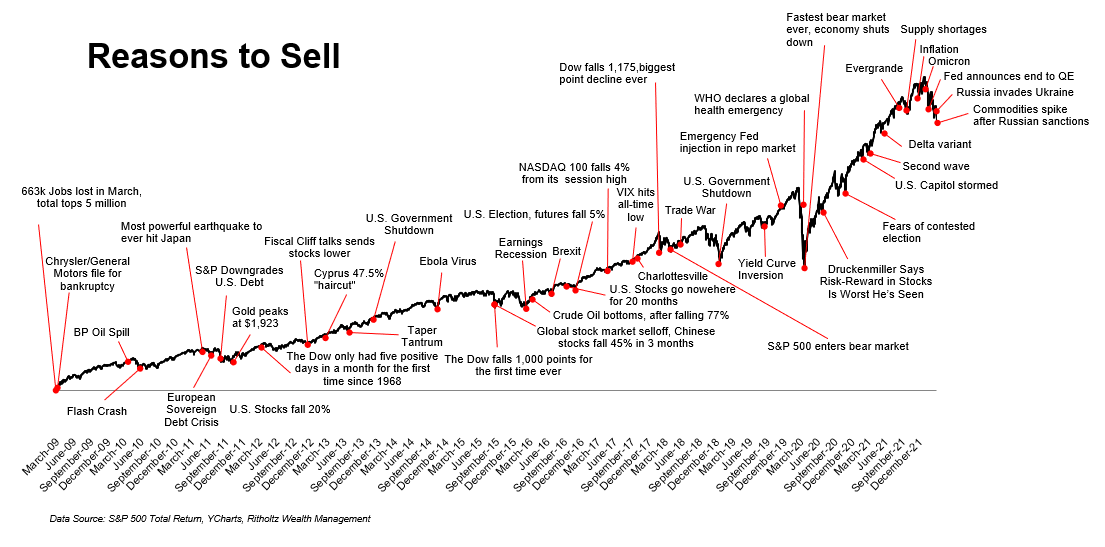

It’s easy to lose sight of the light when all we see is darkness. And it’s easy to overweight today’s problems and underweight the worries that are now comfortably in the rearview mirror.

I said recently that investors haven’t had this much on their plate in a long time. It’s just a lot between the tech blowup, commodity spike, inflation, supply-chain issues, and the fed normalizing rates. But is today really more scary than March 2020? Is it, Michael? Alright, ya got me. It’s not remotely close. I think the economic outcome market’s response is likely to be uglier and choppier than what we saw from the v-bottom in March, but come on. Covid was a different level of uncertainty.

I’m sharing this chart because today is the anniversary of the GFC lows. And it helps remind me, and hopefully you, that there are always reasons to sell. Always. The point is not to make light of the challenges ahead, but it serves as a reminder of what’s on the other side. Actually, it serves as a reminder that there is no other side. It’s never “all good.” That’s really the point. There are always reasons to sell.

The way to deal with uncertain times, and that’s the only times there ever are, is having a plan. The two questions you need to ask, from an investment standpoint, is, “Can I stick with my strategy if the market bottoms today and we’re at all-time highs by the summer?” And, “Can I stick with my strategy if the market falls another 20% and doesn’t recover for a few more years.” If your answer is yes, you’re good. If not, it’s time to find a strategy that works for you.