Bad things happen in bad markets. You’re probably thinking, “thanks captain obvious.” I know, but it’s worth spending a minute on how and why this happens.

The investor’s mentality over the past decade can be summed up in three words: buy the dip. This behavior was rewarded innumerable times, so this was ingrained in our psychology. Buy dip, make money. It takes a while to unlearn this behavior and by definition, that doesn’t happen when the market is going up. To be very clear and again abundantly obvious, this happens when stocks are going down.

Investors lose confidence in the market slowly, then very quickly. Each successive bounce gets weaker and weaker until the dip buyer’s confidence is exhausted.

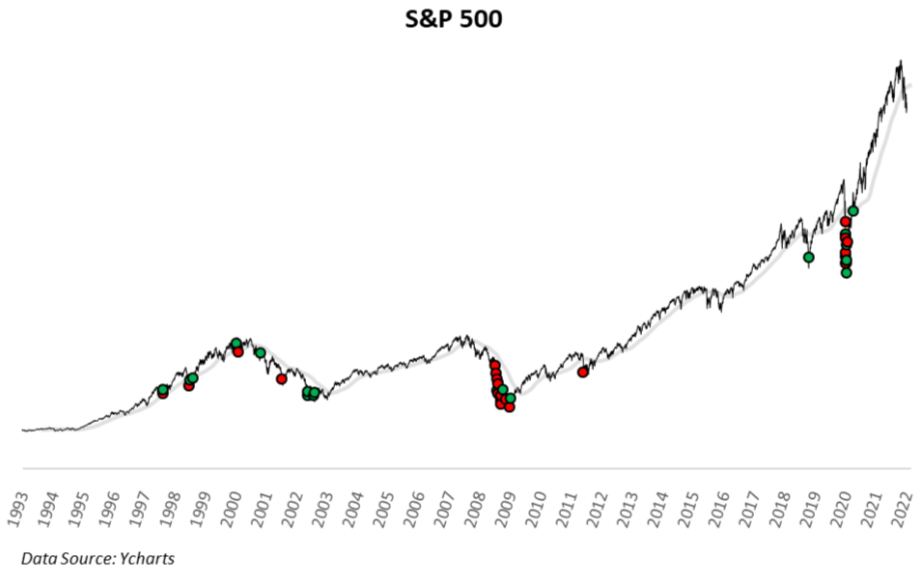

We can see investors’ changing mentality on the charts, and it’s a violent transition. Investors don’t go quietly into the night. You see bright green days and dark red days occurring back-to-back over a long period of time. The chart below shows the 30-day standard deviation of the S&P 500. The green dots are the 25 best days since 1993 (inception SPY) and the red dots represent the 25 worst days. That’s where we currently find ourselves; the S&P 500 was up more than 3% yesterday and is down more than 3% today.

Back to my earlier point about bad things happening in bad markets; Of the 25 best and 25 worst days going back to 1993, 47 of them happened below the 200-day moving average.* This is where dragons lurk.

This is a tough market.

I don’t mean to lecture, but you have to control your emotions. Don’t do something that can’t be undone. That doesn’t mean do nothing, although that’s probably the best advice, but you can’t get all “phew it’s over” on days like yesterday and “oh my god we’re going to zero” on days like today. If you absolutely need to press a button, maybe wait until the weekend when you’re thinking a little more clearly. We can’t be objective when the market is running or crashing, and numbers are flashing all over the screen.

Most people reading this have lived through difficult markets. But if you just started investing over the last twelve months, now you know how it feels. It sucks. This is why people like me spend so much time talking about the importance of having a plan. It’s not that a plan will shield you from market volatility, but it will prevent you from becoming your own worst enemy. A plan prevents you from daily mental whipsaw.

In a market that swings violently, you have to try and remain steady. All storms eventually end.

*There’s nothing special about the 200-day moving average. 175, 224, whatever.