Last week the S&P 500 closed at 4131. On Friday it finished at 4123, down 0.2%. For most people, not those reading this post, it was as if nothing happened this week in the market. For people who were glued to the television and checking their accounts, it was an emotional roller coaster.

The last five days gave us a teachable moment about long-term investing. I know five days is nothing, but one of the core tenets of long-term investing is the idea that less is more. This week that played out in spades. Whose portfolios do you think performed better? People who traded as if there was no tomorrow, or those who were utterly oblivious to the fact that markets were in turmoil?

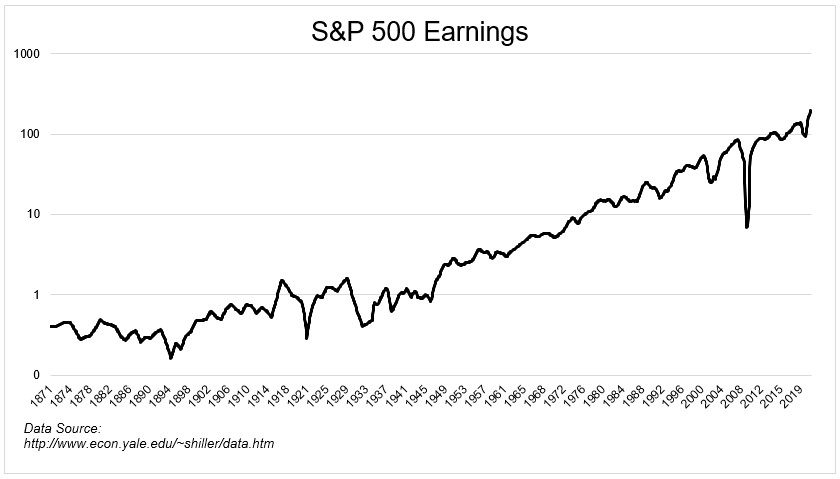

Returns are often viewed through the prism of risk. Stocks are risky, and therefore investors demand compensation for bearing it. This is true, but at an even more basic level, stocks go up over time because things get better over time. This manifests itself through expanding earnings which filters through to its owners. As profits grow over time, so does the value of the business.

Here’s Ben on the long-term earnings growth of the S&P 500:

In 1928, earnings per share for the S&P 500 was $1.11 while corporations paid out $0.78 per share in dividends. It was impossible to do so at the time, but if you could have owned an index fund, those would have been your per share cash flows at the time.

By the end of 2021, those numbers $197.87 and $60.40, respectively. This means over the past 94 years, earnings on the U.S. stock market have grown at an annual rate of 6% while dividends have grown 5% per year.

The markets have been difficult over the past couple of weeks, so I wanted to provide a framework for survival. If you ever found yourself making large adjustments news or selling out of fear, here are some ideas for how to actually think and act for the long term.

Remind yourself why you’re investing

Everyone is at a different stage of their life. Whether you’re just getting into the workforce or whether you left it ten years ago, you’re still investing for the future. Obviously, the portfolios of these two investors will look radically different, but at a high level, they’re both deferring consumption today for security tomorrow. We work to pay our bills today and invest to pay our bills in the future

Investing is about financial security, which is the foundation for living a free life. Most people don’t need ten million dollars to be happy, but it’s hard to be happy when you’re constantly worrying about money. Investing provides a foundation for peace of mind.

It’s easy to overweight comfort today at the expense of success tomorrow. In order to participate in the growth of the economy and the stock market, you simply must get comfortable with being uncomfortable.

Zoom out

Look at a chart of the S&P 500. It goes up over time. Why would you want to hop off something that has historically generated 8-10% annual returns? Most recently, however, it went up too far too fast. Here are the returns for the last three years:

- 2019 +31%

- 2020 +18%

- 2021 +29%

This brought the ten-year annualized return to 15% a year. Clearly, this is not sustainable. You were probably expecting a pullback at some point. Well, here it is. You cannot expect a pullback and then freak out when it happens. I mean, you can, but you’re not going to have much success if you do. Again, investors need to tolerate discomfort if they’re going to earn any return over the long-term. If you think you can sell stocks on the way up, and then avoid stocks on the way down, and you can do that over and over and come out ahead after paying taxes, you’re kidding yourself.

Keep a journal

Imagine you’re a 60/40 investor who sold bonds this week. Here’s what your journal entry might look like:

“I am selling bonds because I just experienced painful losses and I am terrified that rates will keep going up. I will stay in cash until I feel confident that rates have peaked and then I will get back in. TL:DR, I panicked.”

A journal is important because it can help you see the ridiculousness of what you’re doing.

And one thing about bonds while I have your attention; I understand the pain you’re feeling, but bonds are now way more attractive than they were a couple of months ago. Why would you possibly lock in losses now when you know mathematically that your losses will be made whole if you just hang on? Yeah it might take a while, and yeah it can get worse, but going to cash now just doesn’t make sense. End rant.

Another benefit of journaling is that it holds you accountable to your future self. We have a funny way of misremembering the past, always in a way that makes us look better, so looking back at your own handwriting should crystallize the fact that we cannot predict the future.

Think back in time

Past behavior is a great predictor of future behavior. What you did during previous market dislocations should tell you all you need to know about how you’ll respond to future ones.

In bull markets, we tend to overestimate our true tolerance for enduring discomfort. We only know where our line is when we go over it, and sometimes we need to do that a few times before it really sinks in.

If you look back on some of your financial decisions with regret, then maybe it’s time to come up with a plan so that you don’t repeat that mistake.

Have a plan

Having a financial plan is so important because it can help quantify how much risk you need to take in order to achieve your goals. One of the biggest problems investors get into, as I just mentioned, is taking more risk than they can tolerate. They do this because they have no idea how much risk they should be taking in the first place. Charting a course means you won’t abandon it every time the seas get rough.

Maybe you don’t feel the need to have a full blown financial plan, fine. But you need to give yourself an investment policy statement. It doesn’t have to be complicated, but it does need certain parameters.

Everyone has to find what works for them. Active, passive, tactical, alternatives, whatever. Build yourself a portfolio that you can stick with through thick and thin. Adjustments along the way are fine and reasonable. Whole sale panic selling is never okay. Ever.

Diversify

Thinking long-term unfortunately doesn’t work with individual stocks. The Gap is down 10% over the last decade. Disney is trading where it was in 2015. Zillow is trading where it was in 2016. A basket of stocks can benefit from creative destruction, individual stocks do not.

Everyone is investing for the long-term, but not everyone is a long-term investor. Hopefully you can take something from this post and apply it to your financial future.