If you’re reading this, then you already know we’ve been in a bear market for a while. But today it became official.

And while the terminology might not matter to you, it matters to everyone who isn’t reading this because most of the country gets their stock market updates from local or national news outlets, and tonight or tomorrow morning they’ll say, “stocks enter a bear market.” So it doesn’t really matter, but it also kinda does.

Okay, so as I’m typing this, my wife called me and said, “I’m at Nordstrom returning clothes because it’s a bear market.” She was being funny, but she actually said this. She told me it’s all over Facebook and Eyewitness news. “Bear market, bear market, bear market. Inflation, inflation, inflation. It’s everywhere.” I’m using quotes because it’s a real thing she said.

Anyway.

There are 500 stocks in the S&P 500. 495 of them were down today.

Here’s another thing that happened; for just the 12th time since 1950, the S&P 500 fell 1% on four consecutive days. Not great Bob.

Stocks are falling and bonds are falling and prices are rising and so people aren’t thrilled. The only other times that people were this bearish were The Great Financial Crisis and the 1990 recession.

Sentiment can be quantified but it’s also kinda squishy. Anecdotally, it feels like today was the holy shit things are gonna break day. Inflation is responsible for the souring mood on Main Street and interest rates are responsible for the souring mood on Wall Street. Today, the yield on 2-year treasuries rose above the yield of 10-year treasuries which is not something you want to see.

Nick Timiraos is reporting that the fed might do 75 bps this week, which, apparently the market was unprepared for, given the pukage that happened after this hit the wires. Nick is like the Woj of the Federal Reserve, so I would guess that he isn’t merely guessing. There’s no good news here, so I’ll just call it a silver lining, which is that the market is already pricing in a decent amount of risk. I mean, just pull up a chart. Any chart. There’s a good chance it’s completely busted.

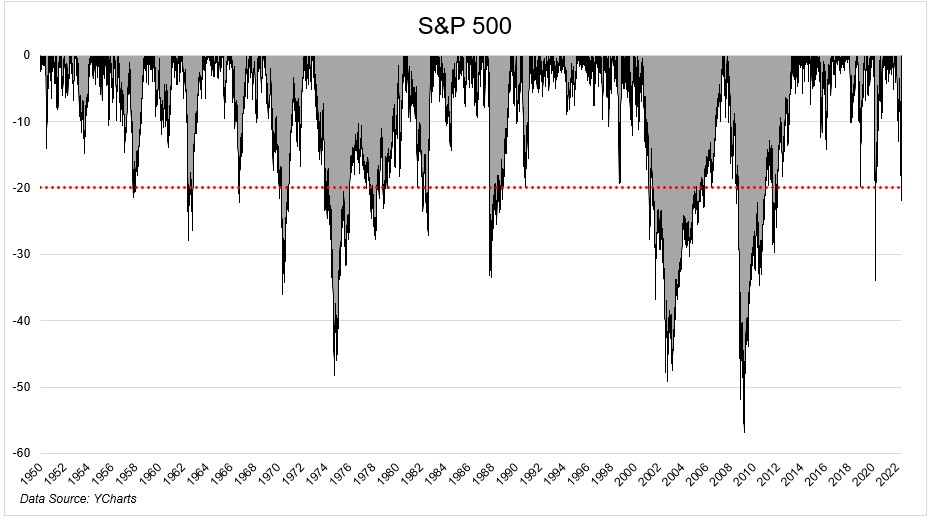

I think this week we’ll hit peak bearishness. We’re not there yet with the S&P 500 down just 21% from its highs, and the VIX only at 34. And to be clear, if I’m right and bearishness peaks, that doesn’t necessarily mean the bottom is in. Stocks can drift lower as the mood shifts from pessimism to apathy. People will become numb to the fact that stocks are red again. And then we can bottom.

Things will probably continue to get worse, but eventually, prices will stop reacting. You’ll know when that is. Just kidding, you definitely won’t.

But for realness, it’s okay to feel bearish and also stick with the portfolio that you’ve built. If you have to take some risk down in order to sleep at night, fine, do what you gotta do. But you can’t dump everything because you’ll never get back in, and if you do, it will probably be at much higher prices.

Things are rough right now, there’s no sugar-coating it. But if you can make it through to the other side, your future self will thank you.