Today’s show is presented by Composer:

See here for more information on Composer’s systematic strategies, and here for important disclosures

On today’s show we discuss:

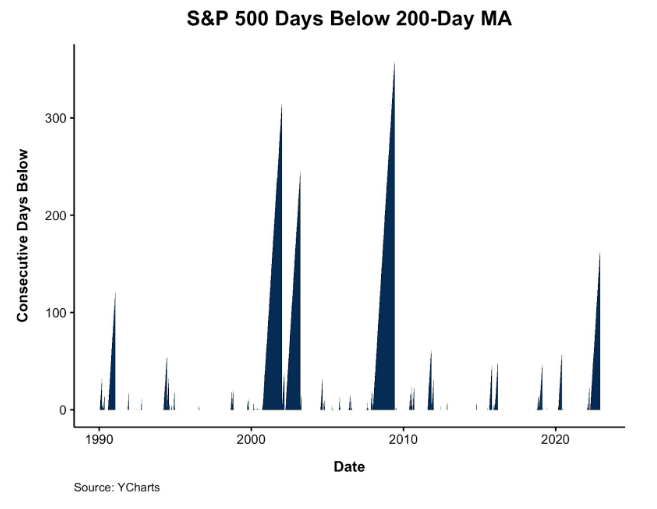

- The market bounce after Powell’s comments

- Record $3B in outflows for $LQD

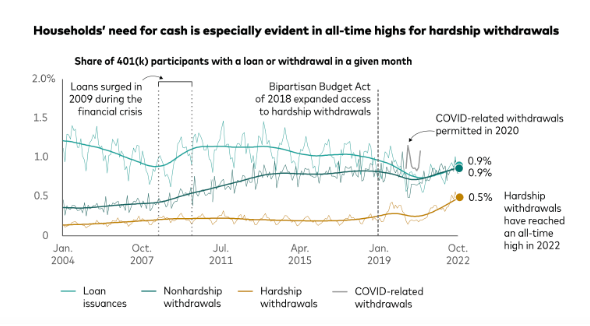

- Vanguard investor pulse: Anxiety and cash needs on the rise

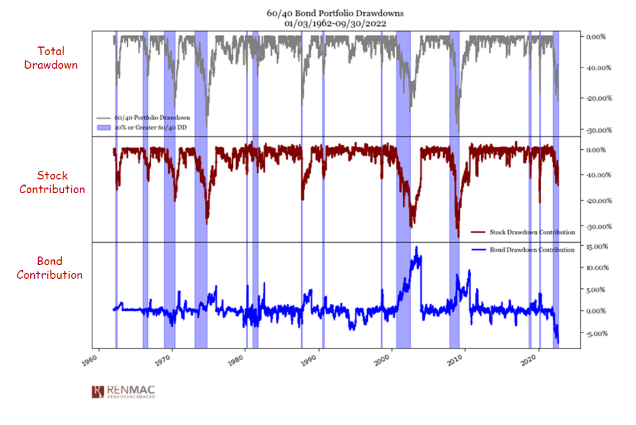

- What is the yield curve saying?

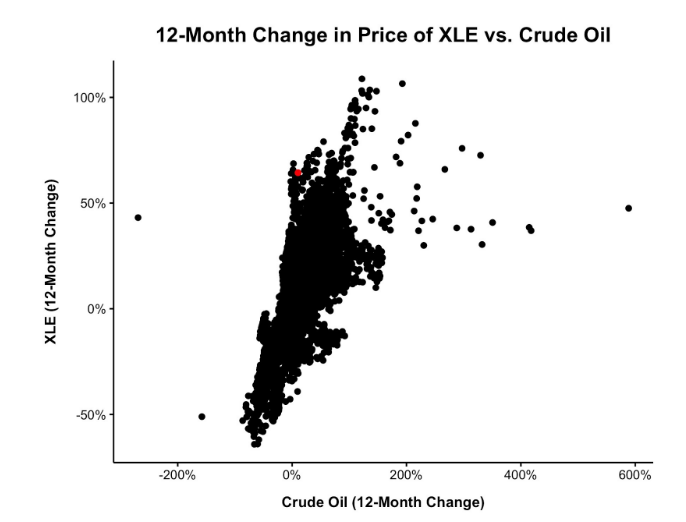

- Oil below pre-invasion price

- The thing that’s hard about markets (AWOCS)

Listen here:

Jeff deGraaf:

Recommendations:

Charts:

Tweets:

FED'S BULLARD: EXPECTED DISINFLATION IS THE PARTY DRIVING YIELD CURVE INVERSION, SO IT IS NOT NECESSARILY SENDING A RECESSIONARY SIGNAL.

— FinancialJuice (@financialjuice) November 28, 2022

Share buybacks played a huge role in the market this year — without them, the bear might have been meaner. Buybacks are holding up at 6.8% of revenues (which are making new all-time highs). So far so good, but we may have reached the peak for this cycle. pic.twitter.com/aMMaJXo50L

— Jurrien Timmer (@TimmerFidelity) November 23, 2022

Contact us at askthecompoundshow@gmail.com with any feedback, recommendations, or questions.

Follow us on Instagram and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.