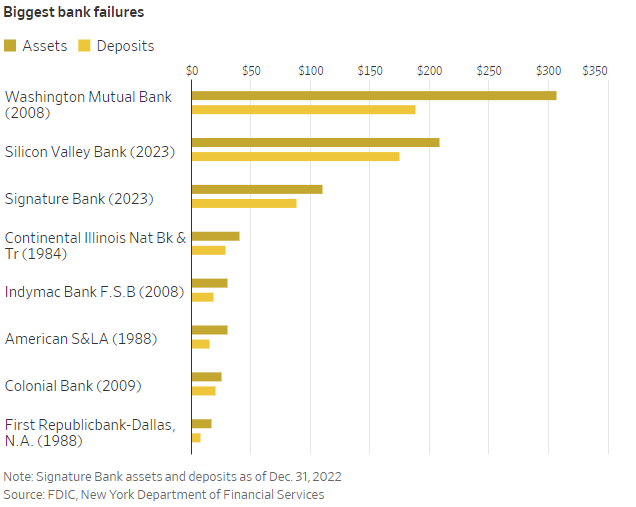

It has been 872 days since a bank failed in the United States. This was the longest streak on record. We’re now at day zero. Silicon Valley bank went down on Friday. Signature Bank last night. These are the second and third largest bank failures in history behind Washington Mutual during the GFC.

People are scared, mad, and looking for someone to blame. How did this happen, and whose fault is it anyway?

Did the fed cause this by keeping interest rates at zero for too long and then slamming on the brakes? Is the venture community to blame for funding anything and everything? Are they to blame for inciting a run on the bank? Are regulators or auditors to blame for not catching the risk ahead of time? Is it the bank’s fault for mismanaging its assets versus liabilities? Or is there an angle that we might not be considering? Let’s take these in order.

Blame the Fed

Three years ago, the fed appropriately took interest rates to zero as an economic meteor slammed into the Pacific Ocean. But two years later with the economy reopened and inflation running north of 7%, rates were still at zero. This made no sense then, and it makes less sense looking back on it. The fed was late to respond, and they compounded the problem by going from too easy for too long to too tight too fast. We haven’t seen a tightening cycle like this in the last fifty years.

A major thing that we didn’t anticipate as a result of these historic interest rates, at least I didn’t, were the ripple effects it would have at banks. According to Marc Rubinstein:

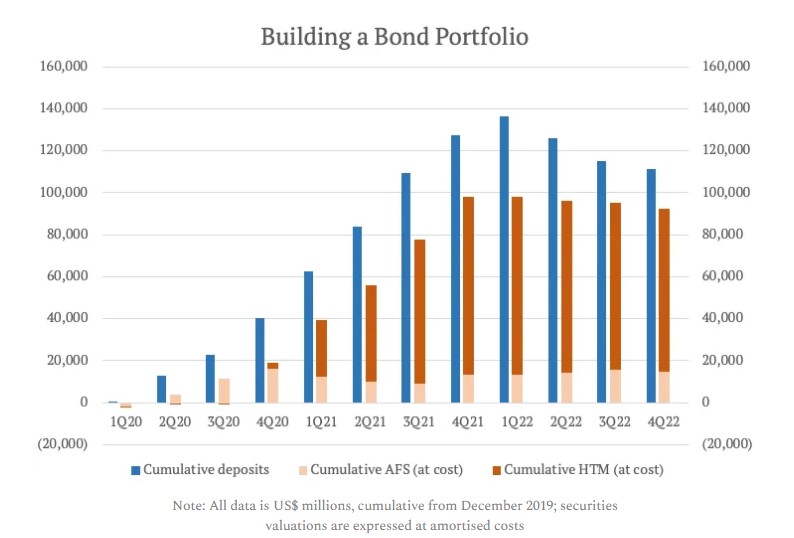

Between the end of 2019 and the first quarter of 2022, deposits at US banks rose by $5.40 trillion. With loan demand weak, only around 15% of that volume was channelled towards loans; the rest was invested in securities portfolios or kept as cash.

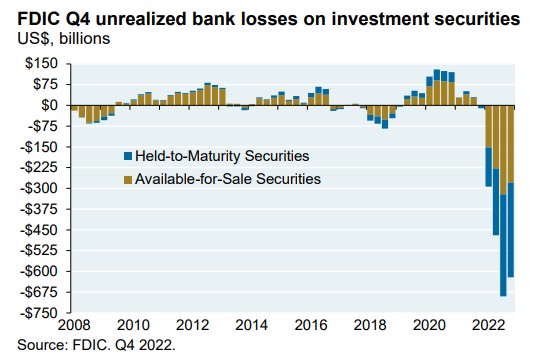

Banks invest their deposits in short-term bonds, for the most part. But even short-term bonds can have large unrealized losses when interest rates spike until the bonds mature. And bonds that have more interest rate risk are even more susceptible to large losses. All told, banks are now sitting on roughly $600 billion of losses in what are supposed to be among the safest instruments in the world. All because the fed went too far to fast.

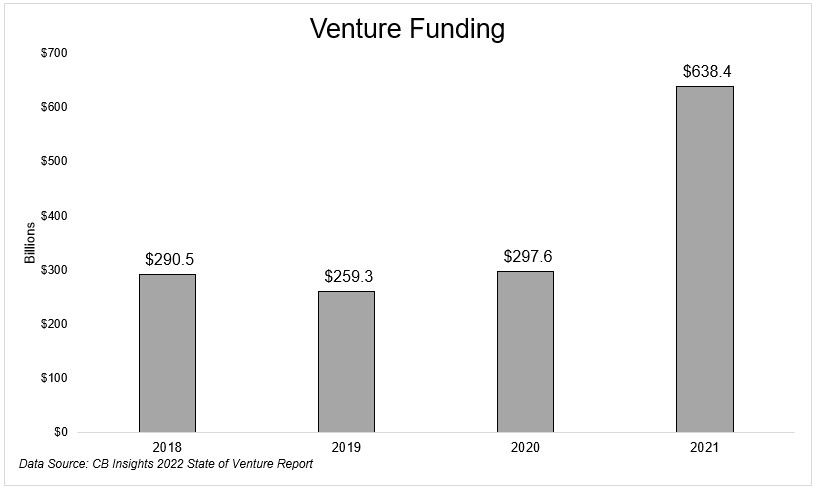

Prior to aggressively raising rates, the fed kept interest rates at zero for too long which spurred excessive risk-taking. Venture capital was at the epicenter of this. Everything got funded in 2021 at a speed and size the likes of which the industry had never experienced. Who’s to blame here? Is it the fed for stoking the flames of speculation, is it the LPs for flinging money at venture funds, or is it the venture capitalists for saying yes to everything? The answer is yes.

Blame the venture capitalists?

The amount of money that poured into venture funds is no fault of their own. 2021 was an outlier for so many areas of the economy.

That being said, there were countless companies that got funded that had no business getting money. And all the money these companies got, or half of it, went into Silicon Valley Bank. Now that we’re on the other side of the bubble, these companies are hemorrhaging money, and so SVB needed to sell bonds and raise equity to shore up their balance sheet. And that was the powder keg that cause the explosion.

Greg Becker, CEO of SVB said:

“I would ask everyone to stay calm and to support us just like we supported you during the challenging times.”

The people he asked to stay calm did the opposite. Some of the most storied firms in venture capital told their companies to take their money out of the bank. And that was that. Everyone understandably followed suit.

Had they said something like “Silicon Valley Bank has been through multiple cycles. They’ve been a trusted partner in up and down markets, and we are confident they will get through this cycle the same way they did all the others.”

That probably would have been enough to calm everyone down. But it didn’t go down like that.

Silicon Valley Bank

One of the biggest beneficiaries of the venture boom was Silicon Valley Bank, a company whose roots go back to 1983. SVB was synonymous with venture capital. If a company was venture-backed, there was a 1 in 2 chance that SVB was their bank. So, from the end of 2019 to the first quarter in 2022, deposits tripled to nearly $200 billion.

When banks buy bonds, they can designate them as “held-to-maturity” or “available-for-sale.” HTM assets are not marked to market. So, if on paper a bank is down 10% on their bonds as interest rates rise, so long as the bond is classified as HTM, it does not need to report the loss. The loss will reverse as the bonds get closer to maturity and that’s that. AFS assets on the other hand are marked to market. And this is where Silicon Valley Bank really got into trouble.

From Marc Rubinstein:

Its $15.9 billion of HTM mark-to-market losses completely subsumed the $11.8 billion of tangible common equity that supported the bank’s balance sheet…In order to reposition its balance sheet to accommodate the outflows and increase flexibility, Silicon Valley this week sold $21 billion of available-for-sale securities to raise cash. Because the loss ($1.8 billion after tax) would be sucked into its regulatory capital position, the bank needed to raise capital alongside the restructuring.

This was a failure of management at multiple levels. I don’t know enough about the banking industry to comment on their failure to hedge interest rate risk. More bills and fewer bonds would have helped, that’s for sure.

But certainly, there was a failure not to anticipate the deposit base would be in trouble. They had to know their concentrated customer base was bleeding money, and they should have adjusted. Lastly, there was a failure of messaging. I’m not exactly sure what they could have done differently, but they had to know that announcing their loss on AFS and simultaneous equity raise would cause the customers to run out of the door. In fact, there were some timely sales by the insiders that indicated they did.

Regulators and Auditors

Should we blame the regulators or auditors for SVB going under? I don’t want to opine too much on bank regulation as that is about three miles outside my comfort zone, but, I have to ask, did a stress test miss this? KPMG gave them a clean bill of health just a few weeks ago, so maybe not? I guess a bank run is hard to quantify. Either way, it sounds like Silicon Valley Banks alleged mismanagement of their assets and liabilities will be part of a wide-sweeping discussion on bank regulations. The fed just announced that they are leading a review of “the supervision and regulation of Silicon Valley Bank in light of its failure.”

Hopefully, you can see by now that events like this are never one person’s fault. I get why people want to point fingers, but this was not a single point of failure. A lot had to happen to lead us here. This brings me to a culprit that nobody seems to be discussing; the pandemic.

As life-altering as the pandemic was, I still think the impacts are being underappreciated. Without the pandemic, rates are not at zero for two years. Without the pandemic, $638 billion does not go into venture capital. Without the pandemic, rates don’t go from 0 to 450 in a year. And without the pandemic, we wouldn’t be talking about a run on the bank.

This is just a really unfortunate situation whose story has yet to fully play out. You might think Silicon Valley Bank was just a place where tech startups did business. Make no mistake that this was a line of demarcation; there’s before the SVB blowup, and there’s after.

I’m just glad the government did the right thing and didn’t allow regular people to lose their money at a bank. If we start asking individuals to become forensic accountants, then we have lost the plot entirely.

We spoke with Samir Kaji yesterday about the whole situation. Samir spent most of his career working at SVB and FRB, so we could think of no better person to have on and break everything down.