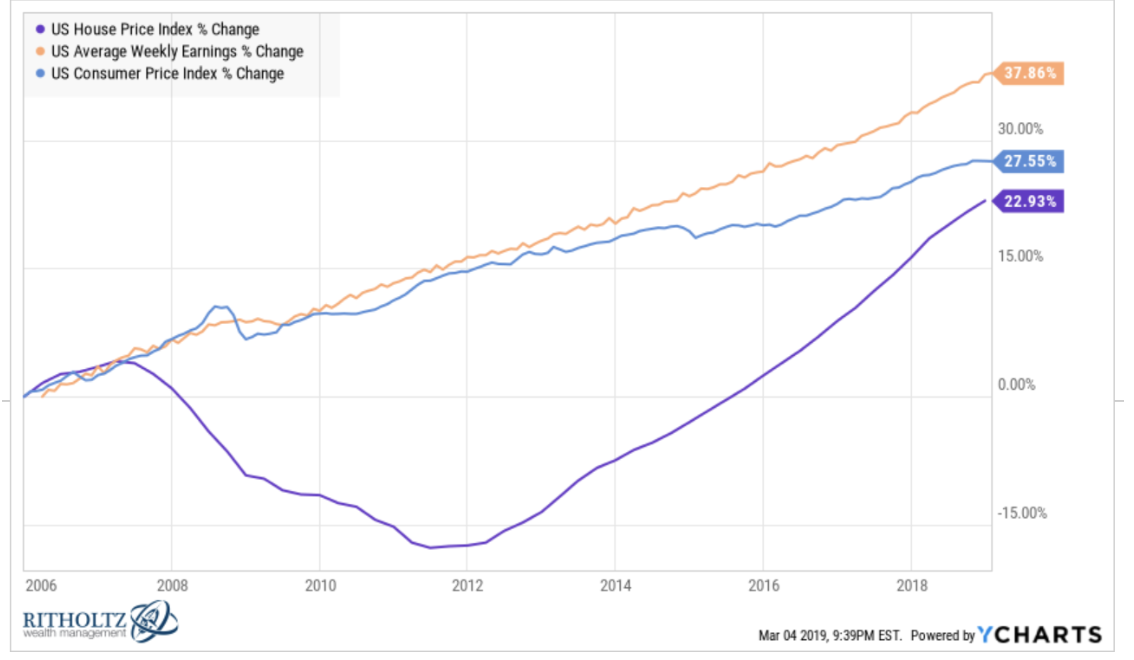

Articles They are being robbed every single day By Ryan Krueger It’s time for young people to stop blaming others for their problems By Ben Carlson Most of the social media networks we study generate much more social capital than actual financial capital By Eugene Wei Maybe there is a better way to discuss money…