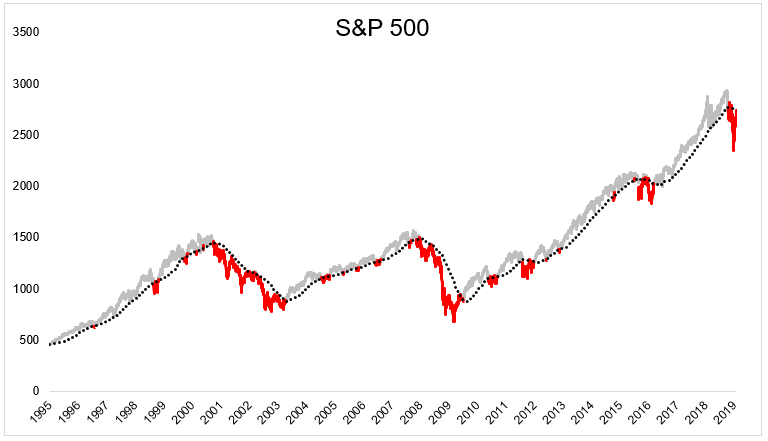

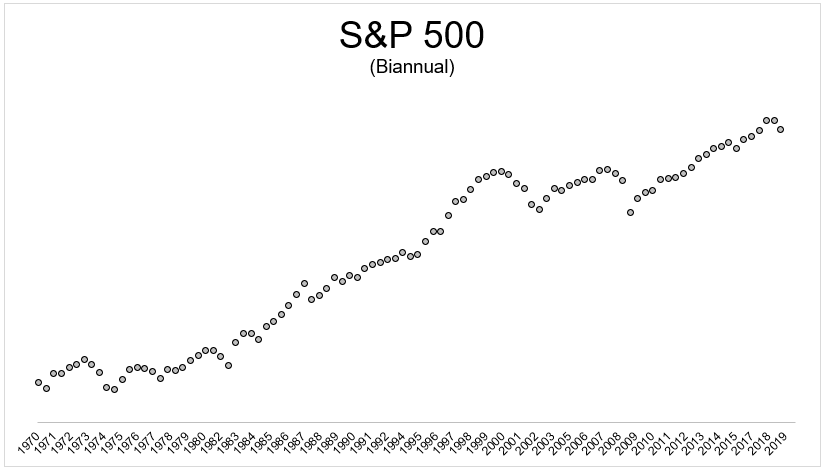

Do investors really need to hear from management every 90 days? The 13-week cycle of reporting earnings and issuing guidance breeds short-term thinking and invites the wrong kinds of questions. Going from quarterly reporting to a biannual system could allow for a sharper focus on running the business rather than wasting time on the business…