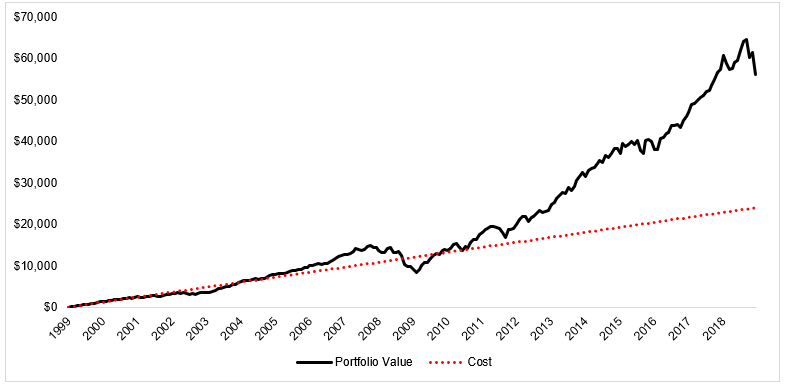

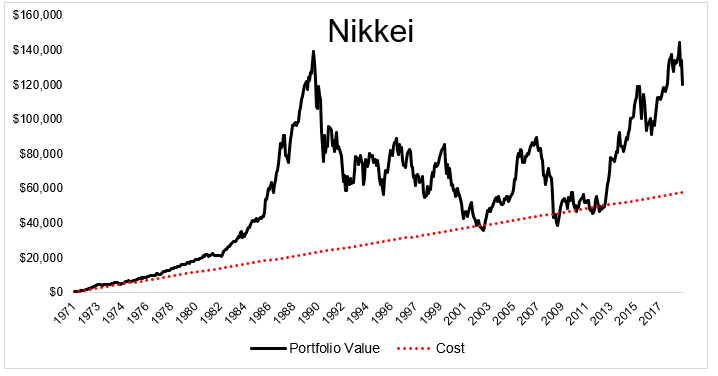

I did a post a couple of weeks ago about the potential benefits of dollar cost averaging. To recap: It’s automated It’s a great way to force you to save money It gives you the ability to systematically buy low, with the cherry being that you’re buying more the lower stocks go. I explained that…