Expectations and positioning drive everything

Expectations and positioning drive everything

On this week’s show, we discuss the stock market’s ability to predict a recession, the hot labor market, wages vs. inflation, the prospect for a soft landing in the economy, Robinhood vs. Coinbase, volatility in the mortgage market, a bunch of movie recs and much more.

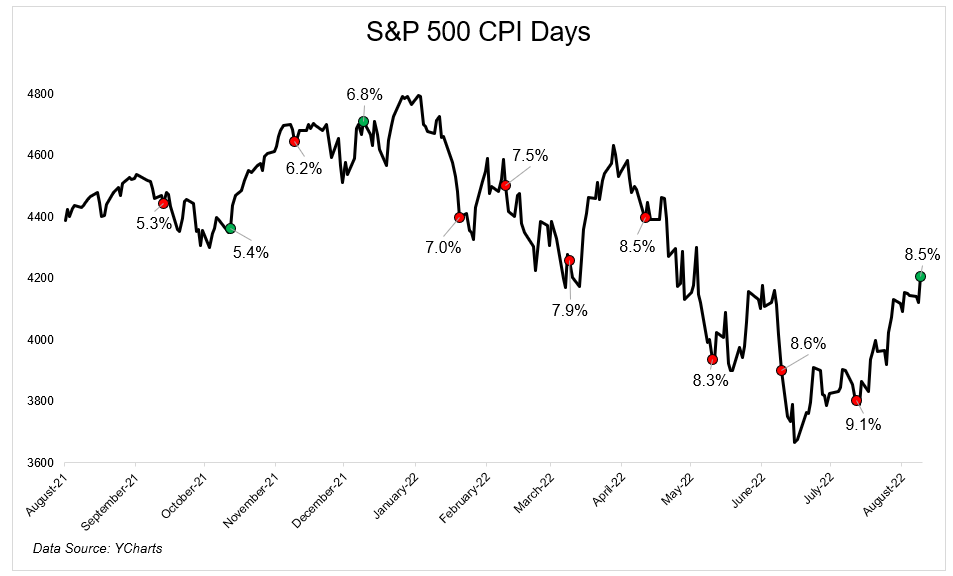

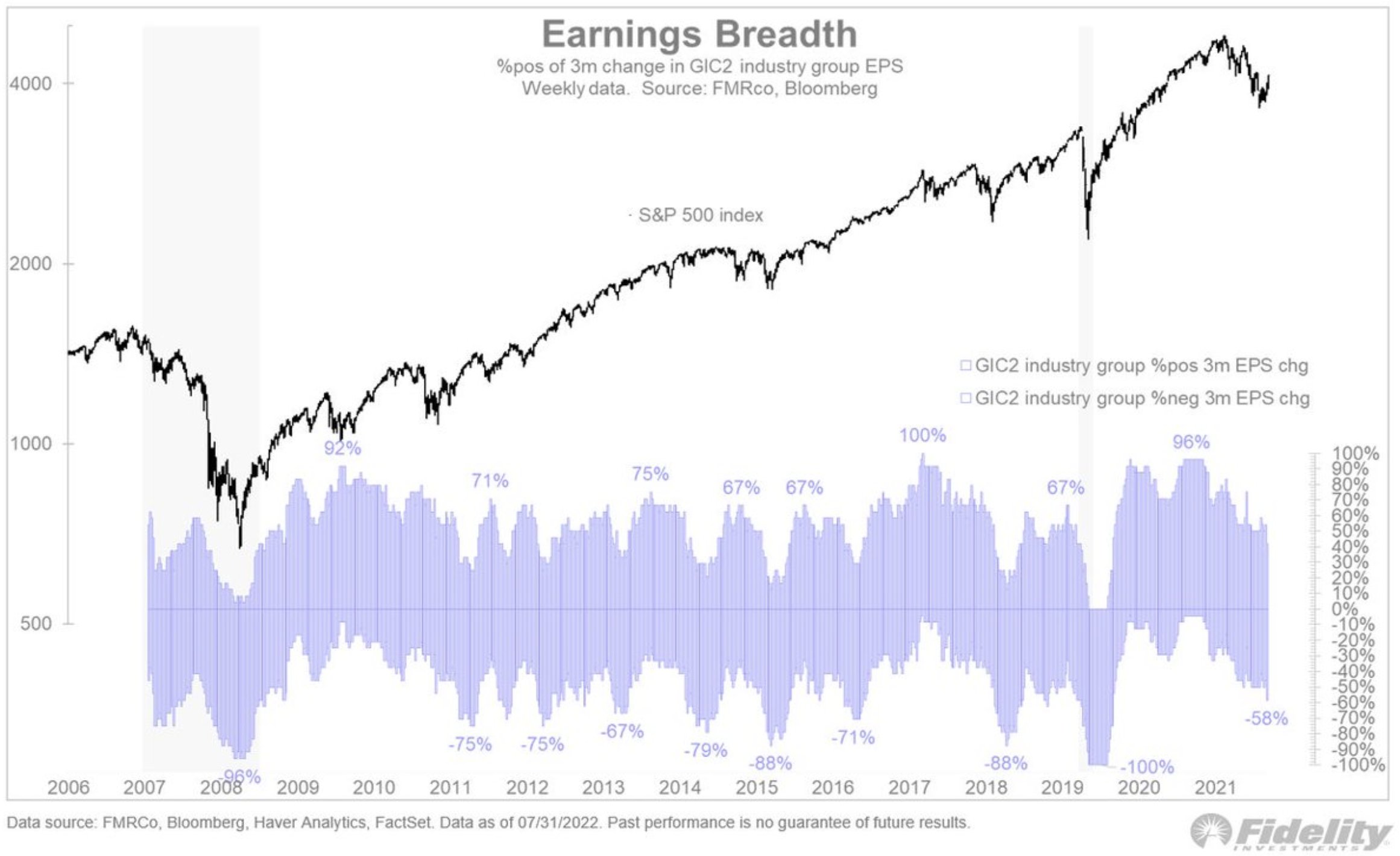

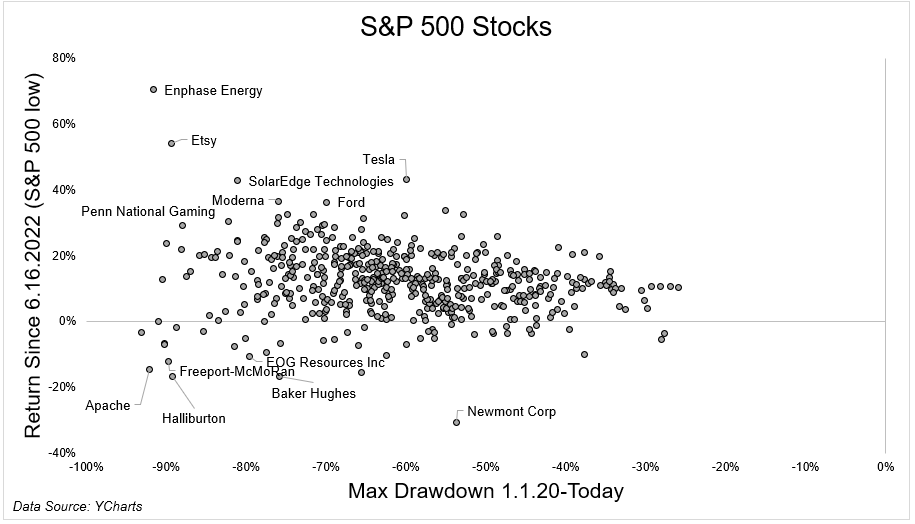

The stock market fell too much

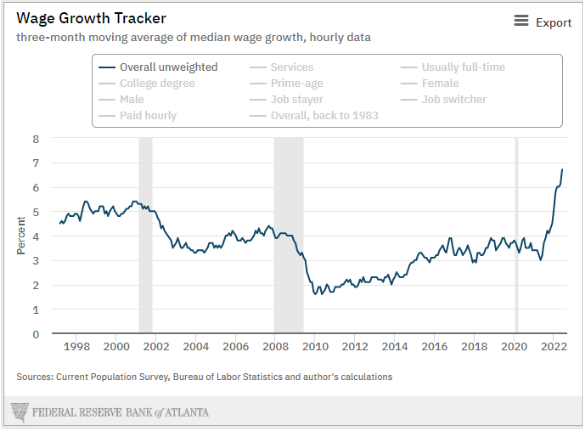

The bull case is always harder

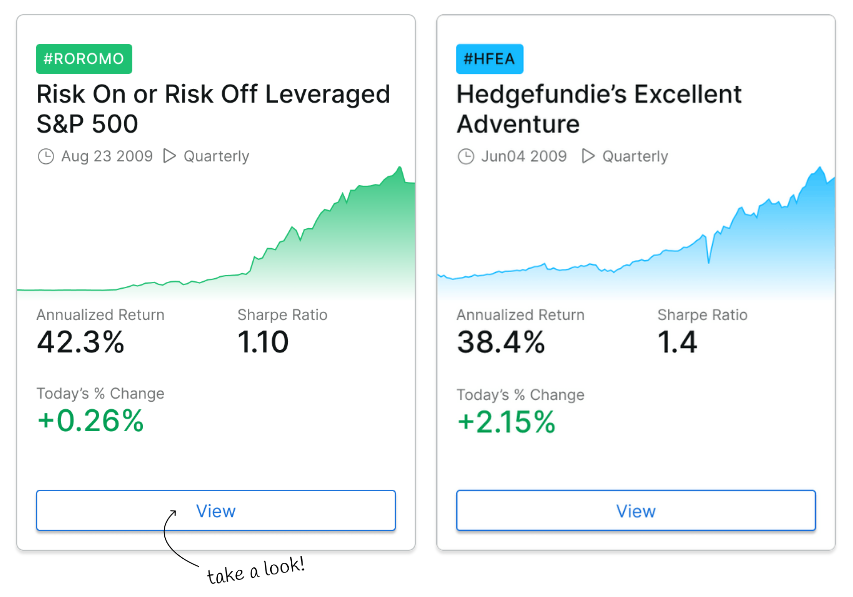

On today’s Talk Your Book we spoke with Composer founder Ben Rollert about creating your own automated investment strategies.

Here’s what I chewed on last week

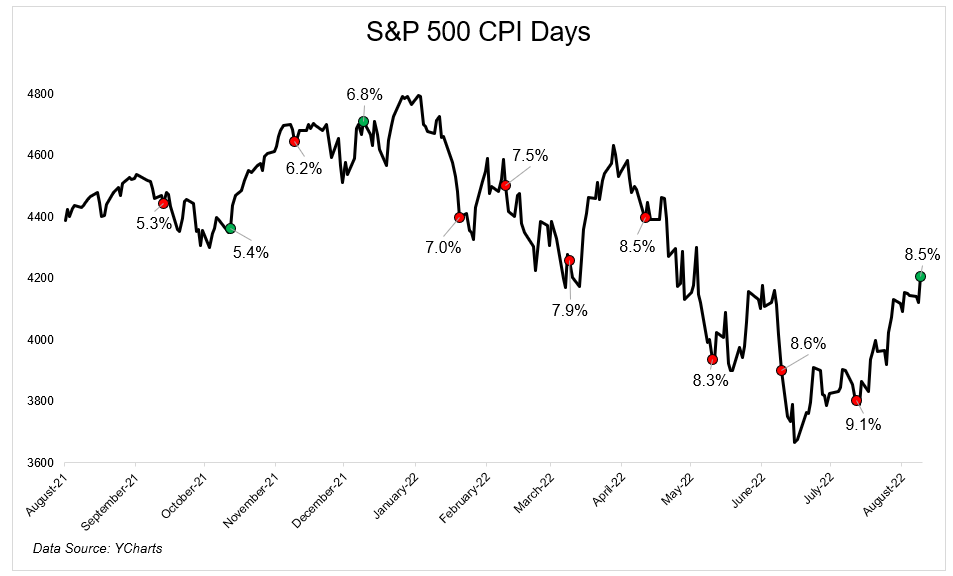

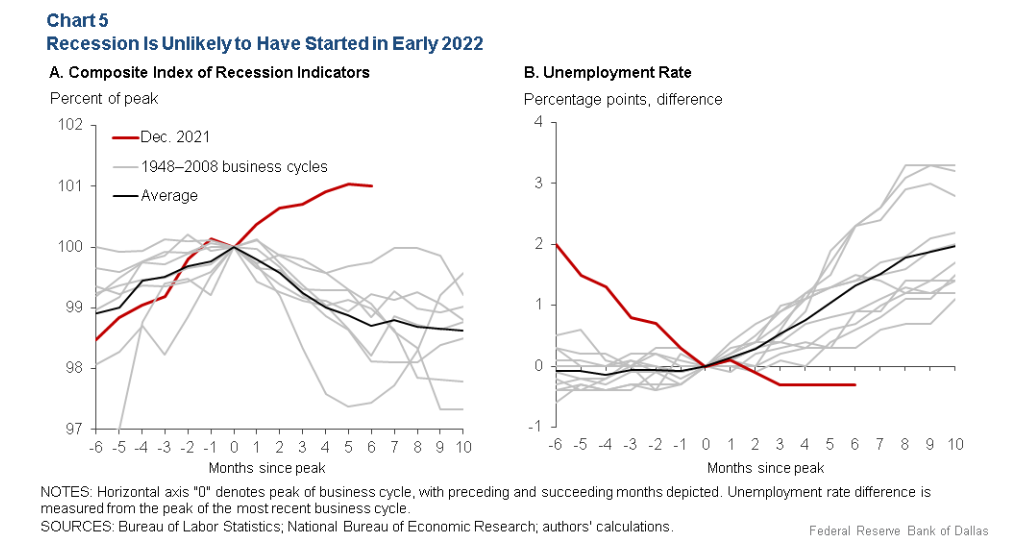

We’re seeing things that just don’t happen during a recession in this so-called recession

On today’s show, we discuss the recession debate, why the economy is so confusing right now, calling a stock market bottom (or not), the tech stock comeback, earnings season, and much more.

I’m confused. You probably are too.

On today’s show, we answer questions straight from the listeners with some help from Rocket Dollar’s Henry Yoshida.