- The Irrelevant Investor

- Posts

- 10 Predictions for 2024

10 Predictions for 2024

Market predictions are silly. We all learned this a long time ago. But that doesn’t mean they’re completely worthless. Even though forecasts are almost always wrong, they can be entertaining and educational. That’s all I’m trying to do with this post. Entertain and educate. Needless to say, but I have to say it anyway, nothing in this list is investment advice. I’m not doing anything with my portfolio based on these predictions, and neither should you.

Here is my list from a year ago. I got some right and a some wrong. I expect my predictions to have a terrible track record, and that’s why I try to ride the market rather than outsmart it. So why am I doing this? Well, it’s fun to look back on what you thought was possible a year ago. When you see that you were so off on some things, it reminds you just how difficult it is to predict the future. I also learn a lot by doing this. I uncovered some things that I didn’t know or forgot I knew. So with that, these are my ten predictions for 2024.

No consolidation in media/streamers.

Apple gets dropped from the magnificent 7. Netflix Replaces it.

Amazon gains >25%/Microsoft becomes the first $4 trillion stock.

Robinhood gets acquired

Money stays in money market funds

Inflation gets to the Fed’s target. The economy overheats. Inflation picks up.

The vibecovery begins

No recession. Stocks gain 20%. Large-cap tech rolls on. The other 493 and small caps catch up.

Bitcoin hits 100k

Obligatory, something comes out of nowhere that makes at least half of these predictions look very dumb.

No consolidation in media/streamers.

My first prediction is the one that might turn out to be wrong the quickest. Last week, a day after I told Josh he was crazy for thinking that WBD would buy Paramount, we got news that the two were having exploratory talks to merge. I don’t buy it, sorry, and the market doesn’t either. Since that news came out, Paramount’s stock has fallen 5%, and Warner Brothers Discovery is down 2%. The market is up 1% over the same time.

These companies are in deep trouble and the decline is structural, not cyclical. In the first quarter of the year, TV providers in the United States lost 2.3 million customers, its worst showing ever. Describing the state of the industry, SVB MOffettNathanson senior analyst Craig Moffett wrote, “We are watching the sun beginning to set.”

WBD networks (TNT, CNN, TLC et al) revenue fell 7% y/o/y in the most recent quarter. The debt situation isn’t great either. WBD has $43 in debt and $2.4 billion in cash with just under $3 billion maturing on average annually over the next five years.

Here is the share price of WBD since it spun out of AT&T in the spring of 2022. Even a $1.4 billion blowout from Barbie couldn’t save this stock.

Paramount isn’t in a much better situation. Their stock has also been more than cut in half over the same time as the business tries to figure out where to go from here.

Paramount+ subscription revenue grew 46% in the third quarter to $1.3 billion, but the company is still losing money. In the nine months ended 9/30 of this year, their adjusted OIBDA (???) was -$1.173 billion, barely better than the $1.244 billion loss over the same time in 2022. It’s not surprising that the market killed a stock whose main business is in secular decline, while its attempted pivot is still losing ten figures.

So why exactly would these companies be stronger together?

Here’s what Rich Greenfield had to say with Matt Belloni on The Town:

The thing that no one’s talking about is Viacom merged with CBS. That’s how we got Paramount today. The stock is dramatically lower. Warner Media, which was part of AT&T got merged into Discovery. It’s dramatically lower than when it merged. So 1+1 on each side has equaled .5 or less. Now we’re talking about putting .5 and .5 together and do we end up with .1? Everyone is sort of missing that putting things together is not the answer here.

What I think is a more likely scenario is that these companies get smaller, not bigger. Lucas Shaw reported that Paramount is in talks to sell BET. I’m not sure if there are private equity buyers for things like Nickelodeon, MTV, or Comedy Central, but maybe this is a situation where the sum of parts is greater than the whole.

Streaming is a tough business. The losers were late, and now the consumer is hitting a wall with how many platforms they’ll pay for. Cancellations hit 5.7% in October, the highest on record. So yeah, linear TV is in secular decline and consumers are saying no mas to additional monthly streaming bills.

The streaming wars are over. There’s Netflix, Amazon, YouTube, and everything else. Disney/Hulu aren’t far behind, but I’ve already gone too long on the first prediction.

So no, I don’t think Paramount or WBD or find a lifeline. I also don’t know that I would bet against their stocks. Surely everything I just wrote is well known by literally every market participant. I also don’t know that I would buy their stocks here, as tempting as a 50%+ drawdown is. Absent a buyer, I just don’t know what the catalyst would be to re-rate these stocks higher, given the structural declines of the businesses. I’m excited to see how this story plays out.

Apple gets dropped from the magnificent 7. Netflix Replaces it.

Apple the business didn’t have a great year. In the last twelve months, revenue is down, expenses are up, and operating income is down. Earnings per share are up a penny because they’re buying back so much stock.

While the business has struggled to grow, the stock delivered another phenomenal year for its shareholders. Apple is going to finish 2023 just shy of a 50% gain. Since 2010, it’s delivered an average annual return of 31%, 18% better than the S&P 500. Truly one of if not the best runs any stock has ever had.

Apple’s stock shined even as the business waned thanks to multiple expansion. It came into 2023 trading at 21x TTM earnings and exited at 31x. Now certainly some of that was in part due to the fact that services, a very high margin business, was 25% of sales in the most recent quarter, up from 21% a year ago. But even still, valuations are significantly higher than they have been for the last decade without all of the growth to support it.

Apple is obviously one of the biggest and best companies of all-time. But maybe with a market cap of $3 trillion and growth waning, it’s time for their shares to take a breather.

Large tech will have another good year, but Apple won’t. They will underperform the S&P 500 by more than 10%, and will be removed from the Magnificent Seven. Taking their place will be the winner from the streaming wars, Netflix (a stock I own).

Could 2023 look any different from 2022 for Netflix the business and the stock? It is amazing that for as much as we talk about Netflix, we might not talk about this angle enough; Its rise and fall and rise again.

This little streaming business brought Hollywood to its knees.

As Netflix garnered hundreds of millions of subscribers and added hundreds of billions in market cap, the incumbents scrambled to catch up. But then something interesting happened; we learned that streaming wasn’t such a great business for everybody but Netflix. Investors looked past that during the ZIRP/covid era, and these companies and stocks were given the benefit of the doubt. Don’t worry about dollars, focus on growth! And they did.

But when Netflix reported that it lost subscribers last year, its stock tanked and it took the rest of the industry down with it. The incumbents were chasing a car going 100 mph right before it crashed into a wall. Like the scene in Leave the World Behind, all the cars piled up behind them.

Netflix shed 75% peak-to-trough and ended up falling 51% in calendar year 2022. In 2023, as it focused on growth via an ad-supported tier and killing password sharing, its stock sharply rebounded, gaining 64% on the year.

In 2024 it will rejoin the Magnificent Seven, after being removed from FANMAG a couple of years ago.

Amazon gains >25%/Microsoft becomes the first $4 trillion stock.

Did you know that Amazon has underperformed the S&P 500 over the last five years?

Amazon’s stock hasn’t hit an all-time high in 624 days, by far the longest streak since 2009.

The stock has been under pressure for legitimate reasons. 23% of Amazon’s revenue comes from overseas, which has experienced an operating loss of $4.5 billion over the last twelve months.

What’s weighed on Amazon’s shares most of all over the last couple of years is that Amazon Web Services, the segment that’s been responsible for the lion’s share of the profits, has been slowing as Microsoft and Google have been fiercely competing for the business.

And despite its challenges, Amazon’s free cash flows have had a dramatic turnaround.

Much like Netflix, Amazon is set to earn a lot of money via ads through its streaming service, which is set to drop in January. At a $40 billion run rate, Amazon is already one of the largest advertising businesses in the world.

Amazon has been left in the dust by the rest of the magnificent seven. In 2024, its shares will gain 25% and hit an all-time high. Full disclosure, I recently bought the stock.

***

Microsoft is an anomaly. Its massive size isn’t slowing down its growth.

Just four years ago in 2019, Microsoft did $126 billion in revenue. Its cloud division, which makes up more than 50% of its revenue, is now on a $127 billion annual run rate. And the gross margins on this business are an eye-watering 72%.

The biggest driver of the cloud business, Azure, is still growing at 28% a year. And we haven’t even begun to see how AI, which Microsoft is well positioned for, will add to its bottom line.

$4 trillion admittedly sounds like a stretch, but we’ll check back in twelve months.

Robinhood gets acquired

The wealth management industry was facing substantial headwinds entering 2023 for the first time in a long time. In a year like 2017, when clients can earn less than 1% on their cash while the S&P 500 gains 20%, financial advice is in high demand. In a year like 2023, when you can earn 5% on cash and the S&P 500 enters the year in a 20% drawdown, cash is stiff competition.

This is how a company like Morgan Stanley can see their net new assets decline by 45% year-over-year.

The name of the game in wealth management is customer acquisition. And everyone is always looking to attract the next generation of clients, who are set to inherit trillions of dollars over the coming years. By 2045, millennials and gen X are projected to control 80% of all private wealth.

That’s why Robinhood and its 23 million accounts are such an attractive asset (10.3 million monthly active users). Sure, the average balance is under $4,000, but that’s the opportunity. How many customers does Robinhood have who view that as their play account? What’s the average net worth of these customers? And what is that going to be five and ten years from now?

With an enterprise value of $6.8 billion, that represents an acquisition cost of $294 per account ($658 per monthly user). Robinhood only generated $77 per account ($172 per monthly user) over the last twelve quarters. If a buyer thinks they can make those numbers converge, then an acquisition here would be a steal.

Now, whether or not a company like that or any other wants to be associated with meme trading and all that, well that might be enough to keep them away.

Robinhood’s stock has been dead money, falling 63% from its IPO in 2021.

But one thing that Robinhood does have going for it is that like most money-losing companies, it has been working hard to become profitable, and could get there next year.

Money stays in money market funds

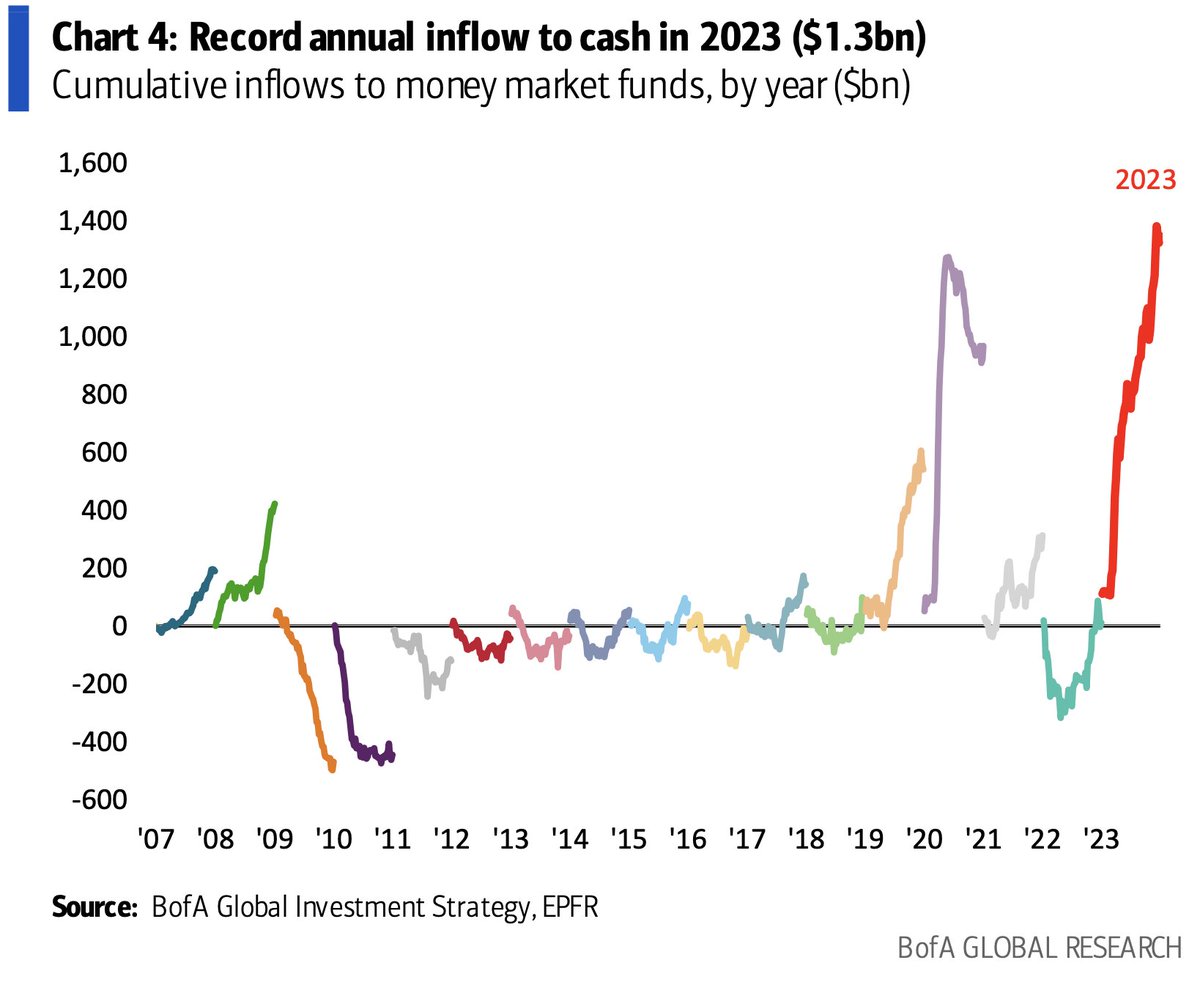

There is a lot of money in money market funds. Over six trillion to be precise. And one-quarter of all those assets flowed there in 2023 as the risk-free rate soared to 5%.

At the beginning of December, I asked Eric Balchunas for some data here and he shared a mind-blowing stat; Fourteen money market funds have taken in over $20 billion each in 2023, and the Top 12 and 25 of the top 30 flow-getting mutual funds are money market funds. The tidal wave of money moving into higher-yielding instruments is a rate story, not a stock market one.

Money rushed out of the market and into cash during The Great Financial Crisis. That’s not even close to what happened in 2023.

Money market fund flows, and I can’t prove this, came from checking and saving accounts that were generating almost nothing. So even if rates come down, and even if the market continues its momentum, money market funds will retain most of the flows from 2023. Certainly I expect leakage at some point if the fed cuts, and more if the market rips, but I’d bet that that money is stickier than some would think.

Inflation gets to the fed target. Economy overheats. Inflation picks up.

What an incredible ride the economy has been on over the past couple of years. We got used to a world with low inflation and the low-interest rates that accompanied it. And then the pandemic happened and shattered the economy as we knew it. Too much stimulus led to too much demand. Mix all that with too little supply and you get an atomic reaction.

CPI isn’t far from the Fed’s 2% target, and it’s already there if you use a more current measure of shelter inflation.

Most of the time the Fed raises rates because they want to cool down the economy. They want to stop it from overheating because there is excess in the system. That’s not really what happened this time around. Sure there were excess savings, but, and I’m making this up, I’d guess that more than, and I cannot stress enough that I’m making this number, 70% of the inflation we experienced was due to supply chain-related issues. So the slowing of excess that barely existed wasn’t much of a factor in bringing down inflation.

All this is to say that we risk seeing an overheated economy if the Fed starts to cut, which the market thinks it will. The overheating will come from two of the biggest parts of the economy that influence consumer spending; houses and stocks.

The market is currently implying an 80% chance that the lower range of fed funds will be below 4% this time next year. I’ll take the under on that.

Sentiment/vibes improve.

We spent so much time wondering and debating why there was a large cap between how the economy was doing and how people felt about their personal financial situations. The disconnect isn’t as complicated as we might have made it out to be. It’s inflation, period. Sure there are other things to consider but they’re just the toppings while prices are the entire slice. Squeezing a decade’s worth of price increases into just two years will destroy consumer morale. In a healthy economy, people don’t change their spending habits. They just spend more than they used to for the same thing. And it pisses them off.

2024 will still be filled what scary headlines. Social media will continue to rot away at the fabric of our society. And I’m sure the election season will be as awful as ever. But as long as prices stop going up, then all of the usual concerns that factored into the vibecession will fall by the wayside.

John, our Senior Creative Media Producer shared this on Slack the other day. “Vibes check. Just got my yearly lease paperwork dropped off to my door. No rent increase, same rent for the renewal – first time ever, I’ll take it!”

John is just one of 45 million households in the United States who will get to experience this win in 2024.

Yes, rents are still up a ton, as you can see below. But they are coming down, and sometimes the direction is more important than the level.

The vibecovery begins in 2024.

No recession. Stocks gain 20%. Large-cap tech rolls on. 493 and small caps catch up.

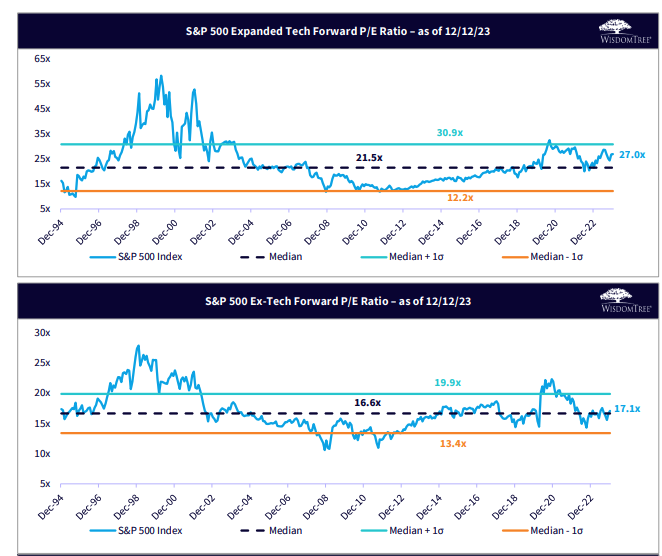

Large stocks beat the crap out of everything else in 2023. There was a 13% spread between the cap and equal-weighted versions of the S&P 500, good enough for the second strongest calendar year ever, outside of 1998. I would be very surprised if this continued next year.

The reason for the gap was pretty simple. It was driven by different exposures to sectors of the market. Having a massive underweight to tech and communication services, which gained 56% and 52% last year will certainly leave a mark.

People spent the entire year talking about how it was only the magnificent 7 that were carrying the market. And that was true for most of the year! The equal-weight index was flat on the year through November 9th. But it ended 2023 up 14% with a tremendous winter rally.

I’m not predicting large tech to have a tough year as I’m bullish on 2024 (I cringed writing that), but I do think the S&P 493 will outperform the S&P 7 as higher interest rates are more of a headwind for companies without trillion dollar market caps and hundreds of billions of dollars in cash.

Valuations are never a catalyst and the timing of when (if?) they matter is hardly a settled matter. Nevertheless, the spread here is pretty dramatic.

The market finished the year with a bang. The S&P 500 was up nine straight weeks for the first time since 2004.

You might be wondering what history says about the year following a 20% gain, which has happened 19 times since 1950. It was higher the next year 15 times, with 10 of 19 seeing a double-digit gain. This is a very small sample size to be rendered inconclusive.

The S&P 500 will gain 20% next year. The equal weight will gain more.

I probably could have said more on this one, but after three thousand words I’m running out of steam.

Bitcoin hits 100k

You might think that with a 150% gain in 2023, the ETF news is priced in. You might also remember the runup in 2017 when the CME launched its Bitcoin futures trading, which marked a pretty significant top.

I don’t expect the ETF to be a sell-the-news event because there will be tens of billions of dollars of buying pressure now that investors can get access to Bitcoin through their vehicle of choice. Bitcoin is a supply and demand story, and 60% of the supply has been held by investors for more than 1 year, the highest rate ever (h/t Tom Dunleavy). These people don’t sell.

I am of the simple view that next year demand will greatly outpace supply, pushing the price a lot higher.

Something comes out of nowhere that makes at least half of these predictions look very dumb.

Ben Graham once said, “Nearly everyone interested in common stocks wants to be told by someone else what he thinks the market is going to do. The demand being there, it must be supplied.”

Predictions are impossible. Everyone knows this, I hope.

If you reframed the question of “What do you think the market will do next year” to “Do you think you can predict the future,” then maybe it would become more apparent how silly all of this is. Of course nobody can predict the future. Of course nobody knows what the market is going to do next year.

I encourage everyone to make a list like this. It will serve as a reminder twelve months from now about how wrong you were about so many things, and hopefully that will encourage you to not invest in a way that counts on you getting the next twelve months right.