- The Irrelevant Investor

- Posts

- Animal Spirits: The Consumer is Slowing Down

Animal Spirits: The Consumer is Slowing Down

Today's Animal Spirits is brought to you by YCharts and CME Group:

See here for 20% off (new customers only) and for more info on the transition analysis tool.

See here for more information on CME Group's valuable educational materials and trading tools and learn more about what adding futures can do for you.

On today’s show, we discuss:

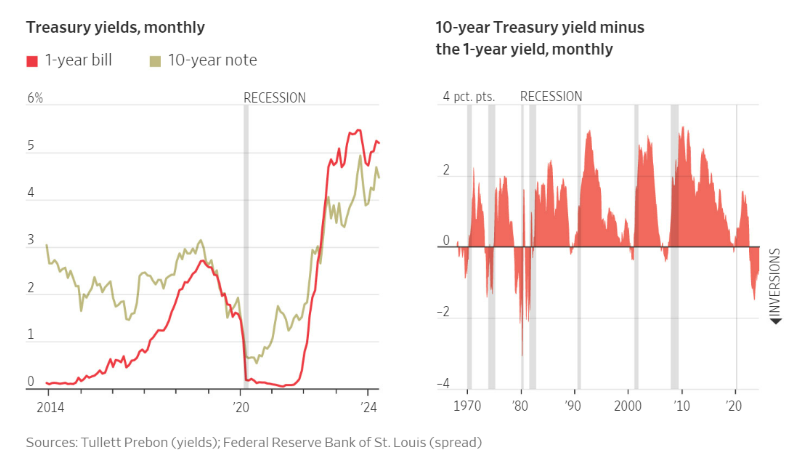

Wall Street's favorite recession indicator is in a slump of its own

Amazon is slashing prices on 4,000 grocery items, joining Target and Walmart

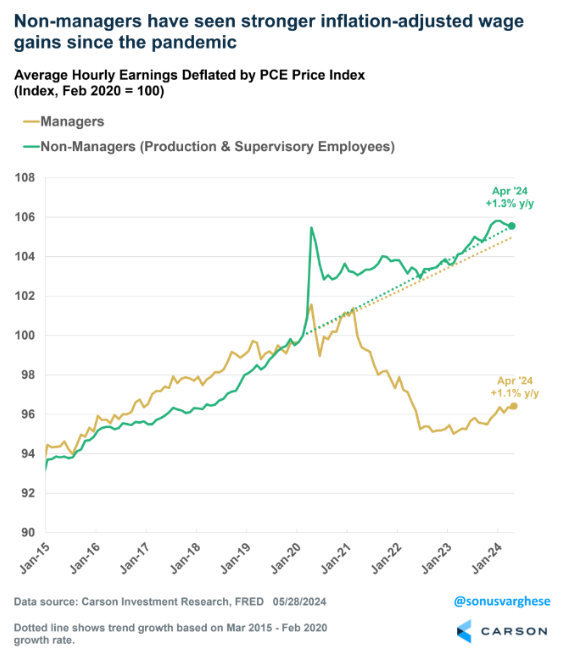

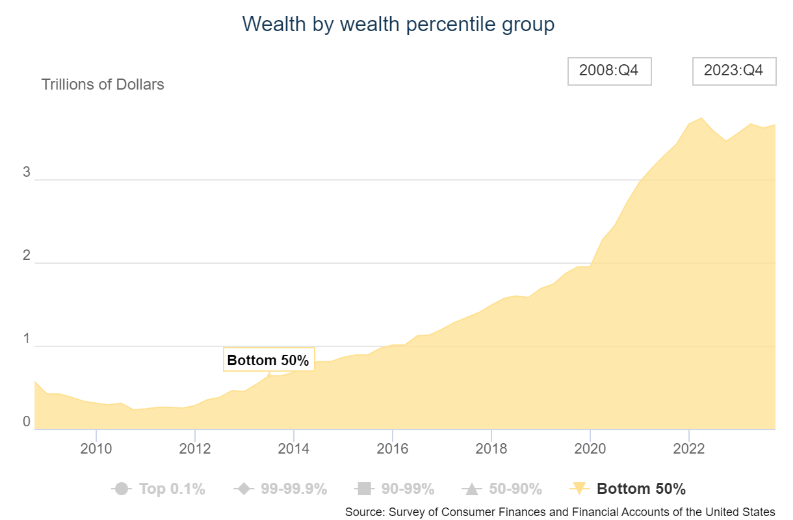

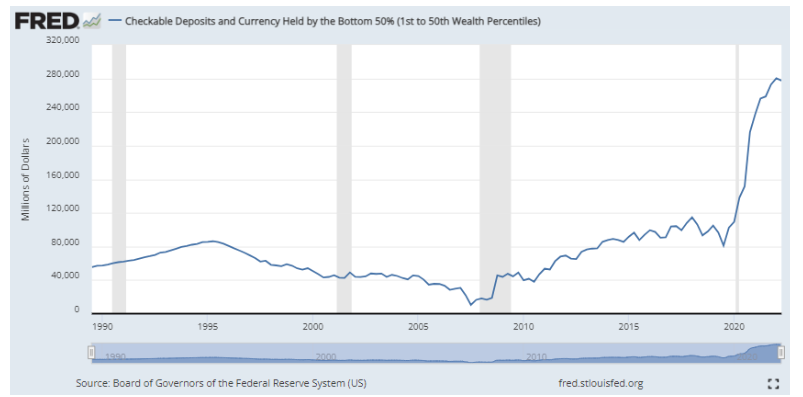

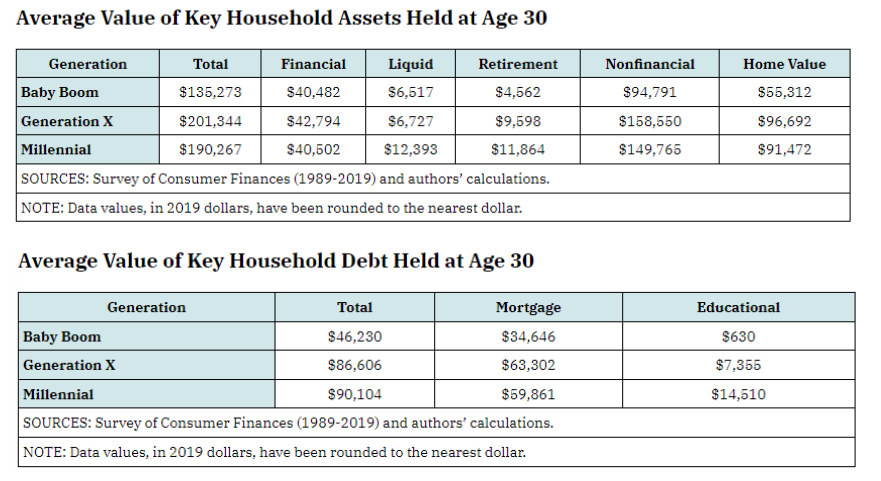

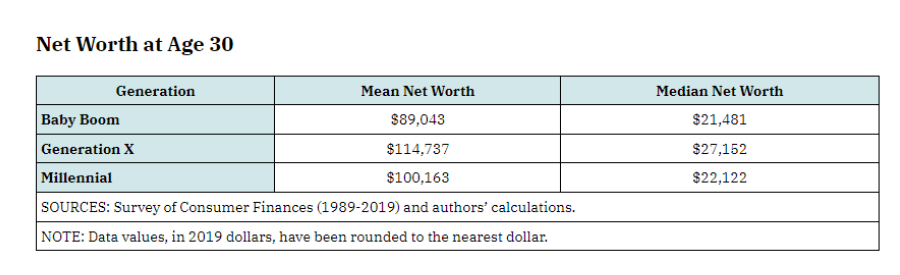

Data has shown most American households have come out ahead of inflation

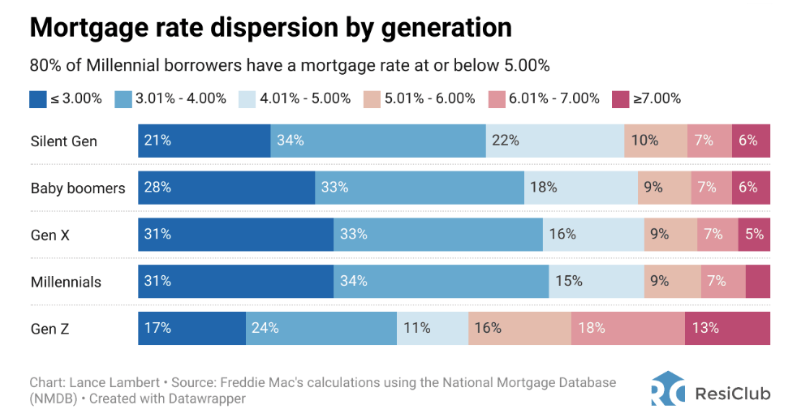

80% of Millenials have a mortgage rate under 5% - only 52% of Gen Z borrowers can say the same

Nearly 80% of Americans say fast food is now a luxury because it's become so expensive

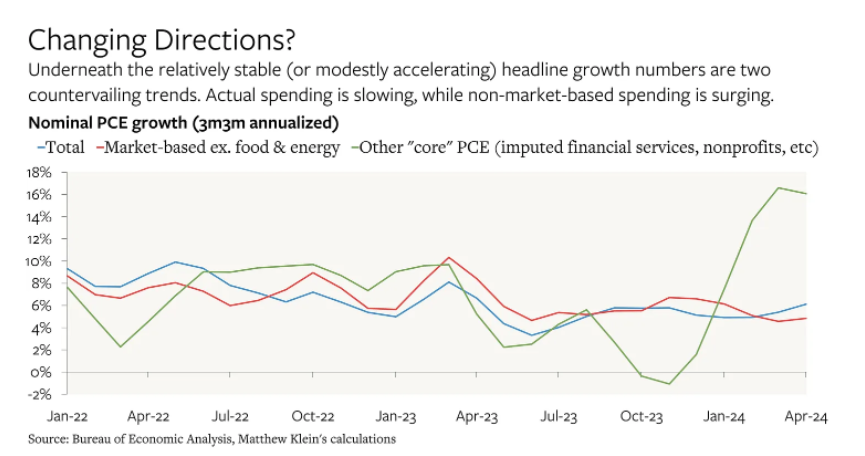

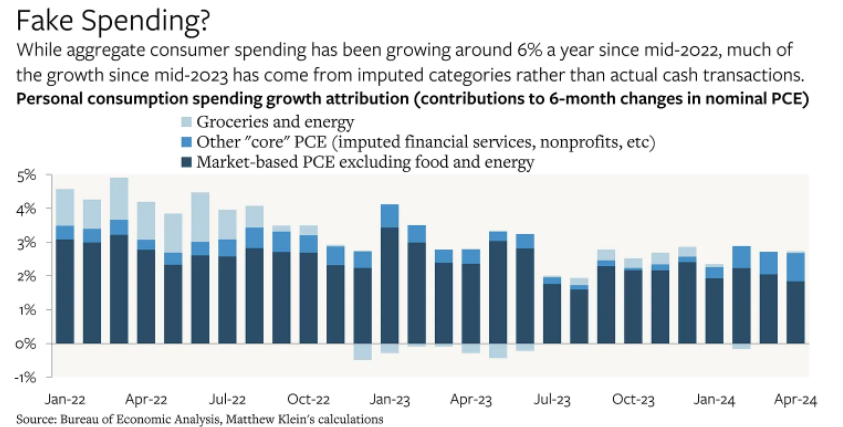

Key engines of US Consumer spending are losing steam all at once

Listen here:

Recommendations:

Charts:

Tweets:

When people ask why the US has outgrown Europe and Japan in the years since Covid, pumpers will often try to point to the large US fiscal deficit as the reason.

This lazy claim is easily refuted by the example of the UK. The UK ran a cumulative fiscal deficit that was almost as… x.com/i/web/status/1…

— Jesse Livermore (@Jesse_Livermore)

12:53 AM • May 31, 2024

My home insurance renewal was a 30% increase yoy

Not great

So I shopped around & actually found a price that was 20% lower than my previous policy last year (nearly 50% lower than the renewal amount)

I am doing my part to personally fight inflation from our corporate overlords

— Ben Carlson (@awealthofcs)

1:47 PM • May 31, 2024

the flippening: $IBIT passes $GBTC

BlackRock is now home to the world's biggest Bitcoin fund

— Katie Greifeld (@kgreifeld)

10:19 AM • May 29, 2024

Millennials' net worth was $5 trillion in early 2020

$13.5 trillion today @yardeni

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi)

12:38 PM • Jun 2, 2024

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.