- The Irrelevant Investor

- Posts

- Animal Spirits: The Envy of the World

Animal Spirits: The Envy of the World

Presented by:

Is your target date series a star performer? 9 of our 10 vintages received a 5-Star Overall Morningstar Rating™ (Class R6, as of 9/30/24). Expect more from your target date series, discover Putnam Retirement Advantage.

Today's Animal Spirits is brought to you by YCharts and CME Group:

See here for 20% off your initial YCharts professional subscription

See here for more information on adding futures to your portfolio with CME Group

The Compound Podcasts:

On today’s show, we discuss:

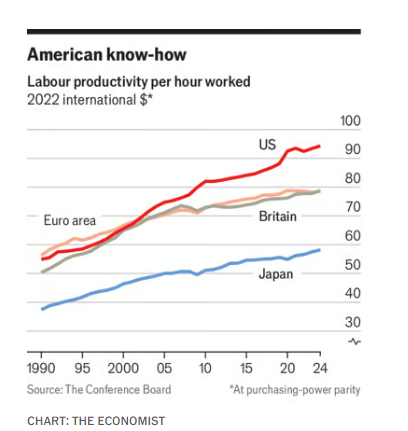

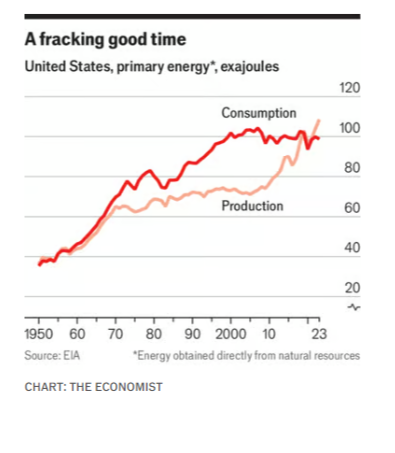

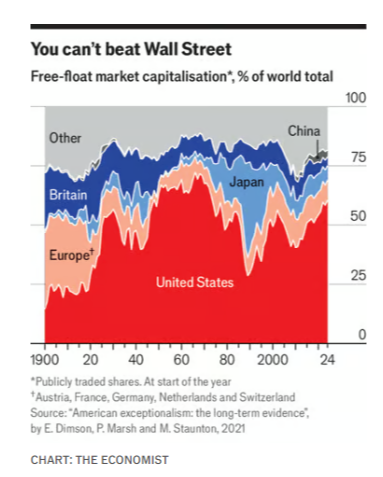

The American economy has left other rich countries in the dust

Archie Karas, a Gambling Legend Who Made--and Lost--a Fortune, Dies at 73

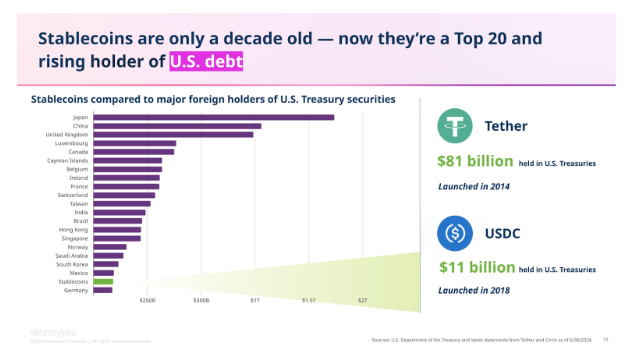

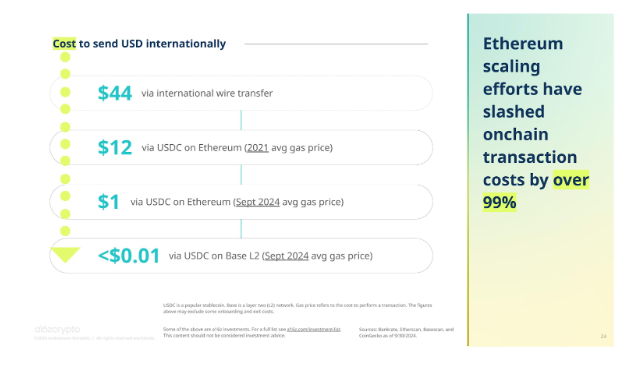

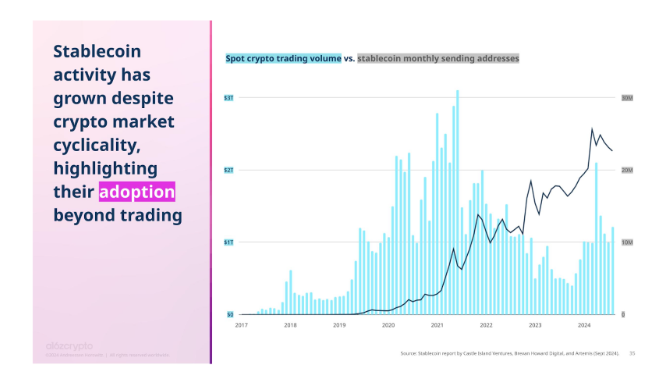

State of Crypto Report 2024: New data on swing states, stablecoins, AI, builder energy, and more

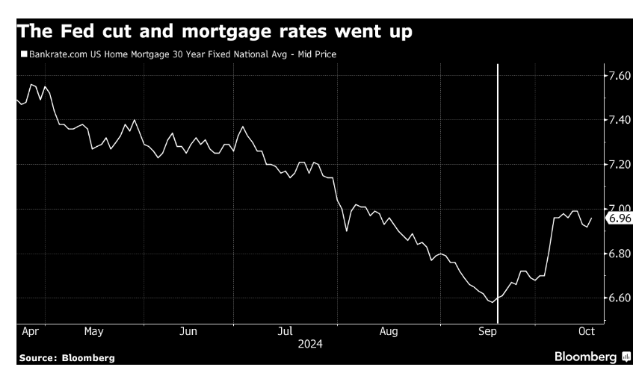

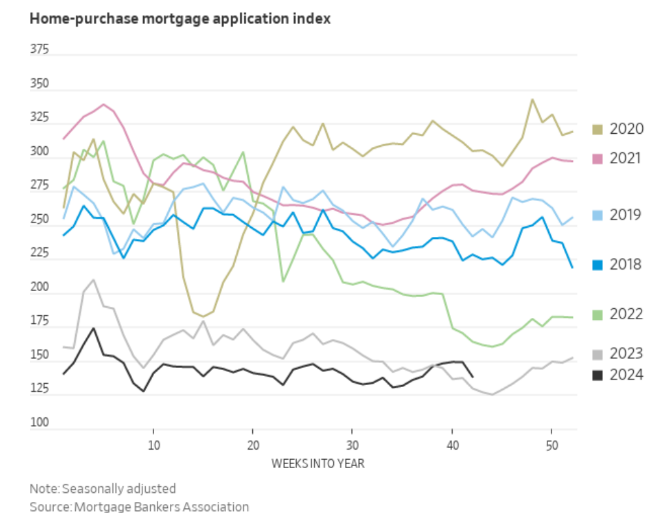

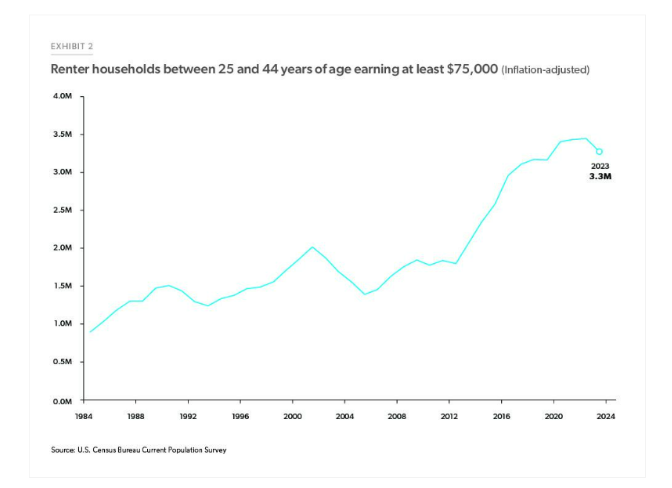

High Home Prices Force Builders to Offer Mortgage Buydowns--and More

Economic, Housing and Mortgage Market Outlook - October 2024 | Spotlight: First-Time Homebuyers

Charts:

Tweets:

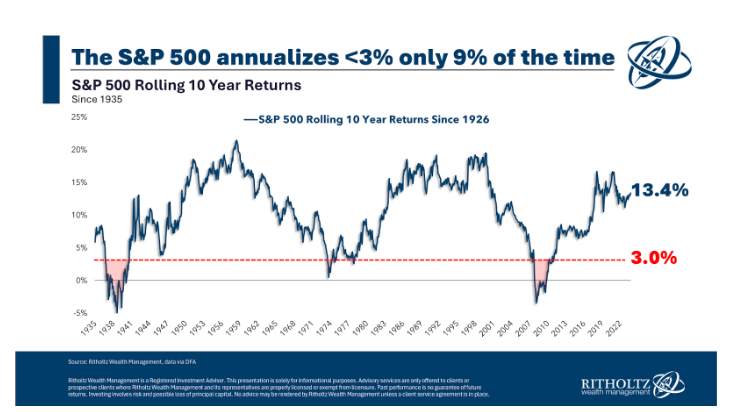

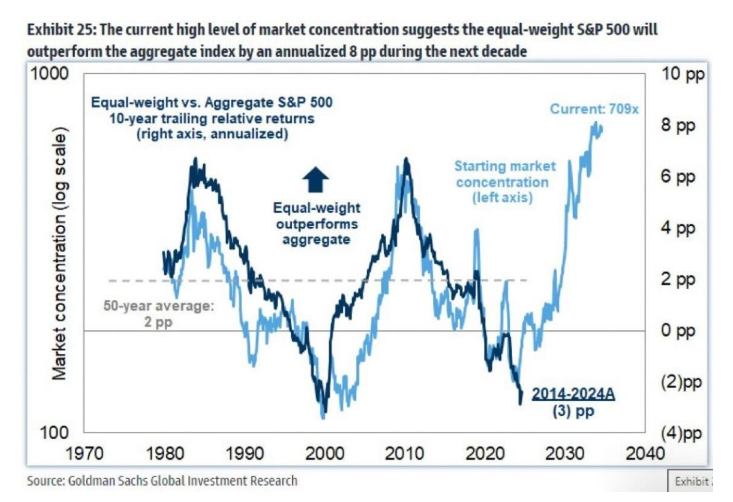

👀 GOLDMAN: "We estimate the S&P 500 will deliver an annualized nominal total return of 3% during the next 10 years (7th percentile since 1930) and roughly 1% on a real basis."

— Sam Ro 📈 (@SamRo)

9:27 PM • Oct 18, 2024

One year ago, Nvidia $NVDA was estimated to generate $79.3 billion in revenue in FY25.

Now, Nvidia is estimated to generate more than $125.6 billion in FY25.

— Beth Kindig (@Beth_Kindig)

9:33 PM • Oct 17, 2024

The end of shrinkflation? Tostitos is adding more chips to bags after sales decline

— Nathaniel Meyersohn (@nmeyersohn)

11:39 AM • Oct 16, 2024

Introducing… Battleshares

— Eric Balchunas (@EricBalchunas)

5:54 PM • Oct 16, 2024

So nearly $1bil into spot btc ETFs in last 2 days…

For context, only 8 out of 560+ ETFs launched in 2024 have taken in more than $1bil for the *year*…

— Nate Geraci (@NateGeraci)

1:48 AM • Oct 16, 2024

The most frequent question I get is: Who is selling #Bitcoin?

Here is the answer 👇

— HODL15Capital 🇺🇸 (@HODL15Capital)

12:39 PM • Oct 16, 2024

25.4% of mortgage borrowers have a rate above 5.00%

74.6% have a rate below 5.00%

The higher rate share is gradually increasing, as new buyers take on rates above 6.0% + borrowers slowly pay down

Subscribe to ResiClub & stay updated on housing: resiclubanalytics.com/subscribe

— Lance Lambert (@NewsLambert)

2:38 PM • Oct 17, 2024

$NFLX update tomorrow morning at TSOH Investment Research

— Alex Morris (TSOH Investment Research) (@TSOH_Investing)

1:45 PM • Oct 20, 2024

Recommendations:

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.