- The Irrelevant Investor

- Posts

- Talk Your Book: Finding Small Cap Diamonds in the Rough

Talk Your Book: Finding Small Cap Diamonds in the Rough

PRESENTED BY MOBY: Global Liquidity Hits Record Highs of Nearly $175 Trillion

Global liquidity is on the rise. Last week, it slowly climbed $1.13 trillion, pushing the total to an unprecedented $174.67 trillion, marking a new all-time high. This influx of capital into the global financial system indicates an overall increase in access to capital across international markets and an approving nod for risk-on assets, including equities and high-yield bonds.

With more capital available, global markets could see some momentum in stock markets, especially in sectors sensitive to economic growth, which bodes well for the U.S. and global economies as increased liquidity can fuel economic expansion and boost investor confidence.

If global liquidity continues to rise, financial markets may strengthen further, with equities likely continuing their upward trajectory. A persistent increase in liquidity would likely lead to lower borrowing costs and stimulate economic activity, but it would also raise concerns about asset bubbles and financial stability.

Get the full insights into how global liquidity highs might affect the future portfolio management with Moby. {Click Here}

Today's Talk Your Book is sponsored by Calamos Investments:

On today's show, we spoke with Brandon Nelson, Senior Portfolio Manager for Calamos to discuss investing in the small-cap space.

On today’s show, we discuss:

Navigating profitable and unprofitable small-cap stocks

Calamos' favorite small-cap sectors

Fighting macro headwinds within small caps

Why this asset class has flown under the radar over the past decade

Understanding the relationship between price and fundamental momentum

The popularity of small-cap investing

Listen here:

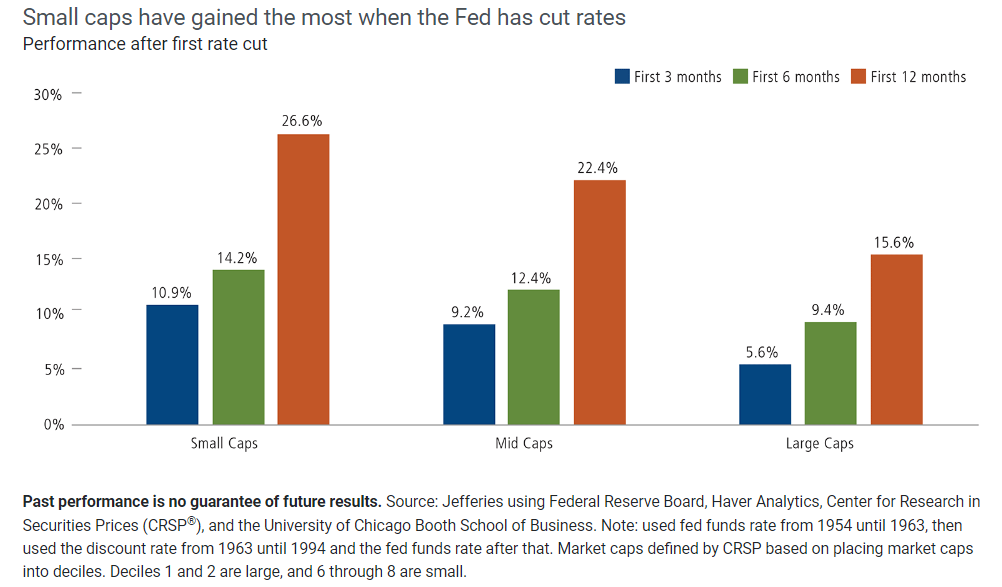

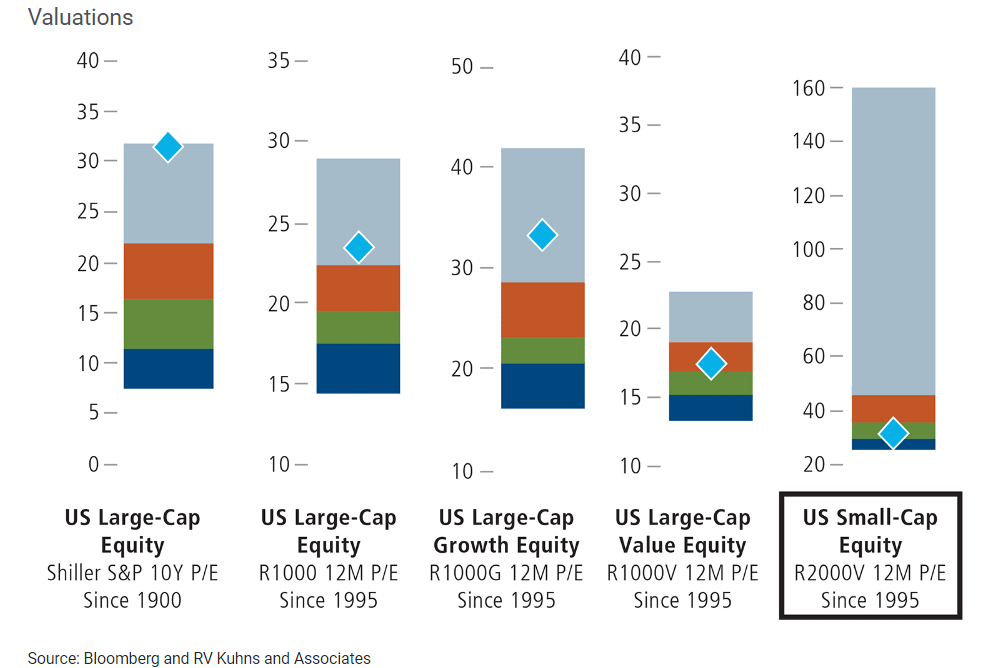

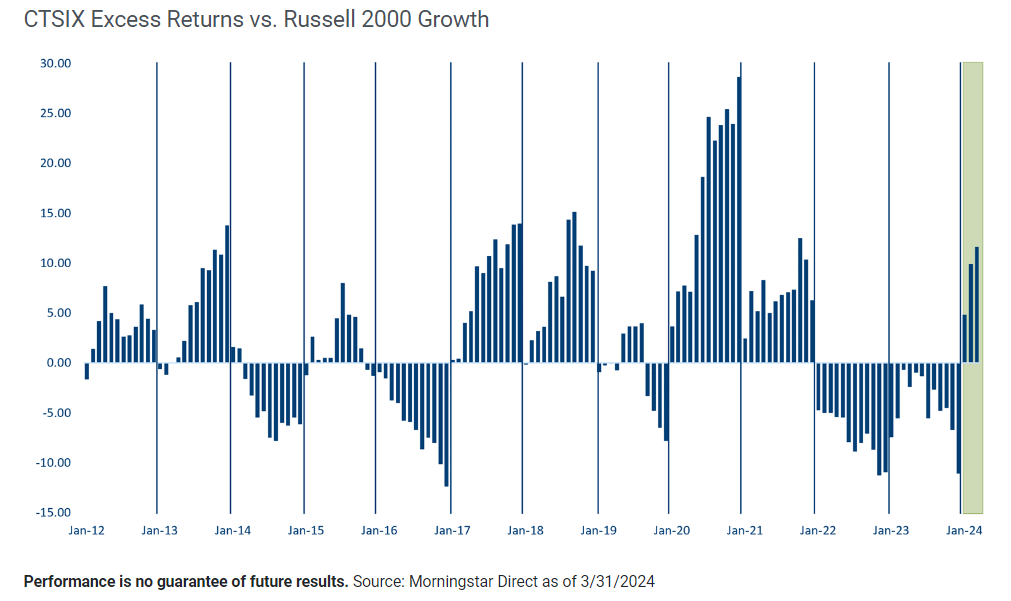

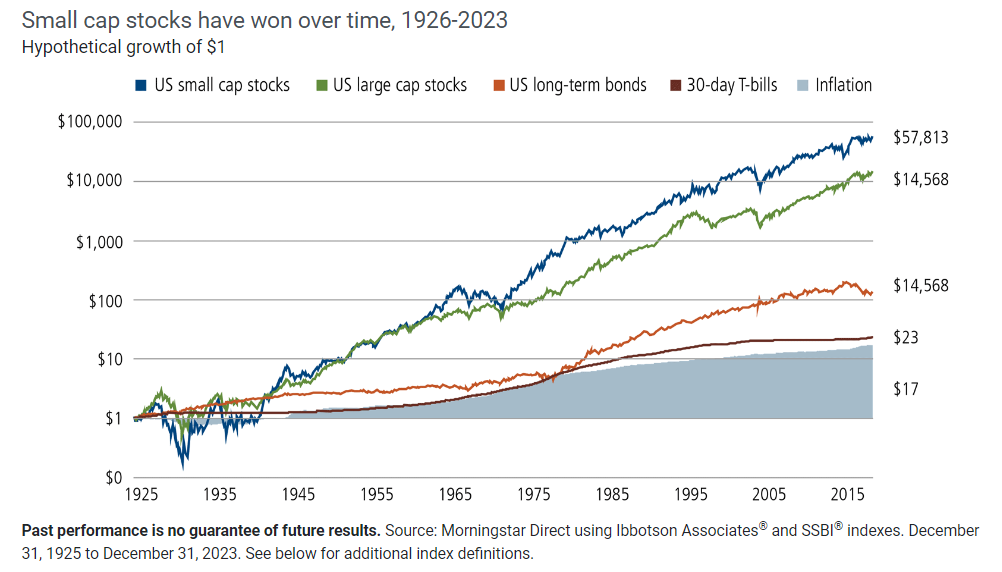

Charts:

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.