- The Irrelevant Investor

- Posts

- Talk Your Book: Conviction in Growth Investing

Talk Your Book: Conviction in Growth Investing

Today's Talk Your Book is brought to you by Motley Fool Asset Management:

See here for more information on the Motley Fool 100 Index ETF

On today’s show, we discuss:

How the index is constructed

The difference between active and passive management

Investing in growth vs value

How to have conviction as an analyst

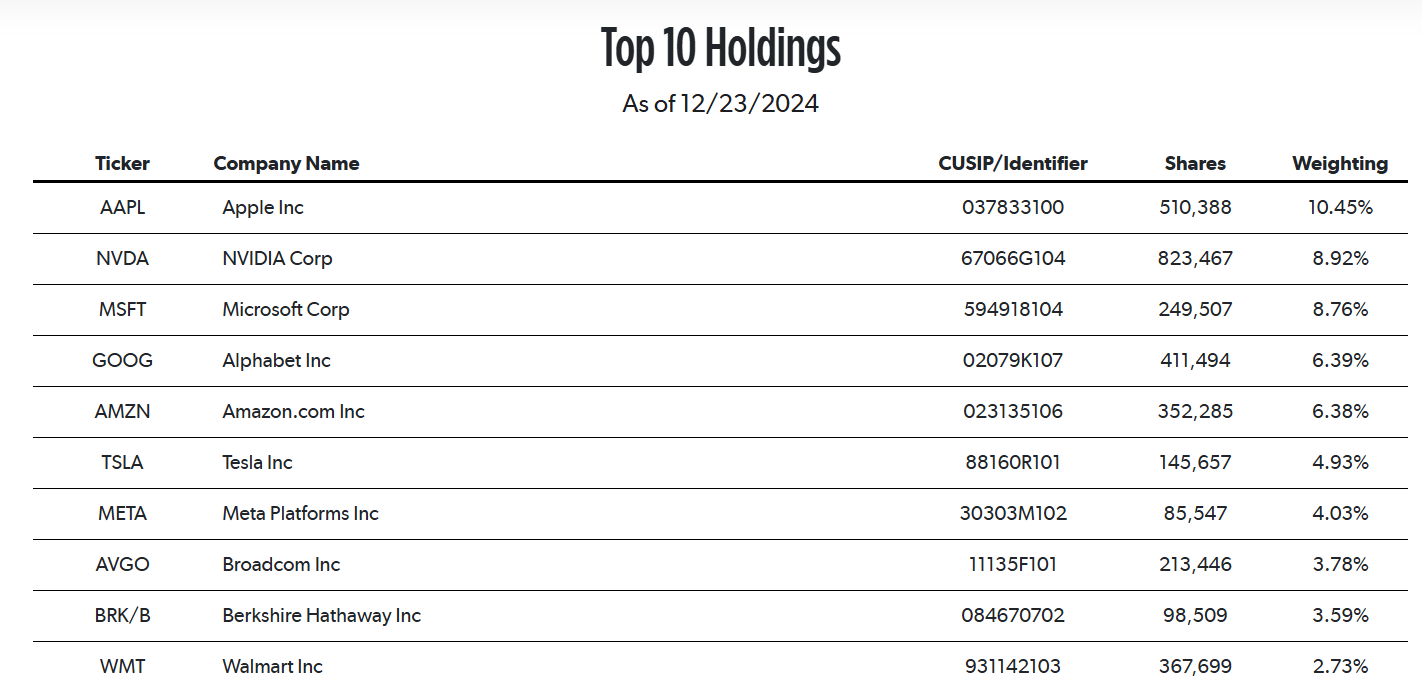

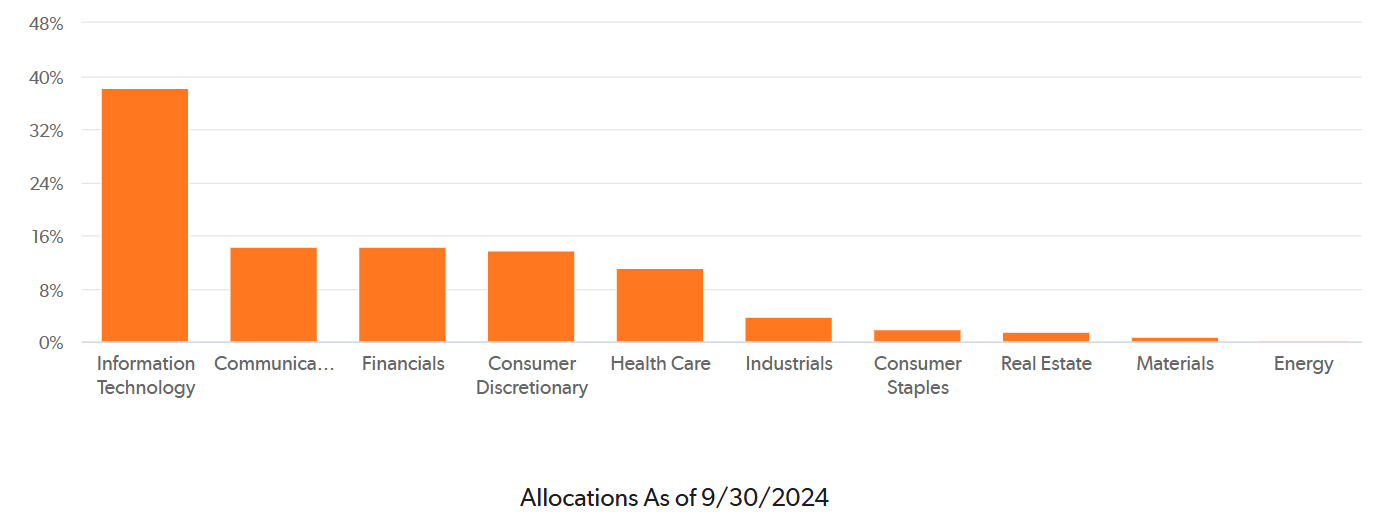

The Motley Fool's Top 100 Index characteristics

Thinking about valuation and market concentration issues

How Motley analysts approach stock picking

S&P top 10 changes over the years

The Compound Podcasts:

Charts:

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.