- The Irrelevant Investor

- Posts

- Talk Your Book: How Private Credit Works

Talk Your Book: How Private Credit Works

Agenda for the Morningstar Investment Conference Announced

Adapt, innovate, and stay ahead with our packed lineup at the Morningstar Investment Conference. Get cutting-edge research, hear from expert speakers, and network with thousands of peers by registering today. |

Today's Talk Your Book is brought to you by Calamos Investments:

See here for more information on Calamos Private Credit Strategies

On today’s show, we discuss:

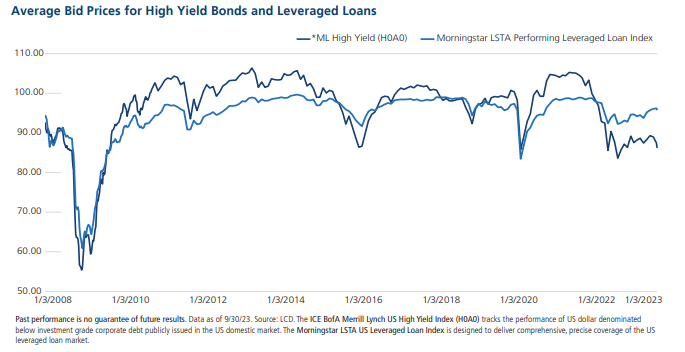

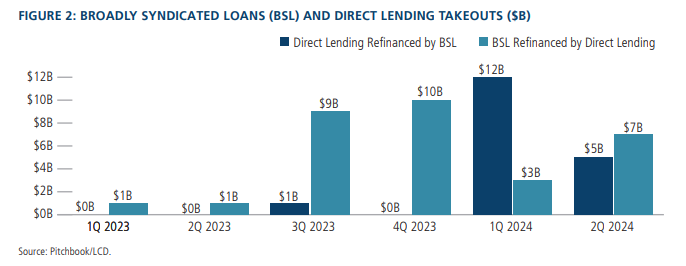

Why private credit has grown so much

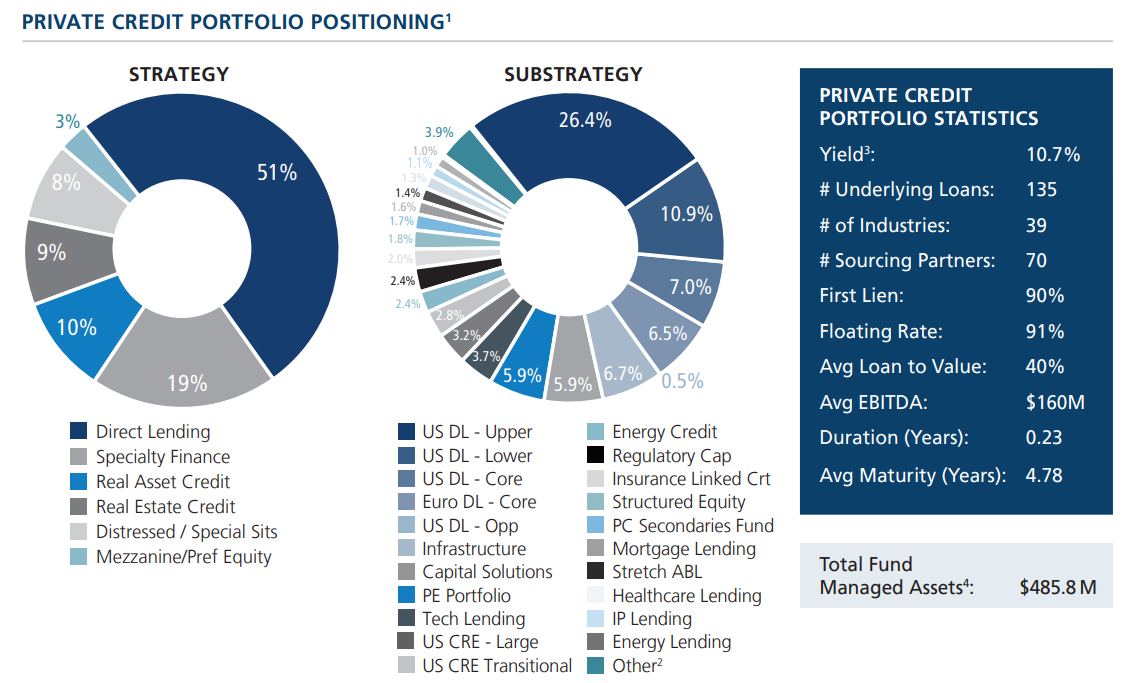

How interval funds work

How liquidity works

How often the portfolio turns over

How the fund yields double digits

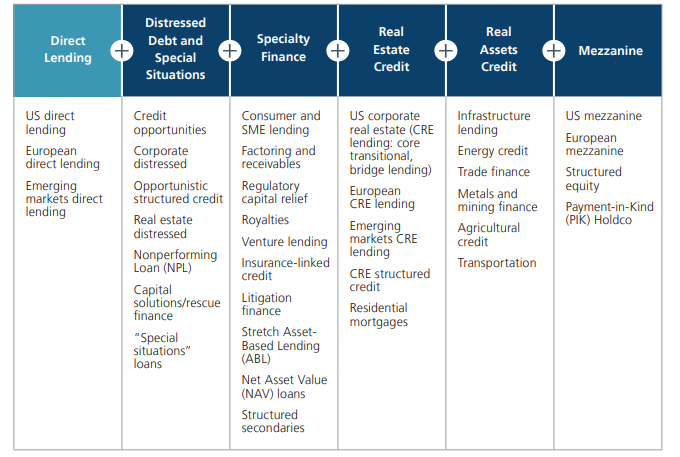

What specialty finance is

How covenants affect private credit loans

Commercial real estate lending growth in the future

The Compound Podcasts:

Charts:

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.