- The Irrelevant Investor

- Posts

- Talk Your Book: Infrastructure Investing

Talk Your Book: Infrastructure Investing

Today's Talk Your Book is sponsored by CION Investments:

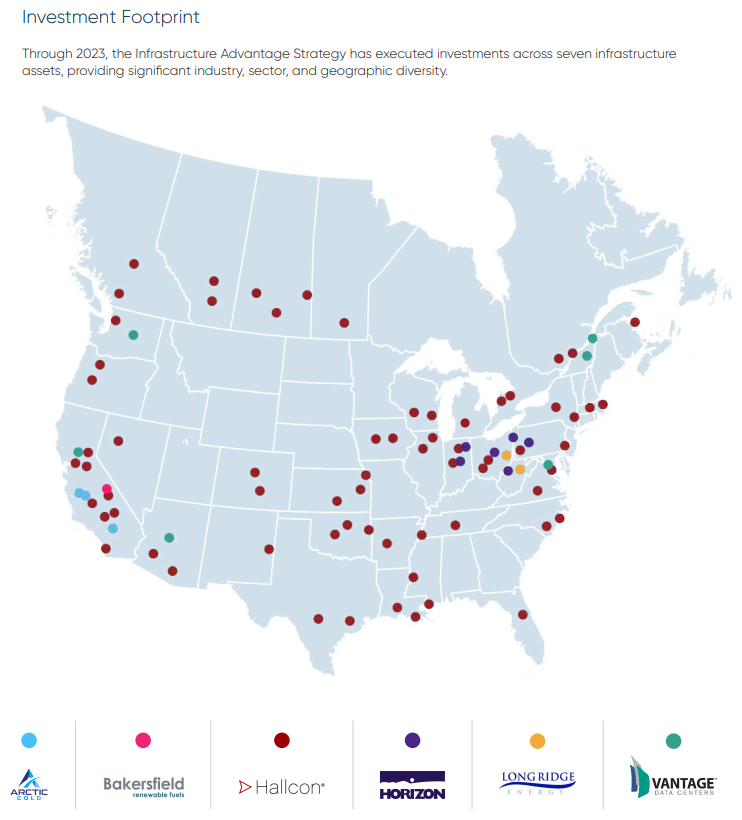

See here for more information on CION and GCM Grosvenor's infrastructure fund

On today’s show, we discuss:

The partnership between CION Investments and GCM Grosvenor

The basics around the infrastructure asset class

What infrastructure investments actually are

How these fund products work

Liquidity around BDCs vs interval funds

Risk and return expectations around infrastructure products

Constructing an infrastructure portfolio

Thoughts on infrastructure investing during rate cycles and election years

The Compound Podcasts:

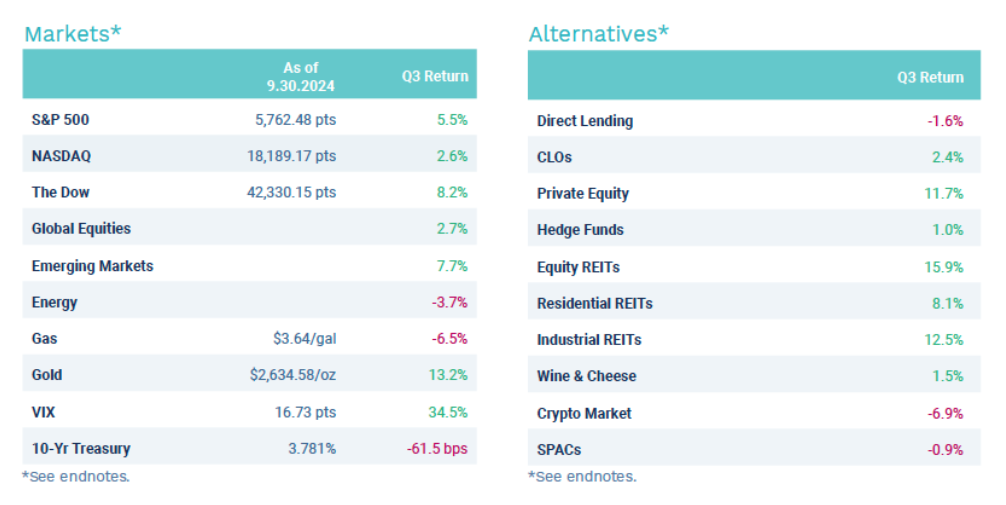

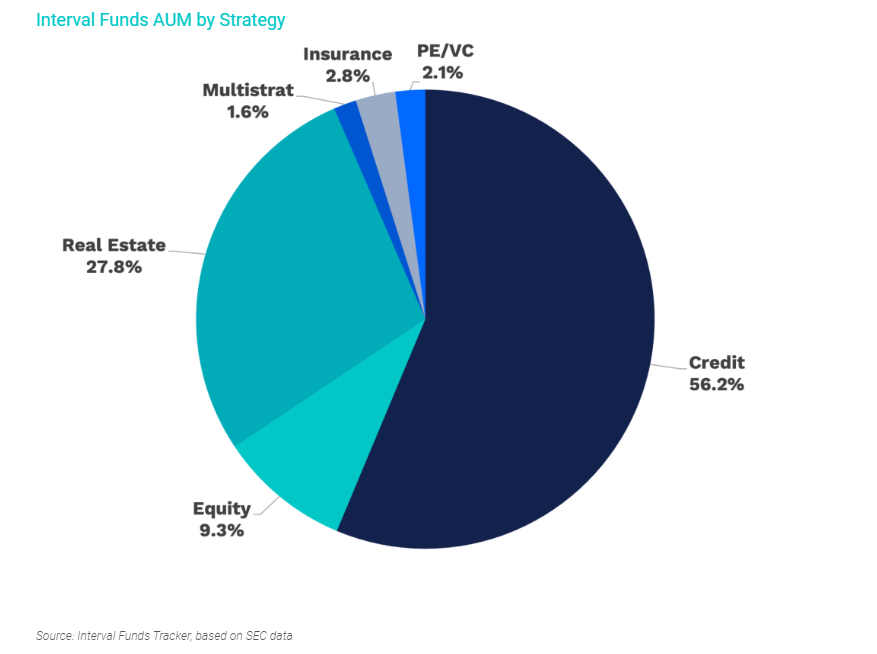

Charts:

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Investments in alternatives are speculative and involve

substantial risk, including market risks, credit risks, macroeconomic risks,

liquidity risks, manager risks, counterparty risks, interest rate risks, and

operational risks, and may result in the possible loss of your entire investment.

No assurance can be given that any investment will achieve its objectives or

avoid losses. Past performance is not necessarily indicative of future results. The

views expressed are for informational purposes only and are not intended to serve as a

forecast, a guarantee of future results, investment recommendations or an offer to buy

or sell securities. All expressions of opinion are subject to change without notice in

reaction to shifting market, economic, or political conditions. The investment strategies

mentioned are not personalized to your financial circumstances or investment

objectives, and differences in account size, the timing of transactions and market

conditions prevailing at the time of investment may lead to different results.