- The Irrelevant Investor

- Posts

- Talk Your Book: The Private Credit Opportunity Set

Talk Your Book: The Private Credit Opportunity Set

Advertisement

What’s your excuse now?

Investors can now embrace bitcoin's outsized upside potential while protecting 100% of the downside (for one year) through Calamos' risk management. |

Today's Talk Your Book is brought to you by Trinity Capital:

See here for more information on Trinity's private debt investments

The Compound Podcasts:

On today’s show, we discuss:

Issues with so much money coming into private credit

The valuations of private companies

Updates on the VC market

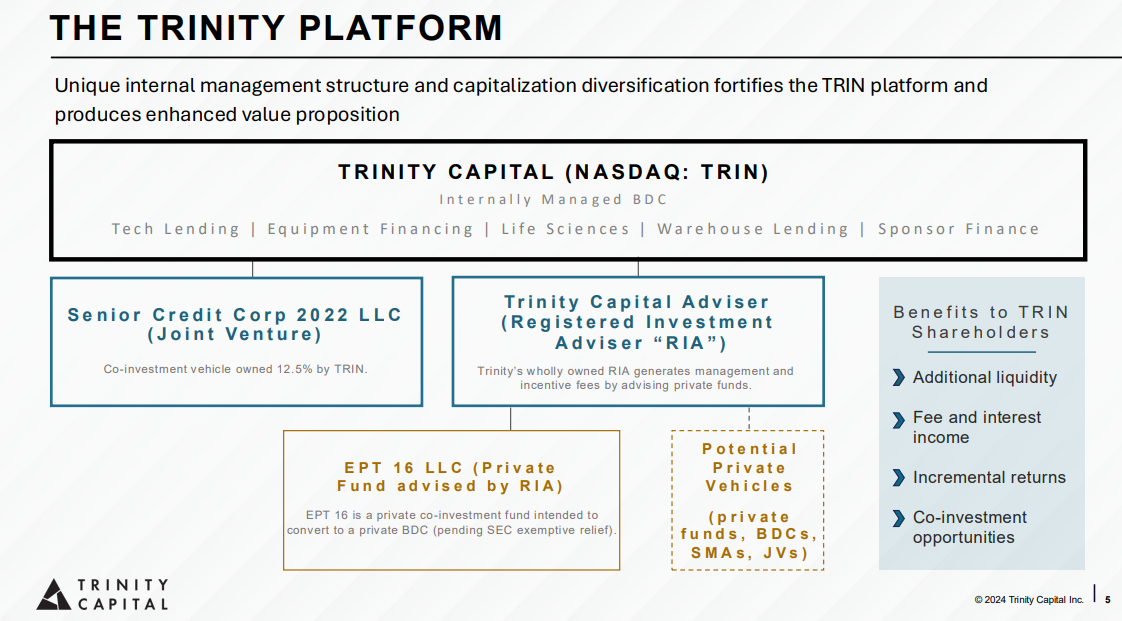

Investing in Trinity vs with Trinity

Trinity vs other BDCs

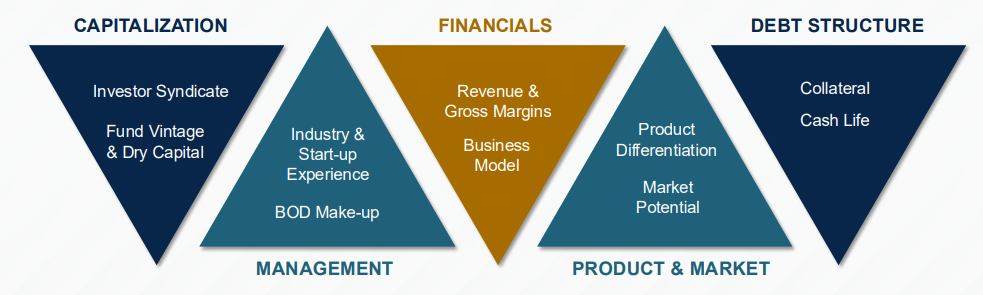

What advisors should be asking about when investing in this space

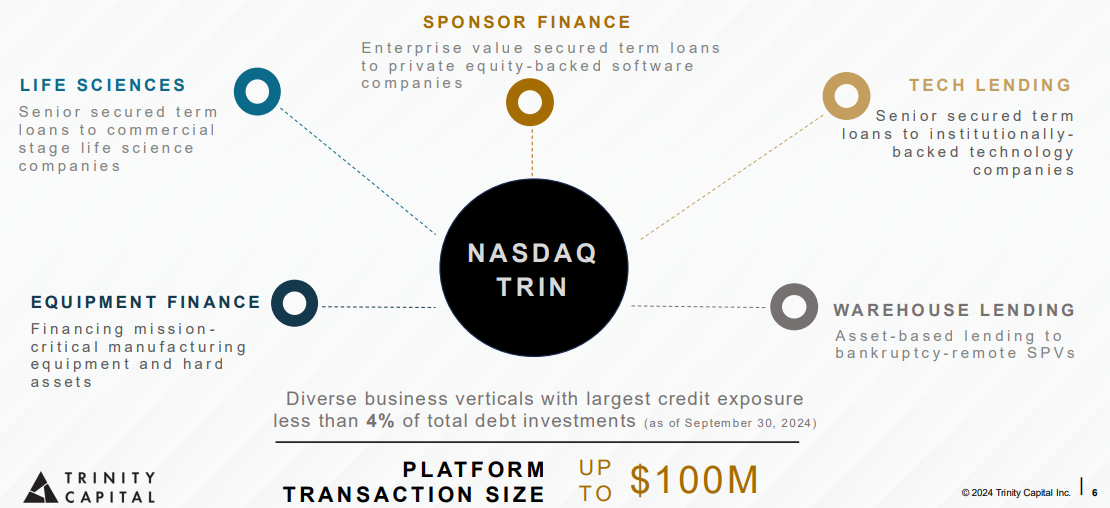

How diversified Trinity funds are

Charts:

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.