“Risk control is invisible in good times but still essential, since good times can so easily turn into bad times.” Howard Marks

As U.S. equity markets enter a correction you’ll hear a lot of people scoff at the phrase “stay the course.” For whatever reason, people seem to think that the portfolio of those on “the course” are 100% U.S. stocks. When advisors say this, what we mean is unless there has been a drastic change to your life, you never allow events in the market to interfere with the investment strategy you already have in place.

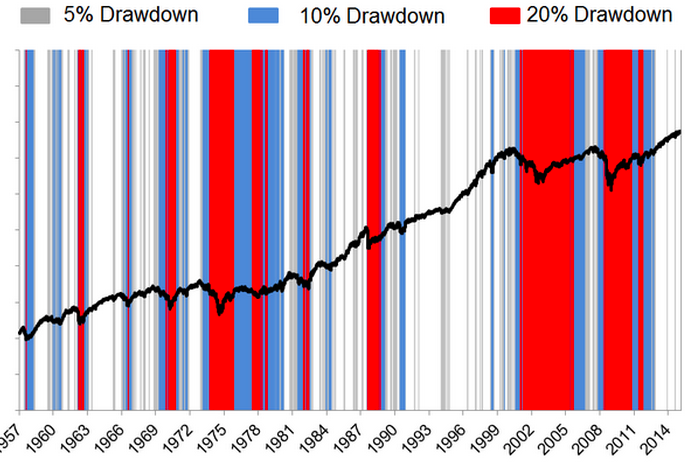

Take a look at the chart below. Since the inception of the S&P 500 in 1957, there were 48 drawdowns from all-time highs of 5%; 17 of 48 became at least 10% and 9 of 48 became at least 20%. Although there is quite a bit of red on the chart, the odds of you consistently timing the exit and re-entry over your investing lifetime is miniscule.

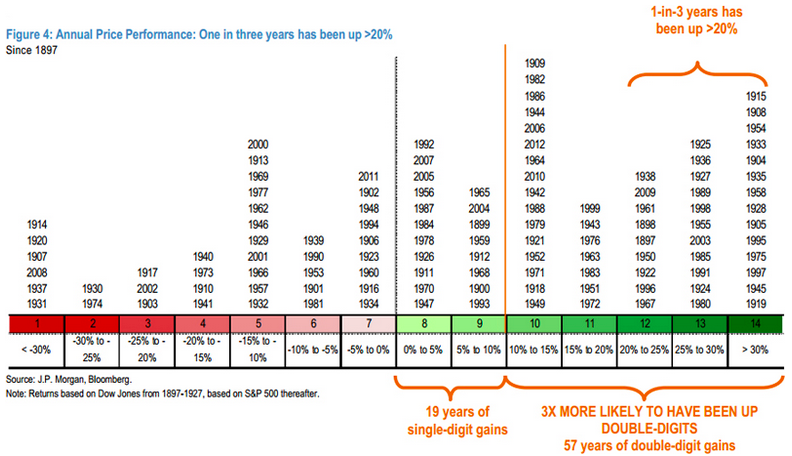

Here are some additional facts, courtesy of J.P. Morgan. One out of every three years has been up at least 20%. There have been 57 years of double-digit gains and just nineteen years of single-digit gains. In other words, if the Dow is positive on the year, it is three times more likely to be up double-digits than single-digits.

So now that we know how skewed the market is to the upside, why would we be tempted to sell? Because we tend to overestimate small probabilities and underestimate large ones. Yes we know the odds of entering a bear market, but fear takes over and data flies out the window. Maybe this is the 5% correction that turns into 20%+, but you’ll never know ahead of time.

“Stay the course” implies that there is a strategy in place and every viable strategy begins with risk management. Risk management for us means constructing portfolios that our clients will not abandon even as markets become headlines news. Moving beyond what we do, it doesn’t necessarily matter what your process is since there is no “right” way to invest. Whether you’re managing risk through diversification, a margin of safety, stop loss orders or having one year of living expenses, you’re doing something right.

We tell our clients to “stay the course” because betting against progress is a losers game. If you experience years where your portfolio goes down 20% or more, have you lost? To the contrary, that’s how you ultimately win! From Nick Murray’s Simple Wealth, Inevitable Wealth:

$6,200,000,000

“Yes, that’s right, it’s six billion two hundred million dollars. A very large sum of money, wouldn’t you say? Now what, you ask, does it represent? It is roughly how much Warren Buffett’s personal shareholdings in his Berkshire Hathaway, Inc. declined in value between July 17 and August 31, 1998. And now for the six billion dollar question. During those forty-five days, how much money did Warren Buffett lose in the stock market? The answer is, of course, that he didn’t lose anything. Why? That’s simple: he didn’t sell.”

Any decent financial plan has accounted for bear markets that will show up over the course of an investor’s lifetime. If an advisor has properly identified your ability to bear risk, you should be able to stay the course for the next few days, weeks and months, no matter how deep the selloff gets. I hate to be an optimist, but this too shall pass.