“It is an iron rule of history that what looks inevitable in hindsight was far from obvious at the time.” -Yuval Noah Harari

Imagine watching The Sixth Sense for the first time. Only you start at the final scene, and then continue on to the beginning. This is sort of what it’s like reading and studying market history.

In his amazing book, Sapiens: A Brief History of Humankind, Harari writes:

This is one of the distinguishing marks of history as an academic discipline- the better you know a particular historical period, the harder it becomes to explain why things happened one way and not another. Those who have only a superficial knowledge of a certain period tend to focus only on the possibility eventually realised…

This is a profound observation. It’s easy to fool ourselves, especially as investors. We know now how things turned out, but the $229,576,000,000 that was pulled from equity mutual funds in 2008 is proof that we never know in advance.

But what if the Fed never bailed out AIG? What if they hadn’t done several rounds of quantitative easing? What if Ebola turned into a pandemic virus? What if China had a hard landing? What if crude oil went to $10 a barrel? What if the Fed hiked rates three years ago? What if the Euro reached parity? Etc, etc.

Things are only certain after the fact; in real-time, anything is possible.

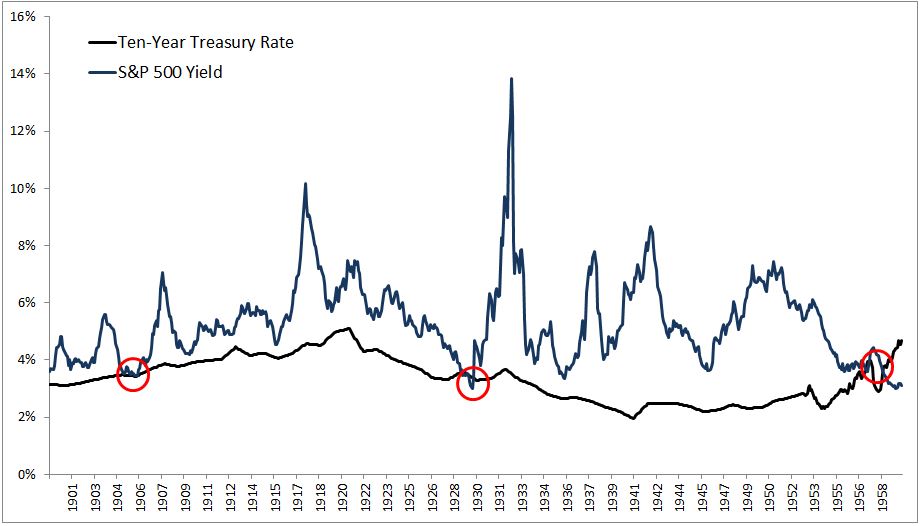

As an example, let’s look at the paradigm shift that occurred in the late 1950s between dividend yields and the ten-year treasury rate.

Prior to 1957, dividend yields on stocks were higher than the interest paid from bonds. At the time, investors demanded a higher payout to compensate them for the additional risk. In fact, from 1900-1957, stocks had a higher yield than bonds 99.1% of the time. And it was a good rule of thumb, that any time yields and interest rates converged, stocks were expensive and taking down exposure wasn’t a terrible idea.

In the chart below, you can see this was a pretty reliable indicator. Dividend yields briefly fell below interest rates just before the Panic of 1907, when stocks fell nearly 50%, and also prior to The Great Depression, when stocks fell nearly 90%.

And then in June 1957, something changed. The yield on the S&P 500 fell below bonds, only this time it stayed there. And not only did stocks not fall- as many warned at the time- but in the following ten years, the S&P 500 returned 200%.

Since the crossover in 1957, the dividend yield for the S&P 500 has been lower than the 10-year treasury rate 94% of the time. What caused this sudden and dramatic shift? Did stocks all of the sudden become less risky than bonds? Did their corporate structure change? Were investors doing it wrong for nearly sixty years? No, no, no.

Studying the past can help provide context but it can never tell you exactly how things will play out in the future.

Source: