Dimon is the new Bufett letter, are things worse now, why you shouldn’t mix A players with C players, and more things I chewed on last week

Worry About the Right Things

Risk is inevitable

The Compound and Friends: That Wasn’t the Bottom

On today’s show, we are joined by Tony Dwyer, Head of the US Macro Group and Chief Market Strategist at Canaccord Genuity Group to discuss if we are in a recession, if inflation will make a comeback, Q1 stock market performance, the AI race, and much more!

Animal Spirits: The 3 Levels of Wealth

On today’s show we discuss why investors are always looking to catch a falling knife, a reversal in the markets since last year, why European stocks are outperforming, how money market funds became the biggest market story of the year, de-dollarization, some vacation thoughts from spring break and much more.

Talk Your Book: No Bank Runs in Commercial Real Estate

On today’s show, we spoke with Tom Miller, CEO and CIO of USQ to discuss real estate in Manhattan, the hottest sectors of commercial real estate, office space investing in the next few years, and much more!

These Are the Goods

AI, being famous, more AI, and more things I chewed on last week

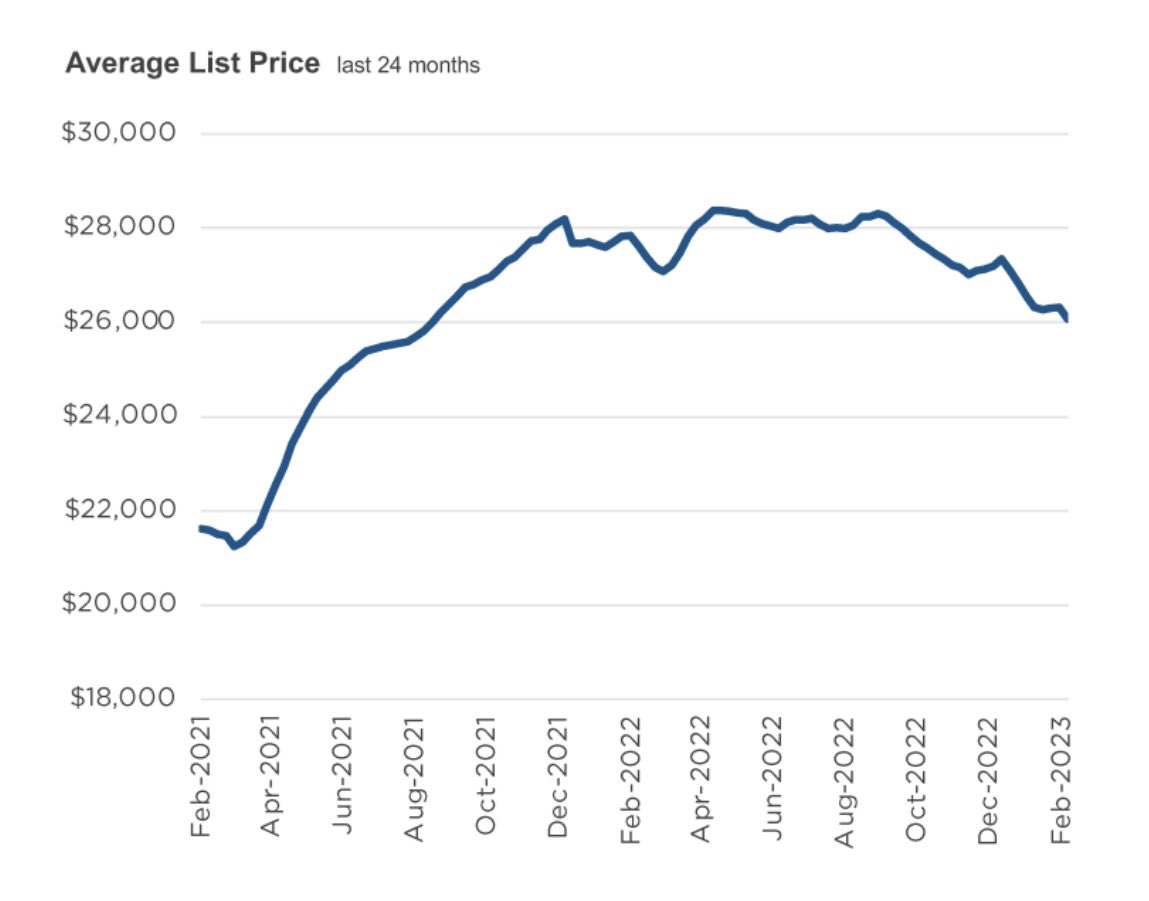

Talk Your Book: Car Dealership Guy

On today’s show, we are joined by CarDealershipGuy to discuss buying a car in 2023, buying v leasing, the downfall of Carvana, the electric car market, and much more!

The Compound and Friends: Bearish But Priced In

On today’s show, we are joined by Jurrien Timmer, Director of Global Macro for Fidelity Investments to discuss tightening financial conditions, when the Fed will cut rates, where the S&P goes from here, Bitcoin v Gold, and much more!

Animal Spirits: The Worst Chart in Finance

On today’s show, we discuss why investing is so hard, the time between all-time highs in a bear market, why the Fed is in such a tough spot, ramifications from the banking crisis, low supply in the housing market, why people think their children will be worse off, the psychology behind the AI boom and much more.

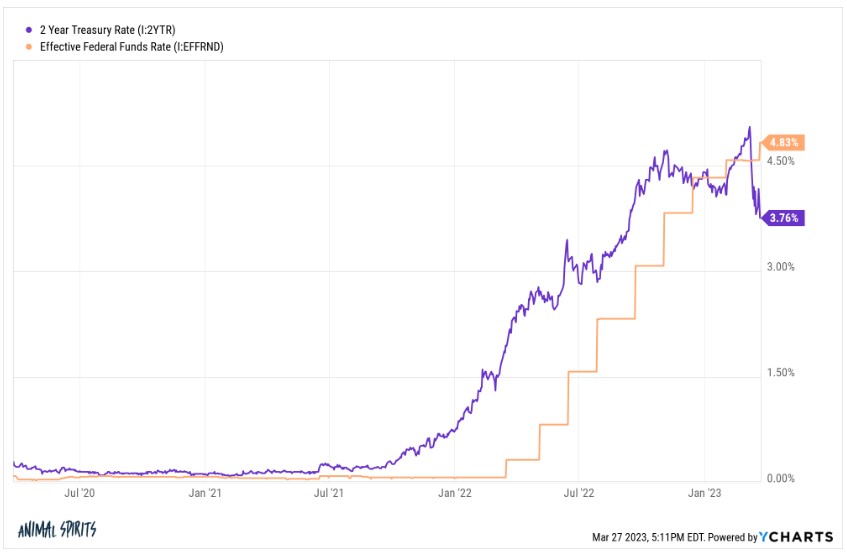

Hike, Pause, Cut

The market is telling the fed to relax