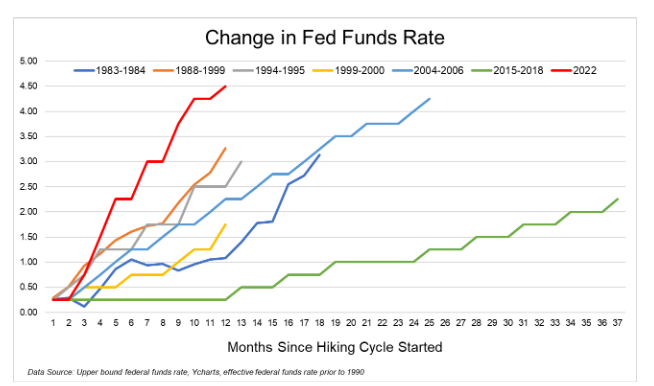

On today’s show we discuss Silicon Valley Bank, the psychology of bank runs, how the Fed broke stuff, FDIC insurance, why the banking industry is forever changed, tech is the new Wall Street, why the bank crisis could be bullish for the stock market and much more.