So this happened today.

Wow, we’ve come a long way.

I vividly remember the first time I heard about Twitter, it was March of 2009. This experience is burned into my memory because I was so turned off by it.

I was sitting in my dining room, probably eating a bowl of cereal and flipping through the seven available channels on our decrepit 7 inch RCA television when I saw Puff Daddy on Ellen. During the conversation, he took out his Blackberry and tweets, “sitting with Ellen right now.” Twittering, which was described as “mass email that goes out to everybody,” sounded as appealing as having a peanut butter and squirrel sandwich. So I can’t remember what compelled me to do so, but eight months later I created an account.

I tend not to be very forward thinking with these sort of things. I’m the type of person who can watch a suspenseful episode of television and not spend a second wondering what will happen next week. I don’t know why I’m sharing this other than to make the point that I live firmly in the present, so really, when I created an account in November 2009, I had no idea that it would change my life.

The first people I followed were a few friends, characters on the Howard Stern Show, and beat writers for the Knicks and Giants. But it wasn’t long before I discovered the finance section.

At the time, I was working at an insurance agency and knew I would soon be looking for other work. I didn’t know much of anything about the markets and I needed an education. Twitter is where I got it. I was excited and inspired by the people sharing their ideas, so I spent the next two years on the stream getting my MBA and I haven’t stopped learning since.

Fast forward to today and things like this are going on. Hendrik Bessembinder, author of Do Stocks Outperform Treasury Bills? updated his paper with two links to blog posts. Finance Twitter for the win!

Twitter really is the new tape. It’s where news breaks and is a big part of why twentieth century media is shrinking. This platform has made me a better and more informed investor. It got me my job, it connected me to the world, and it got me on stage with Abby Joseph Cohen. But like everything else in life, Twitter is flawed.

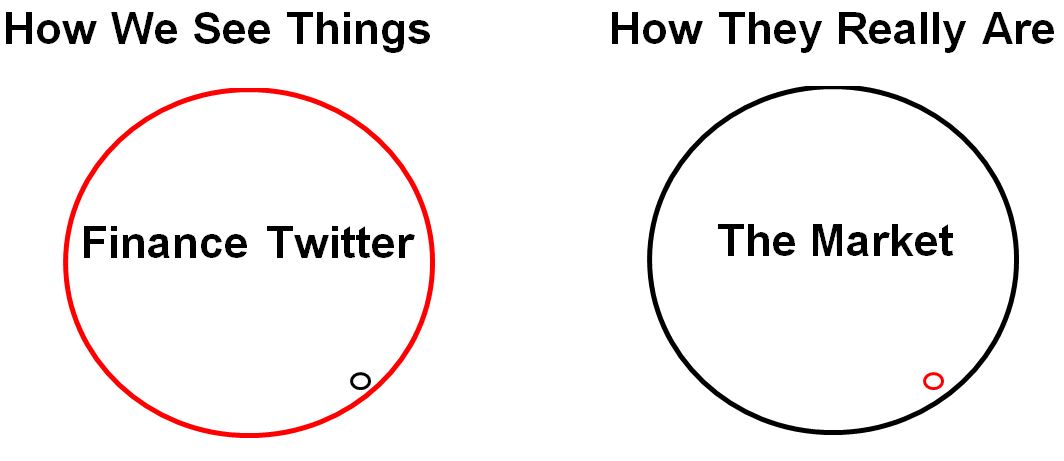

One of the best and worst things about this platform is selecting who you want to follow; You can create a stream of like minded people who you never disagree with. But the problem is it’s so easy to get trapped in our own little bubble, and it’s hard to grow if you agree with everyone around you.

On the other side, it’s easy to follow too many people and completely lose touch with reality. Consensus is when two people agree, a crowded trade is when three people agree, and the contrarian trade is when you disagree with the person you always disagree with anyway.

I created this graphic below, which does a pretty good job describing the view on Finance Twitter.

Twitter is invaluable for people in the industry, but it can be a really difficult and potentially dangerous place if you’re on the outside looking in. It’s hard to know who is full of shit and who is sincerely trying to help. And even when you find the right people, how much weight do you put on what they say? How do you know if they’re right? How do you know what their typical holding period is. How do you know if they’re even trading at all? These are all tricky questions to answer, and even for people in the business who are able to discern all of this, it’s nearly impossible to drink from a fire hose and not lose a few brain cells.

It seems like there is a unanimous love/hate relationship among engaged users. We all love Twitter, but we hate how much time we spend on it. It’s certainly possible, even probably that one day my attitude will change, but at this point I’ve made the decision to stop telling myself to spend less time on it. I’ll end this with a short story from Mark Twain, whose Twitter was his cigars.

When I was a youth I used to take all kinds of pledges, and do my best to keep them, but I never could, because I didn’t strike at the root of the habit–the desire; I generally broke down within the month. Once I tried limiting a habit. That worked tolerably well for a while. I pledged myself to smoke but one cigar a day. I kept the cigar waiting until bedtime, then I had a luxurious time with it. But desire persecuted me every day and all day long; so, within the week I found myself hunting for larger cigars than I had been used to smoke; then larger ones still, and still larger ones. Within the fortnight I was getting cigars made for me–on a yet larger pattern. They still grew and grew in size. Within the month my cigar had grown to such proportions that I could have used it as a crutch. It now seemed to me that a one-cigar limit was no real protection to a person, so I knocked my pledge on the head and resumed my liberty.