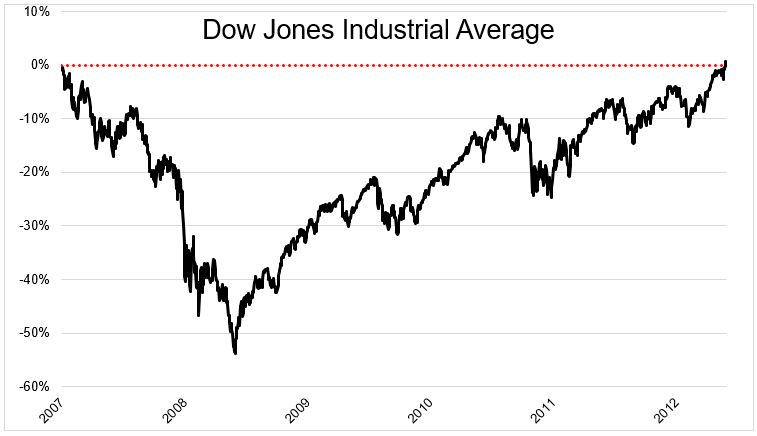

Today in March 2013, after 1,974 days and a 54% drawdown, the Dow Jones Industrial Average recaptured all-time highs that were last seen in October 2007. The Dow was at 14,000, the CAPE ratio was under 18, unemployment was 7.5%, and the ten-year was yielding 1.9%

From time to time I like to look back at what the newspapers were saying as a reminder that nobody knows what the future holds.

A few snips from a Wall Street Journal article, “Dow Hits Highest Close Ever”

- “But skeptics point to a slowing earnings outlook and potential tax and spending headwinds as lawmakers sort out the U.S.’s debt troubles.”

- “It’s good fundamental data that has been lacking”

- “This market has really been hanging on central-bank stimulus from around the world.”

In another Wall Street Journal Article, “Five Stocks Handled the Heavy Lifting“

-

“IBM currently holds the biggest weighting in the Dow, making up about 11% of the index. The stock has risen 147% from the spring of 2009 and finished at $206.53 on Tuesday. That move alone contributed 941.77 points to the Dow’s 7,706.72-point rally since March 9.”

- “The market is priced as if the U.S. recovery is in full-blown expansion mode. But that’s simply not the case. Instead, we are merely entering year four of what’s been a subpar recovery. And there are more reasons to be worried than excited.”

- “On Tuesday, Mr. Lindsay checked his TD Ameritrade account at about 10 a.m. and saw that the market had hit a new high. He decided to check back around noon. If the market was falling back, he planned to buy an inverse exchange-traded fund, which would allow him to profit from a market drop. But the market didn’t give up its gains, so he didn’t buy one. “I still think there’s a pullback coming,” he says.”

There’s always a pullback coming, but the Dow has returned 75% since March 5th 2013 and would need to fall nearly 45% to get back to those levels.

Check out what CNBC was saying.

https://www.youtube.com/watch?v=h2nUWn78vVc