No, the S&P 500 is not a momentum fund.

When Netflix was added to the S&P 500 in December 2010, at $10 billion, it represented 0.08% of the index. Today, 1200% later, Netflix has grown to 0.65% of the index and is now the 33rd largest component, behind Pepsi and Disney. With this example and others like it, some people have come to the conclusion that the S&P 500 is really just one giant momentum fund.

I found this argument compelling, but I was proven (mostly) wrong in this excellent post from Ehren Stanhope: False Promises: Going Passive is Not Momentum Investing

Ehren found that using 12-month momentum, excess return peaks at about 10 months. And if you don’t move out of momentum names, which a market cap index does not do, then you will end up underperforming. Here’s Ehren:

For simplicity’s sake, let’s say the optimal holding period, selling at the peak, is 12 months. This suggests that the entire “strongest momentum” portfolio must turn over every 12 months–100% turnover to realize the benefits of momentum. For the middling momentum deciles, it needs to turnover even faster.

Last I checked, no passive cap-weighted indexes have anything near 100% turnover. If they did, it would be completely antithetical to their objective, low cost exposure to the market. It is empirically impossible for low turnover cap-weighted indexes to provide value-add momentum exposure over a market cycle. A 3% turnover implies a holding period of 33 years. I wonder what the momentum horizon looks like over 33 years?

I said I was proven mostly wrong and here’s why. If you think about momentum in terms of years and decades, which I know is not actually momentum but something else entirely, then an index fund will benefit from the winning-est names moving up the ladder.

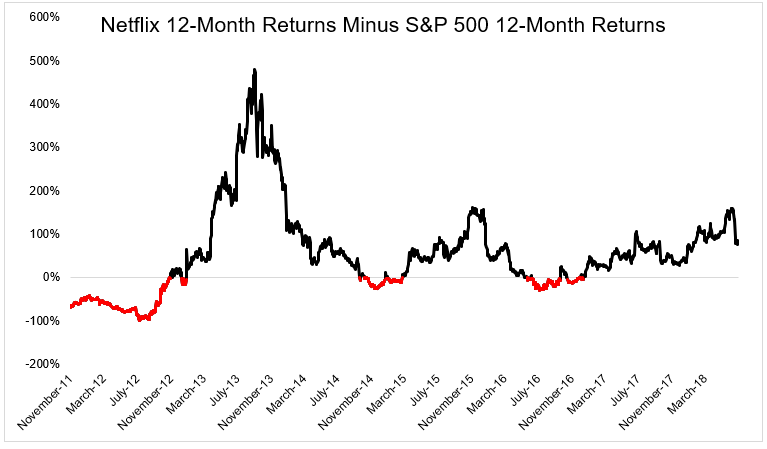

Let’s stick with Netflix as an example. There have been plenty of times in the eight years since it was added to the index that it would’ve screened in the bottom decile of momentum. The chart below shows the difference in 12-month returns between Netflix and the S&P 500. The red parts of the line show when Netflix underperformed the index over the previous twelve months.

Ehren is right. A true momentum strategy will have a vastly different return path and profile than the S&P 500. But I still like the idea, for simplicity’s sake, of thinking about the S&P 500 as being a long-term slowmentum fund, where it will gradually give a bigger weight to stocks that perform well, with stocks with poor performance having the opposite experience. Despite the fact that momentum came and went with Netflix over the years, its long-term success has added $150 billion in market cap to the S&P 500.