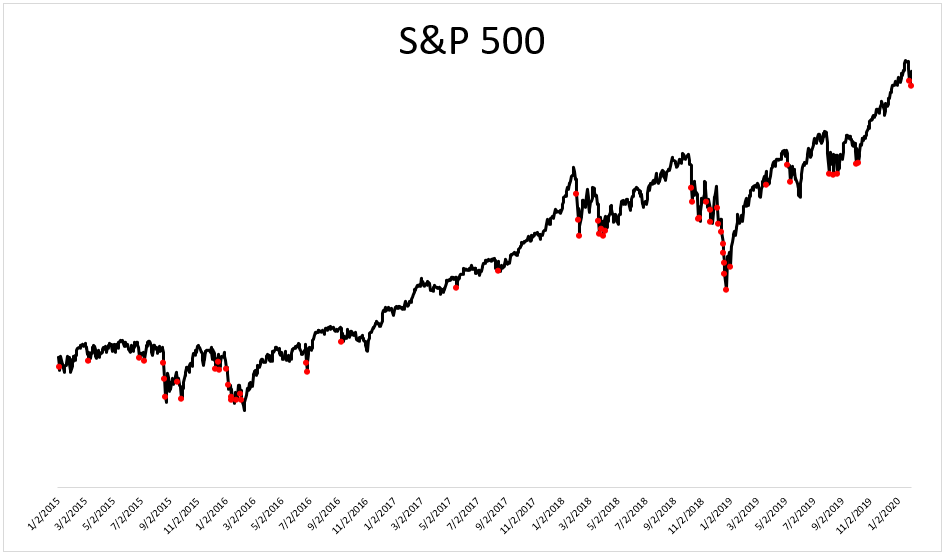

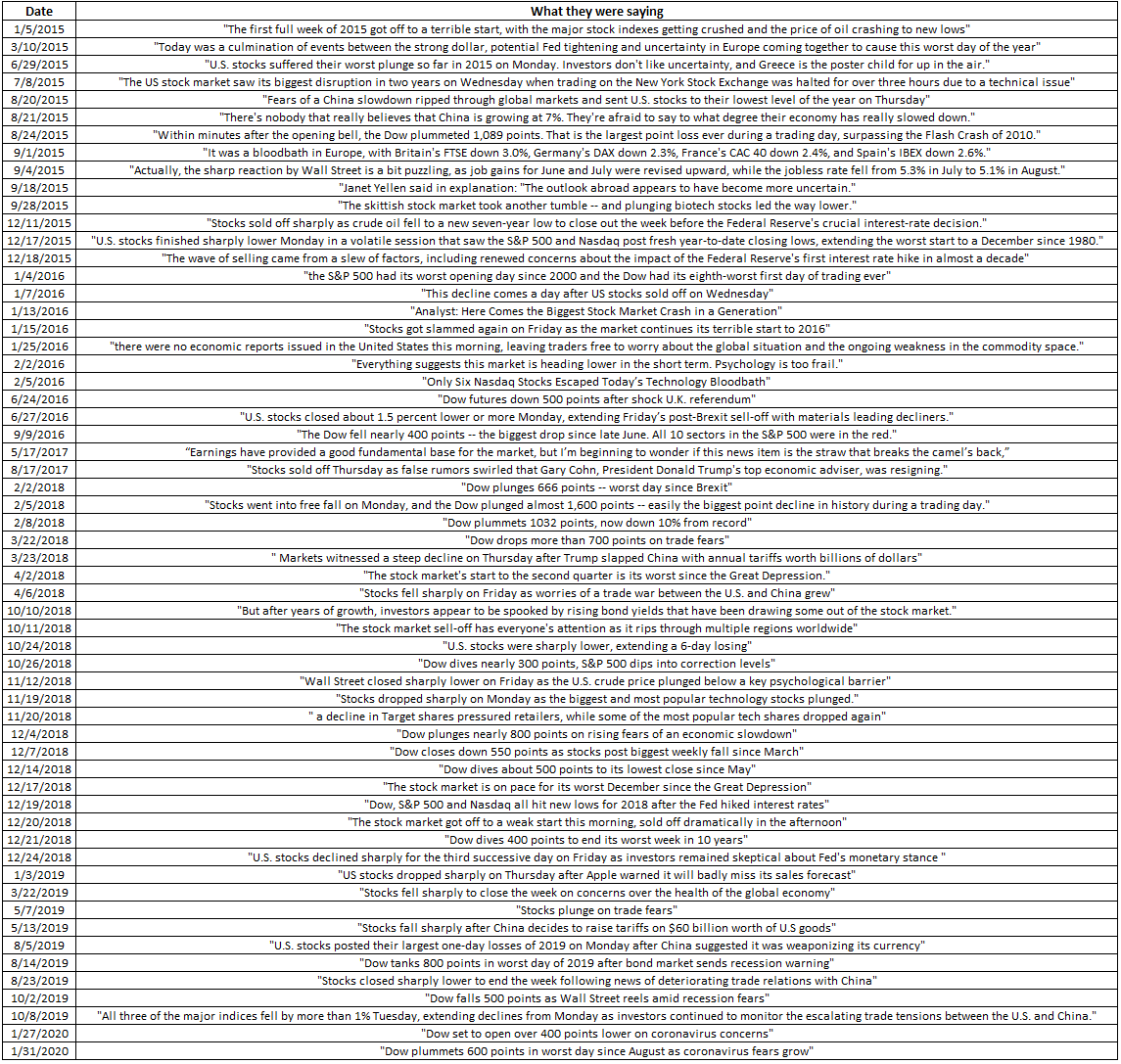

For the 59th time since 2015, stocks fell more than 1.5% on Friday. The culprit this time was the Corona Virus.

I wanted to look back on each of the 58 previous occasions to see what they were saying in the financial media

This was a good exercise for me to go through because like many investors, I tend to fear the worst. Every time stocks fall a little, I think they’re going to fall a lot. As I revisited the recent past, I had forgotten so many of these days, days that seemed very important at the time.

Which brings us back to today. After Friday’s selloff, the S&P 500 sits 3.1% below its all-time closing high.

I’d guess most people aren’t too concerned yet, and that got me thinking about the state of the current investor.

It’s obviously impossible to capture everybody under one umbrella, but I’m really thinking about the average investor here, not professionals. And by average I mean people that regularly contribute to their retirement account, don’t watch the market on a day-to-day basis, and have no desire to time the market. These are investors who have told themselves “I’ll never sell.”

There is an important aspect that this average investor might be overlooking, and this is that stocks don’t fall a lot for no reason. People might tell themselves they can withstand a 30% drawdown, but can you withstand a 30% drawdown as the Corona Virus is spreading across the globe? Of course I pray this doesn’t happen, I only say this to make the point that stocks don’t go down a lot in a vacuum, they go down a lot because there is something seriously wrong going on.

On a related note, there is a school of thought that thinks young people are ill prepared for a bear market because they’ve never seen one. I don’t subscribe to that. First of all, it’s not like seeing one or even two bear markets makes you any more likely to foresee the next one or swallow those losses, but the real reason why I think young investors will be just fine is because they don’t have a lot of money. People respond to dollar losses, not percentage ones. It’s one thing to see your portfolio cut in half when you have $20,000 and something entirely different when you have $1,000,000.

The best way to make sure you never sell out of fear is to never put yourself in that position in the first place. Think about the most you can stomach in terms of dollar losses, and then lower that number just to be safe. In other words, if you think you can take a $50,000 loss, you’re probably overestimating your ability to stay calm when everyone is panicking. Again, stocks don’t fall a lot for no reason. So maybe you can really stomach a $30,000 decline instead. Once you have that number, then you can build yourself a portfolio so you never sell.