Last month I was at a casino playing blackjack. As I sat down to play my first hand, I felt a surge of adrenaline rush through my body. Was I playing with too much money on the line? Is that what was causing my heart to race like I was about to jump out of an airplane? No, I bought in for a few hundred bucks and was playing with $25 chips. The amount I was wagering had absolutely zero effect on my financial well being.

Every time I play blackjack I am reminded of the fact that I cannot navigate my own emotions when money is on the line, which makes me eternally grateful that technology has given us automation. I’m a better investor because I don’t have to be counted on to make sound decisions in the heat of the fire.

Every month I make several automatic deposits: One into each of my son’s 529 plans, two into my 401(k) and one into Liftoff which is powered by Betterment. Almost all of my investing is automated, but every now and then I get manual, on days like today when the market is having a normal large decline.

One of my favorite things about this technology, which you can see below, is that I can enter a note for why I’m making a deposit. Years from now I’ll be able to look back and see when I bought and why, whether it was during a decline or using the Maggiulli spending rule. What’s also great about this technology is that it can theoretically protect you from selling out of fear. Imagine entering “I’m scared” as a reason for why you’re selling?

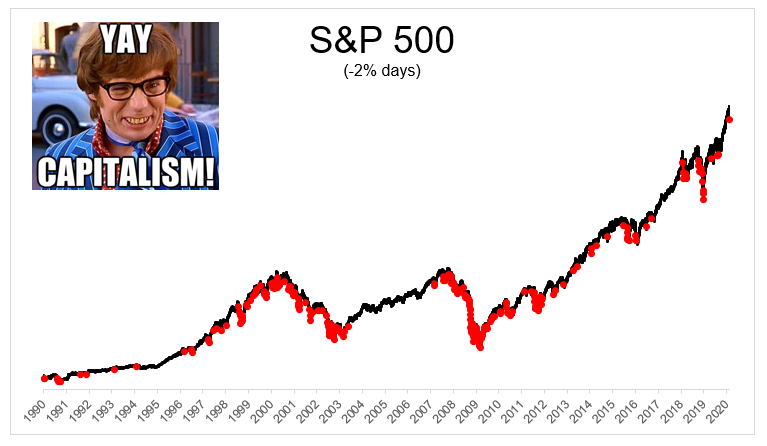

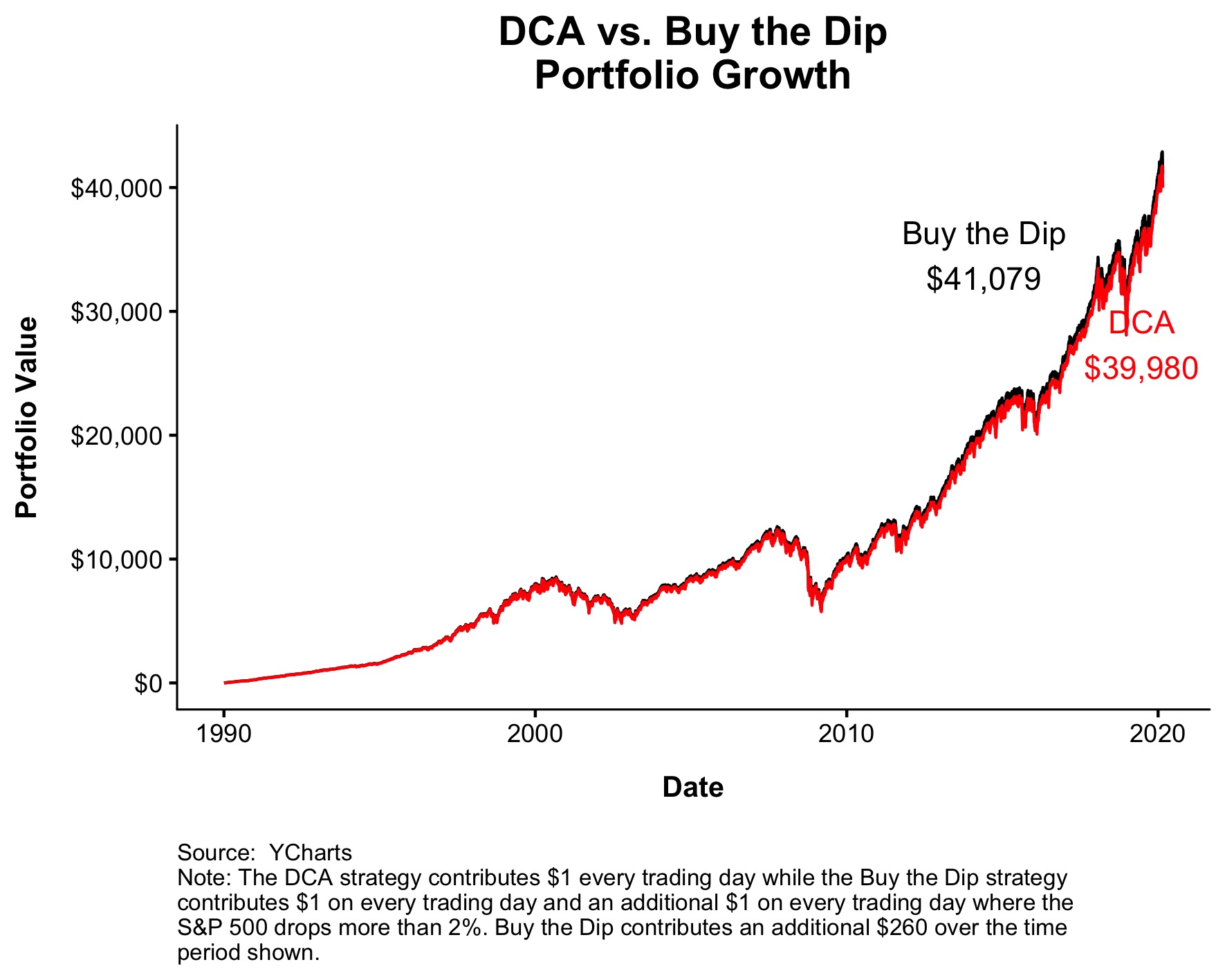

Today looks like it will be the 260th time that the S&P 500 fell 2% or more on a single day. Over this period, the total return of the index is 1,640%. So if something has a positive expected return, then it pays to buy the dip, right? Yes and no. I had Nick run some numbers for me on this.

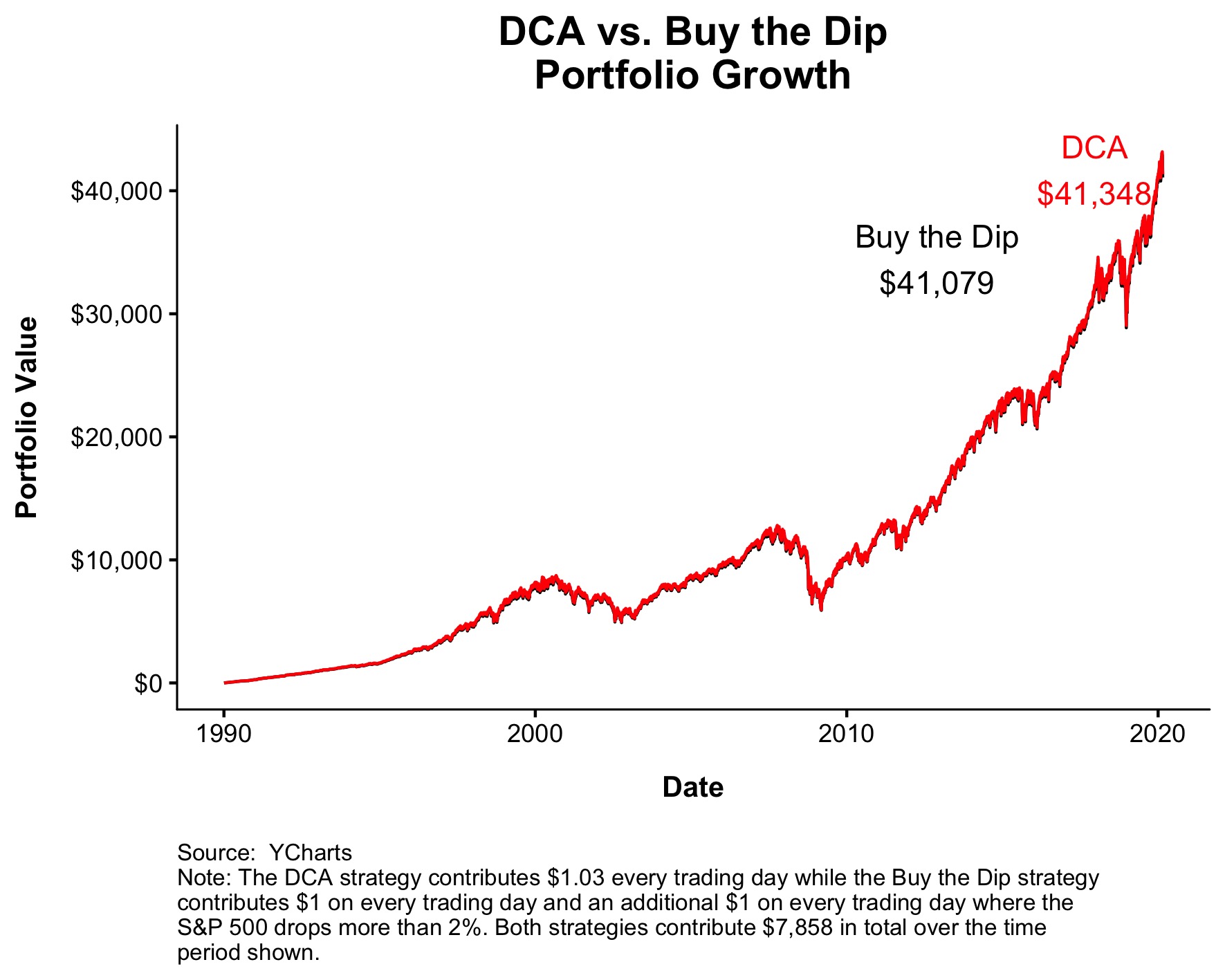

What if you invested $1 every day, and added an extra dollar on days when stocks fell 2%. In order to make this an apples to apples comparison, Nick figured out what would be needed to contribute on average over the course of this period for the DCA strategy to make sure that the dollars invested were the same. In this case, a straight dollar cost averaging actually did better than the buy the dip strategy.

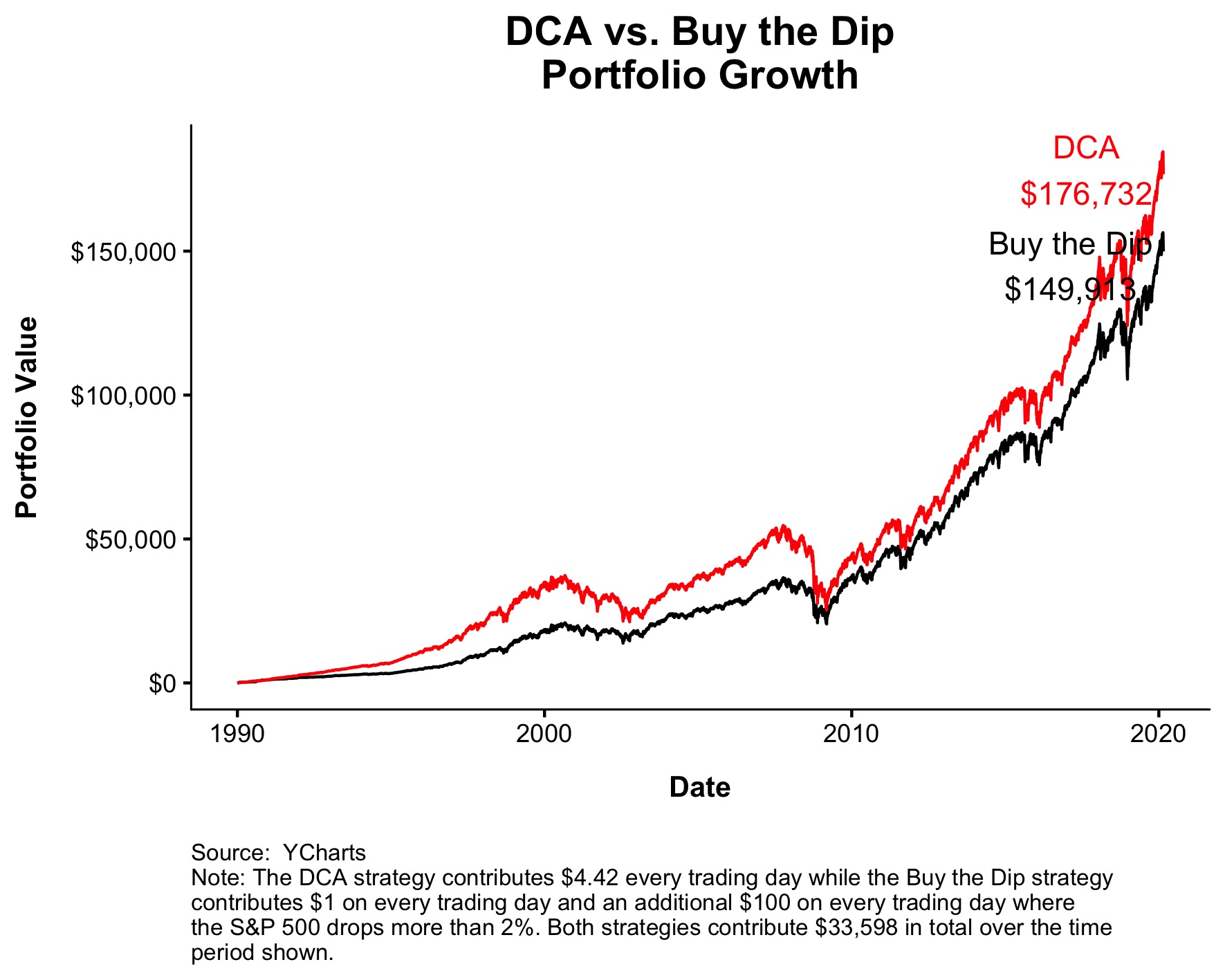

Hmm. What if instead of adding $2 when the market fell 2% you added $100, what would that do to the results? In this case, the $100 added be the equivalent of investing $4.42 every day. This buy the dip strategy lagged the straight dollar cost averaging by an even greater margin! What’s happening here is actually very simple; If something goes up over time, then the longer you delay investing, the worse off you are.

Okay but what if you only invested $1 a day and doubled up when the market fell 2%. In this case, you would have invested an extra $260, and came out ahead, but not by nearly as much as I would have guessed.

Okay but what if you only invested $1 a day and doubled up when the market fell 2%. In this case, you would have invested an extra $260, and came out ahead, but not by nearly as much as I would have guessed.

This is one of those rare pieces of analysis that might have an affect on how I invest. The message is clear, don’t wait to buy the dip, just keep investing, because the earlier you start, the better off you’ll be.