People in the same investments can have very different experiences.

If you’ve been investing since the 90s, you have now seen your third big market downturn. If you started any time in the last ten years, you can now say you know what it feels like to be in a bear market, but only sort of.

For young people who have been contributing to their 401(k) over the last ten years, they’ve seen nothing but gains. The stock market didn’t necessarily go straight up, but because their accounts started at zero, declines were quickly recovered with the injection of more contributions. This is why I say that even now, young investors only sort of know what a bear market feels like.

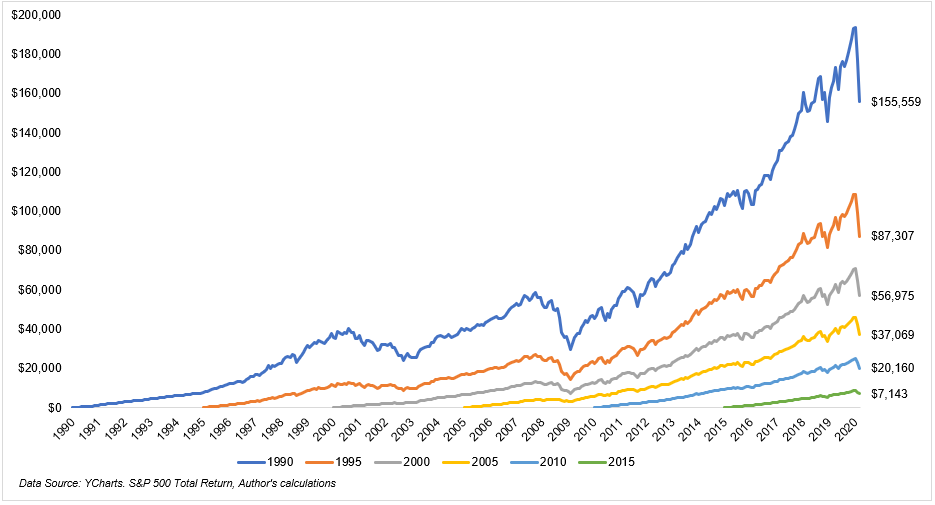

The chart below shows the experience of six different investors, who for the sake of simplicity, invested $100 a month into the S&P 500 at different starting dates.

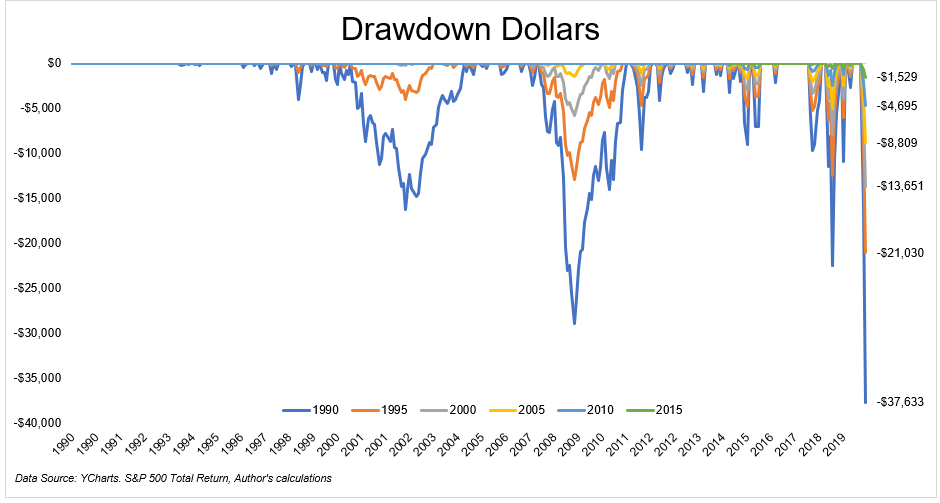

The person who started investing in 2000, right as the market was entering a bear market, like the person who started investing in 2015, technically experienced a bear market, but the contributions put a floor in the percentage decline. The chart below shows what this was like. Look at the gray line compared to the blue. Same investment, different experience. Somebody who started investing in 1990 bore the full brunt of the bear market. They felt it in every part of their body.

If you started investing in 1990, which means you’re 50-55 years old today, you had the opportunity to earn nearly 1,300% from the S&P 500, or just over 9% compounded annually. These returns were harvested only by those who were willing to pay the painful price of deep losses. Three nasty bear markets in 30 years is enough to test anyone’s nerves.

When you look at the drawdown in dollar terms as opposed to percentage declines, you get a better sense of why bear markets are so much more painful for seasoned investors. Not only are the dollar declines much larger, but they also don’t have as much time in the labor force to make up for these losses. And for investors in retirement that are drawing down their portfolio it hurts even worse. Without any income, they don’t have the opportunity to buy at lower prices.

Everybody’s investing experience is different, even if what we’re investing in is the same.

One thing I’ve been thinking about lately is what impact this will have on the way investors view risk.

A 55 year old person has now experienced three bear markets and might have grown disenchanted by the stock market. Unfortunately, given the average life expectancy and where the average retirement balance is, it’s unlikely that they can achieve their goals by investing all their money in bonds earning just a few percent. They’re going to need to be in the market, for better and for worse.

As for younger investors, I think it’s premature at this point to speculate how long these scars will last. Another 30% decline and this will likely stay with us forever and change the way that a lot of people think about investing in stocks.

The scars of the Great Depression lasted a lifetime. That’s what happens when stocks are under water for 25 years (give me a break with total return), and unemployment reaches 25% and stays above 10% for a decade.

I’m very concerned about the state of the economy, but assuming the worst doesn’t come to bear, and assuming the market is near a bottom, it’s possible that we take this in stride. If not, well, we’ll see.